QUOTE(Nom-el @ Aug 14 2019, 07:03 PM)

I have read the T&Cs. That is why I am confused.

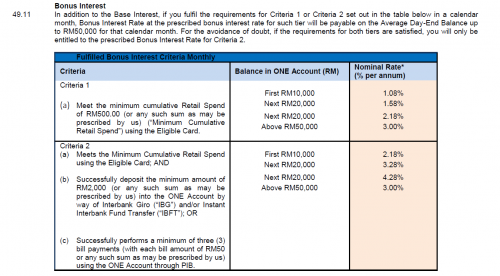

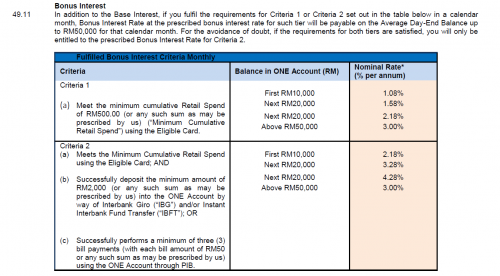

According to this, the Bonus Interest will be payable on the Average Day-End Balance up to RM50,000 for that calendar month. However, there is a 3% rate for balance above RM50,000. This does not make sense at all unless the 3% includes the interest from the base interest (it is cumulative instead of separate). The rates shown on the T&C are outdated btw. The T&C is very poorly written indeed. The calculation method is supposed to be separate for base interest and bonus interest but is should be added up if there is a cap on the balance. Or they changed the conditions but forgot to update it.

I am aware of that but what I am not sure about is the max EIR of 3.05% applicable only on the bonus or on the total interest earned.

This is a

rough estimation of interest can be earned if you have RM 100k as MAB in your ONE saving account with Tier 2 requirement fulfilled:

| Amt | Base (%) | Tier 2 Bonus (%) | Base Interest Earned | Tier 2 Bonus Earned | Total Earned | EIR (%) |

| 10000 | 0.1 | 2.8 | 0.82 | 23.01 | 23.84 | 2.90 |

| 20000 | 0.1 | 2.8 | 1.64 | 46.03 | 71.51 | 2.90 |

| 20000 | 0.1 | 2.8 | 1.64 | 46.03 | 119.18 | 2.90 |

| 25000 | 0.1 | 3.8 | 2.05 | 78.08 | 199.32 | 3.23 |

| 25000 | 0.1 | 3.8 | 2.05 | 78.08 | 279.45 | 3.40 |

MAB: monthly average balance != amount in the amount of the last day of the month

Also, you need to ensure that your MAB never exceed RM 100k; otherwise, your EIR is 2.65%.

Interest earned should be cashed out so that your MAB is always <= RM 100k

P/S: If I make any mistake, I apologize upfront as I'm not from banking background.

This post has been edited by CardNoob: Aug 14 2019, 08:03 PM

Jul 5 2019, 08:26 AM

Jul 5 2019, 08:26 AM

Quote

Quote

0.0558sec

0.0558sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled