There is no way to analyze this info. It does not tell us if you're trading the right way or not.

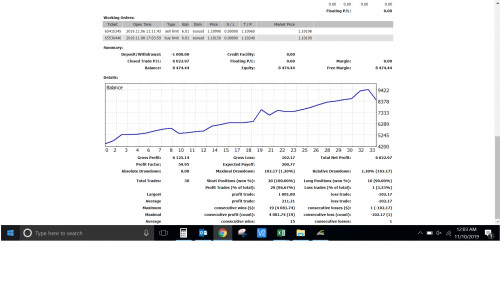

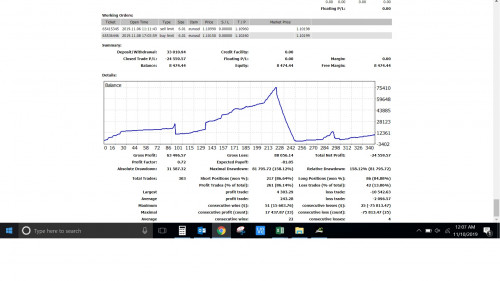

All I know is that in the first report, you're a superstar.

In the 2nd report you're a very bad trader.

Unfortunately, martingale or grid type of trading is often going to produce such results.

But I can tell you a few things. Just for you to ponder on. I tell you this based on my 9 years of experience. Accept it or not, is up to you.

1)There is no shortcut. You must make more money when you're right, and you must lose less money when you're wrong.

2)You must have an edge. And your edge must do at the minimum 2 things:

2a)It must give you a price forecast. Meaning, it must tell you whether to go long or short or do nothing.

2b)As an extension of 2a, it must also tell you when you are wrong.

3)The more accurate you are in forecasting price, the stronger your edge.

4)Money management strategies by itself cannot provide an edge. They only determine how fast or slow your account grows/shrink.

4a)If you use martingale and grid strategies without an edge(price forecast), you will ruin your account eventually.

4b)The problem with martingale and grid is that traders use it because they don't want to forecast price. But without price forecasting, you do not know when you are wrong. And because you do not know when to stop applying martingale/grid, one day the market will do something funky and you will wipe your account.

4c)You can get lucky in the market for a long time using martingale and grids. Which is why, most traders tend to do very well for very long periods of time and then suddenly go bust in 1 week. One day the markets decides to do something unexpected, and these traders have no way of knowing whether the market will eventually cooperate. So they keep trading their grid until they eventually ruin themselves.

5)Can you turn grid trading into a good strategy?

a)The answer is yes. But not by itself. It must be combined with a proper edge.

b)Grid strategies are at best ‘average entry point’ strategies. They are good at giving a good entry point, but they can’t provide an edge.

c)But... if for example, you have a system that can identify when price is ranging.

d)Once you have determined that the market is ranging, you can start to apply the grid.

e)When your system tells you that the range has ended, you close all your grid positions regardless of loss or profit - because your market edge tells you that the range has ended. Therefore if you continue to grid, you will probably be applying grids in a trend market.

f)How well your strategy performs ultimately depends on how well you can determine when market is ranging.

THIS is your edge. Ultimately, your edge is what will give you consistent profits. The grid is only used as a money management tool to help you get better returns.

Thank you so much for the details explaination .

This would really help everyone on the FX journey.

Oct 30 2019, 02:02 PM

Oct 30 2019, 02:02 PM

Quote

Quote

0.0214sec

0.0214sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled