QUOTE(icemanfx @ Feb 23 2019, 11:19 AM)

Ohh . The burn of sarcasm... 😂 😂

Auction properties

|

|

Feb 23 2019, 03:53 PM Feb 23 2019, 03:53 PM

Return to original view | Post

#1

|

Senior Member

579 posts Joined: Mar 2010 |

|

|

|

|

|

|

May 25 2019, 09:28 PM May 25 2019, 09:28 PM

Return to original view | Post

#2

|

Senior Member

579 posts Joined: Mar 2010 |

|

|

|

Jun 14 2020, 11:14 PM Jun 14 2020, 11:14 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

579 posts Joined: Mar 2010 |

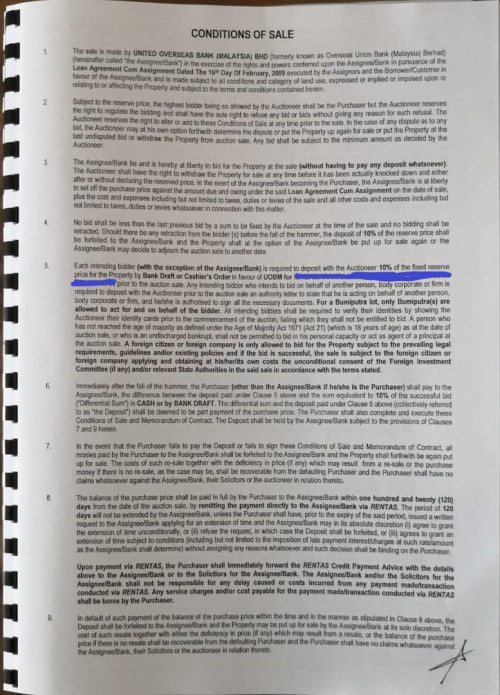

QUOTE(chiucheng @ Jun 14 2020, 05:54 PM) Hi guys, just sharing some info my friend shared to me earlier this week, but not sure how true it is, maybe some of you here with more experience can shed some light for this matter? Basically no extension allowed for court auction..as the current position is that parties cannot contract out of statutory provision. However.. This may change as there is a Federal Court case pending to be heard which is challenging that position. Based on what my friend told me, it is against the law to allow the extension of payment settlement due date of 120 days from auction date as stipulated in our country's law?  I bought an auction unit (LACA) around end of February, and my POS stated that is it at the discretion of the Bank for any extension of due date.  So is extension of payment settlement due date actually allowable by law or not? Those auction by way of PA under LACA no issues |

|

|

Jun 14 2020, 11:23 PM Jun 14 2020, 11:23 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

579 posts Joined: Mar 2010 |

QUOTE(Thasmita @ Jun 11 2020, 06:26 PM) Missing payments will not automatically make one a bankrupt. Technically speaking...the bank doesnt need to wait until the auction to complete before initiating bankruptcy.When liabilities exceed assets technically one becomes insolvent. In order to become a bankrupt- one needs to have debts in excess of rm 50,000. Then the creditor will need to go to court and first prove that you owe them the money. Then if you can’t pay - file a bankruptcy action against you. Then the official assignee take conduct of your assets and try to settle your debts. Usually for mortgages - they foreclose the property first then if there is still monies owing in excess of rm 50k- carry on with bankruptcy proceedings. I’m malaysia the mortgagee I.e bank doesn’t make the arrangements for viewing. However for vehicle auctions they allow. In the UK and US- financial institutions prepare comprehensive reports about the property which is foreclosed. Well I guess that’s one of the traits of an advanced society where consumerism is very strong. They can do it concurrently as both are different types of action. The charge avtion is against the property.. The bankruptcy is personal. |

|

|

Jun 16 2020, 08:33 AM Jun 16 2020, 08:33 AM

Return to original view | Post

#5

|

Senior Member

579 posts Joined: Mar 2010 |

QUOTE(mini orchard @ Jun 16 2020, 06:29 AM) If bankruptcy action succeeded ahead of auction, OA will take over the property from the bank to dispose and which the bank would not want this route. It depends.. If it is a charge action.. Ie court auction the situation doesn arise at all. The property being charged means the bank signs all papers. The OA doesn't have any rights over the property nor is required to sign. BTW, a property on auction doesnt meant that the owner has no money. For LACA cases since the property has been absolutely assigned to the bank the owner doesnt have any beneficial. Interest in the pripoeery anymore. As such the Beneficial interest will not vest to OA since it is not part of the bankrupt assets in the first place |

| Change to: |  0.0805sec 0.0805sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 05:21 PM |