Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

koja6049

|

Feb 23 2024, 07:11 PM Feb 23 2024, 07:11 PM

|

|

QUOTE(wyen @ Feb 20 2024, 06:37 PM) Just opened uob one account but the account number not reflected on uob tmwr. Should i wait tmr instead? I received sms if i open uob account i will get rm138 any term and criteria? you have transfer RM100 to the account number to activate it, only then it will show. BTW you missed out on a better deal, use code UNIFI during sign up will get RM388 |

|

|

|

|

|

koja6049

|

Feb 25 2024, 05:02 PM Feb 25 2024, 05:02 PM

|

|

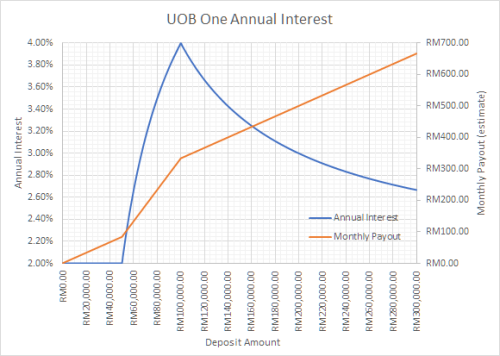

QUOTE(Nom-el @ Feb 25 2024, 04:58 PM) What is the EAR you are referring to? EIR or something else? How much did you deposit and how much interest did you get? It is impossible for you to get 4% EIR if you deposit only 60k for e.g. 60k means: 50k@2% 10k@6% It's not that hard, just some primary 6 math  |

|

|

|

|

|

koja6049

|

Feb 25 2024, 05:06 PM Feb 25 2024, 05:06 PM

|

|

QUOTE(ericlaiys @ Feb 25 2024, 04:40 PM) Ear is correct. Every month get those interest bank in since they introduce it last few month. hope this lasts for some time and they don't go and change the mid-tier 50k-100k from 6% to some lower amount, which I suspect they will do after they gain enough depositors  |

|

|

|

|

|

koja6049

|

Feb 29 2024, 10:51 AM Feb 29 2024, 10:51 AM

|

|

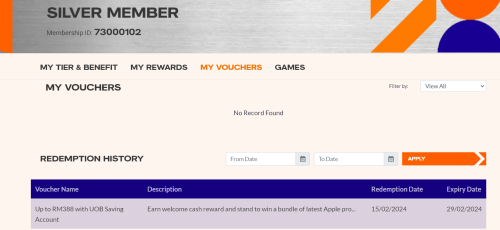

QUOTE(Hinote @ Feb 29 2024, 09:44 AM) Sifu!! 🙇🏻♀️ Hmm is that a randomly received SMS? Is this code still valid? Any page description on that? 😆 Planning to open UOB One, from their website now seems the best I could get is RM50 for new account opening + RM50 referral fee for another person who's existing customer. if you are unifi customer, just go to the rewards unifi page to claim it. Today may be the last day.  The unifi rewards page looks like this  This post has been edited by koja6049: Feb 29 2024, 10:57 AM This post has been edited by koja6049: Feb 29 2024, 10:57 AM |

|

|

|

|

|

koja6049

|

Feb 29 2024, 06:54 PM Feb 29 2024, 06:54 PM

|

|

QUOTE(Hinote @ Feb 29 2024, 06:50 PM) How did you land on this rewards page? Been searching high and low after login, but just could not find any where to get to this page... use this link https://rewards.unifi.com.my/or you can use the uob landing page. not sure if it works if you didn't redeem the voucher: https://www.uob.com.my/personal/promotions/...s/telekom-jan22This post has been edited by koja6049: Feb 29 2024, 07:36 PM |

|

|

|

|

|

koja6049

|

Mar 6 2024, 06:00 PM Mar 6 2024, 06:00 PM

|

|

QUOTE(westlife @ Mar 6 2024, 05:40 PM) the condition is to maintain an average of rm6000 credit balance inside the account until end of march to get the rm388 rite? yes, correct  |

|

|

|

|

|

koja6049

|

Mar 12 2024, 10:08 AM Mar 12 2024, 10:08 AM

|

|

QUOTE(LostAndFound @ Mar 9 2024, 08:36 AM) Couldn't understand whether this has been addressed yet for UOB One account - the tiering discussion I did see. Is the interest calculated daily rest or monthly average? So if today I put 100k in and leave it till end of the month, will I earn 4% EIR on that 100k for each day remaining? Or will it take the monthly average balance (RM0 x 8 days + RM100k x 23 days) of 74.1K and then give interest of 2% on the first 50k, 6% on the next 24k? It's my 1st month in and I just confirmed it is MAB, not daily rest  |

|

|

|

|

|

koja6049

|

Jun 20 2024, 04:11 PM Jun 20 2024, 04:11 PM

|

|

I also got mine 388 2 weeks ago. Registered using UNIFI code  |

|

|

|

|

|

koja6049

|

Oct 4 2024, 03:32 PM Oct 4 2024, 03:32 PM

|

|

QUOTE(sno0py @ Sep 23 2024, 04:00 PM) Anyone know how to fulfill this criteria for UOB one account?  I have a lifehack for this: I transfer RM50 3 times to my wise account via fpx  |

|

|

|

|

|

koja6049

|

Dec 24 2024, 11:08 PM Dec 24 2024, 11:08 PM

|

|

QUOTE(PseudomonasSA @ Dec 24 2024, 02:52 AM) Hi Sifus 1) I made 4 bill payments via FPX on 21/12/24 (worth RM 50 each). However this is still not reflected in the UOB Interest Rate tracker. Does it normally take a few days? 2) Is it true that the UOB One debit card can only be activated for online transactions by contacting UOB? There was no option for enabling or disabling online transactions in the apps or online banking. Thank you!! it should reflect the next day. Make sure your fpx comes from your UOB One account and not from your Debit card account |

|

|

|

|

|

koja6049

|

Jul 26 2025, 02:17 PM Jul 26 2025, 02:17 PM

|

|

QUOTE(Kelefeh @ Jul 25 2025, 10:38 AM) want to have high interest yet liquidity like saving account, the best option is go for money market fund, can handle it online also totally different products. savings account have pidm, mmf don't have |

|

|

|

|

|

koja6049

|

Jul 27 2025, 12:31 PM Jul 27 2025, 12:31 PM

|

|

QUOTE(Kelefeh @ Jul 27 2025, 10:21 AM) You want to have PDIM, you will never get 4% mmf you know is still park your money to FD and saving in the form of unit trust At least that is the safest thing to put aside from saving account or FD opps btw with the OPR goes down, mmf also won't have 4% this thread is about savings account, you're in the wrong place to discuss mmf. also, conditional high yield savings account can go beyond 6%, so it is way way better than mmf  |

|

|

|

|

Feb 23 2024, 07:11 PM

Feb 23 2024, 07:11 PM

Quote

Quote

0.0390sec

0.0390sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled