QUOTE(Duckies @ Dec 22 2020, 11:37 PM)

If you can wave it at the counter, you'll get cash back.Credit Cards Credit Card v20, Post/Ask general questions here, Please read post 1-3 before posting, tq

Credit Cards Credit Card v20, Post/Ask general questions here, Please read post 1-3 before posting, tq

|

|

Dec 23 2020, 06:41 AM Dec 23 2020, 06:41 AM

Return to original view | IPv6 | Post

#61

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Dec 23 2020, 08:19 AM Dec 23 2020, 08:19 AM

Return to original view | Post

#62

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 23 2020, 09:20 AM Dec 23 2020, 09:20 AM

Return to original view | Post

#63

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Duckies @ Dec 23 2020, 09:17 AM) What does it say? Product link: https://www.affinonline.com/tap_for_cash_back |

|

|

Dec 23 2020, 10:51 AM Dec 23 2020, 10:51 AM

Return to original view | Post

#64

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 23 2020, 11:02 AM Dec 23 2020, 11:02 AM

Return to original view | Post

#65

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Duckies @ Dec 23 2020, 10:59 AM) So.. Transactionless means online also can right... Also exclusion doest not have insurance.. So I guess it's all right...? It's Contactless not Transactionless.Contactless/Wave/Tap is not equivalent to Online/No-Card-Present/No-Presence-Card So it's not eligible as you need to tap the physical card at the merchant card terminal. This post has been edited by GrumpyNooby: Dec 23 2020, 11:02 AM |

|

|

Dec 23 2020, 11:06 AM Dec 23 2020, 11:06 AM

Return to original view | Post

#66

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Duckies @ Dec 23 2020, 11:03 AM) PB Quantum Mastercard/PB Visa Signature: For manual payment via onlineor Affin Duo Visa Cash Back: For manual payment via online or auto-debit/auto-pay/direct debit This post has been edited by GrumpyNooby: Dec 23 2020, 11:07 AM |

|

|

|

|

|

Dec 24 2020, 04:07 PM Dec 24 2020, 04:07 PM

Return to original view | IPv6 | Post

#67

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(realitec @ Dec 24 2020, 03:38 PM) I wonder, if salary above 3k, how many credit card can we hold? If i remember, 2-3k, we only can have 2 credit cards from diff issuance bank. RM 36k per annumLink: https://www.maybank2u.com.my/iwov-resources...t/BNMcc_FAQ.pdf |

|

|

Dec 26 2020, 02:49 PM Dec 26 2020, 02:49 PM

Return to original view | IPv6 | Post

#68

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 27 2020, 10:18 PM Dec 27 2020, 10:18 PM

Return to original view | IPv6 | Post

#69

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(alandhw @ Dec 27 2020, 10:16 PM) Not just JomPay if you want to put the correct detailed matters into perspective:QUOTE Transactions under Merchant Category Code (MCC) 8999 “Professional Services” which include but are not limited to Jompay transactions, FPX transactions, DuitNow QR transactions and Paypal transactions. Better to refer to the SC Liverpool T&C. This post has been edited by GrumpyNooby: Dec 27 2020, 10:21 PM |

|

|

Dec 29 2020, 06:45 AM Dec 29 2020, 06:45 AM

Return to original view | Post

#70

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 29 2020, 06:50 AM Dec 29 2020, 06:50 AM

Return to original view | Post

#71

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(eddievh @ Dec 29 2020, 06:49 AM) They should as long as the terminal can accept Mastercard.BigPay is prepaid/debit card. eddievh liked this post

|

|

|

Jan 4 2021, 02:47 PM Jan 4 2021, 02:47 PM

Return to original view | Post

#72

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Human Nature @ Jan 2 2021, 05:41 PM) Try this campaign by Boost:Spend and shop with less worry this year end! Enjoy up to RM320 Cashback when you go on the RinggitPlus website and sign up for a brand new credit card from AmBank, Citi Bank, HSBC and many more! Register now by visiting here: https://bit.ly/2J10p61 #BoostMyMalaysia #BoostingTheNation #KitaBoostKita #KitaJagaKita #FasaPemulihan #BoostGotYou This post has been edited by GrumpyNooby: Jan 4 2021, 02:48 PM Human Nature liked this post

|

|

|

Jan 5 2021, 07:11 PM Jan 5 2021, 07:11 PM

Return to original view | IPv6 | Post

#73

|

All Stars

12,387 posts Joined: Feb 2020 |

RinggitPlus Readers’ Choice Awards 2020: Affin Duo, Maybank, TNG eWallet Emerge As Big Winners

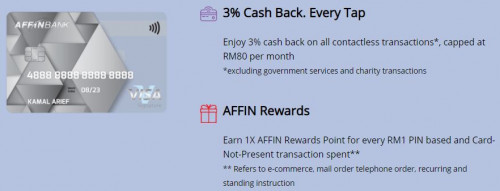

Best Cashback Credit Card In Malaysia: Affin Duo (39.2%) - A clear winner with almost 40% of the votes cast, this award is richly deserved for this newcomer. Launched in the latter half of 2020, AffinBank has achieved what its contemporaries struggle to: offer a dual credit card combo that rivals the evergreen Maybank 2 Cards that have been around for almost a decade. - Its ease of earning cashback (particularly for e-wallet reloads), high monthly cashback cap, and low barrier of entry (minimum monthly salary of just RM2,000/month) makes this a great card to own at a time when e-wallet usage and online transactions are peaking. Best Petrol Cashback Credit Card In Malaysia: Maybank Visa Signature (25.3%) - A tightly-contested category that ended with Maybank’s Visa Signature marginally pulling ahead of the AffinBank BHPetrol Touch & Fuel Mastercard and Citi Cash Back Card. The less popular Visa Signature from Maybank (many would be more familiar with the FC Barcelona Visa Signature), it is one of the most rewarding cashback cards for petrol and groceries if you spend a lot on these two categories. - Offering 5% cashback every day with no minimum spend and a highly generous RM88 monthly cashback cap, you’d need to spend RM1,760 to hit the RM88 cashback cap – making it a solid cashback credit card for families. Just be wary of the RM550 annual fee – it’ll be waived only upon reaching an annual spend of RM30,000. Best Groceries Cashback Credit Card In Malaysia: Maybank Visa Signature (25.2%) - As mentioned earlier, the Maybank Visa Signature’s generous cashback for fuel and groceries makes it a great option. Other cards, like the second-placed Citi Cash Back Card, may offer a higher effective cashback rate, but we believe the two factors behind this card’s popularity with our readers are its zero minimum spend requirement, and a high cashback cap that goes well beyond what other cards offer. Best Online Cashback Credit Card In Malaysia: Affin Duo (40.6%) - Once again, the Affin Duo is a clear winner. As mentioned earlier, the ease of which Affin Duo cardholders can earn cashback makes this card highly attractive. You earn cashback for up to RM2,666.67 in monthly spending, which should easily cover your e-wallet reloads, online shopping, as well as any bills you may have set the Affin Duo Visa for auto-billing – all three categories earn cashback under this card. Best Backup/Secondary Credit Card In Malaysia: Affin Visa Signature (66.1%) - No bank sets out to design a credit card for “backup” usage, or a card to use when you’ve exhausted your main card’s benefits (for example, reaching the spending amount required to unlock the full monthly cashback). - We’re big advocates of multi-card use to optimise your returns, and in many cases a “backup” card is useful. Our favourite previously was the Maybank FC Barcelona Visa Signature and its 2% cashback on almost all retail spending, capped at RM50 – but unfortunately it has now been revised to 1%, possibly a bit too low for most users. - The Affin Visa Signature, with its “contactless” cashback feature, earns you 3% cashback on almost all transactions made via PayWave (i.e. contactless). It has a huge RM80 monthly cashback cap, but there’s a very important caveat: you only earn cashback if it is a “pure contactless” transaction below RM250 – if you input your PIN after tapping your card, you won’t receive cashback for that transaction. - That said, 3% cashback on all low-value transactions is still very rewarding if you’ve exhausted your main cashback card’s benefits! Best Air Miles Credit Card In Malaysia: HSBC Visa Signature (18.7%) - The most tightly-contested category where the top 3 spots were separated only by 1.9% of votes, HSBC’s Visa Signature comes up tops here. As one of the most popular air miles credit cards in Malaysia, the HSBC VS lets you earn Rewards Points at up to 8x multipliers depending on where you use the card. The points can then be redeemed for air miles with the most popular frequent flyer programmes in the region: Asia Miles (Cathay Pacific), AirAsia BIG (AirAsia), Enrich (Malaysia Airlines), and KrisFlyer (Singapore Airlines). - Cardholders also get 6x complimentary airport lounge access in KLIA, Changi (Singapore), and HKIA (Hong Kong) per year. Best Credit Card Design In Malaysia: Alliance Bank Visa Infinite (30.1%) - Late last year Alliance Bank surprised everyone with a complete revamp of its Visa Infinite and Visa Platinum credit cards. The modern minimalist look was chosen to appeal to the younger generation, and has clearly struck a chord – it’s a good thing their new card features are pretty impressive too! - The Visa Infinite sports a sleek matte black design, which contrasts well with the gold magnetic strip and wording. The vertical card face is also strikingly modern and makes it easy to read the card number – which is useful considering this card offers 8x Timeless Bonus Points for online transactions and e-wallet reloads. Best New Credit Card Of 2020: Affin Duo (38.5%) - It’s no surprise that the Affin Duo is the runaway winner here as well. 2020 saw eight new credit cards launched and a number of refreshed/relaunched cards, but few generated the same level of excitement that the Affin Duo managed to achieve. - This year’s Awards alone has seen Affin Duo win three categories, which speaks volumes of the card’s features. Article link: https://ringgitplus.com/en/blog/ringgitplus...ig-winners.html This post has been edited by GrumpyNooby: Jan 5 2021, 07:22 PM |

|

|

|

|

|

Jan 22 2021, 10:02 AM Jan 22 2021, 10:02 AM

Return to original view | Post

#74

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 22 2021, 12:08 PM |

|

|

Jan 22 2021, 10:11 AM Jan 22 2021, 10:11 AM

Return to original view | Post

#75

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 29 2021, 11:41 AM Jan 29 2021, 11:41 AM

Return to original view | Post

#76

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Human Nature @ Jan 29 2021, 11:40 AM) Somebody has replied in UOB thread:QUOTE(rocketm @ Jan 23 2021, 12:20 AM) QUOTE(joetiew @ Jan 25 2021, 11:37 AM) rocketm liked this post

|

|

|

Jan 29 2021, 01:56 PM Jan 29 2021, 01:56 PM

Return to original view | Post

#77

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Jan 29 2021, 01:51 PM) My statement shows that I am not entitle cash back from auto debit using the CIMB cc, even my monthly balance more than RM1500. So would like to confirm with other user. Please call CS to confirm if the auto-debit for insurance falls under:h) Recurring payments/transactions. https://www.cimb.com.my/content/dam/cimb/pe...latinum-tnc.pdf rocketm liked this post

|

|

|

Feb 10 2021, 09:12 AM Feb 10 2021, 09:12 AM

Return to original view | Post

#78

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(persona93 @ Feb 10 2021, 09:10 AM) Hi good morning, recently started paying my PTPTN Best is to reload into supporting e-wallet (for example Boost) and use to it to pay your PTPTN loan. iinm, PTPTN is under gov body so no cashback/points whatsoever in paying using CC right. or there's another way to atleast get some sort of reward paying (sorry if too cheapskate) so just do autodebit and get done with it? Boost can support in-app bill payment for PTPTN. |

|

|

Feb 17 2021, 10:53 AM Feb 17 2021, 10:53 AM

Return to original view | Post

#79

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Human Nature @ Feb 16 2021, 11:03 PM) Wondering if there is any new acquisition campaign giving cashback / voucher? RP and CH are giving out iPhone.Excluding banks from MBB, PBB, SCB, HSBC, Affin, Citi Also, require the card to arrive within 2 weeks Check them out. Human Nature liked this post

|

|

|

Feb 18 2021, 02:44 PM Feb 18 2021, 02:44 PM

Return to original view | Post

#80

|

All Stars

12,387 posts Joined: Feb 2020 |

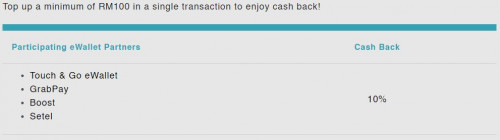

Enjoy 10% Cash Back when you top up your eWallet with BSN Credit Cards

GENERAL TERMS & CONDITIONS 1. Campaign period is from 15 February 2021 until 15 May 2021. 2. Campaign is open to all BSN Visa and BSN Mastercard Principal Credit Cardmembers. 3. A minimum top-up amount of RM100 in a single receipt is required to be eligible for the offer. 4. Maximum cash back per Credit Cardmember is RM10 per month based on first-come, first-served basis. 5. Total cash back allocated during the campaign period is RM30,000 with RM10,000 Cash Back allocated per month. 6. For the full terms and conditions, click here. https://www.bsn.com.my/cms/upload/pdf/promo...op-up_final.pdf 7. For the campaign Frequently Asked Questions, click here. https://www.bsn.com.my/cms/upload/pdf/promo...op-up_final.pdf Campaign link: https://www.bsn.com.my/page/ewallet |

| Change to: |  0.0382sec 0.0382sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 04:48 AM |