Outline ·

[ Standard ] ·

Linear+

eUT / POEMs / Phillip Mutual Berhad UT discussion, Coz' Fundsupermart not cheapo enuf'!

|

majorarmstrong

|

Jul 20 2020, 11:30 PM Jul 20 2020, 11:30 PM

|

|

selamat malam - uncle checking into this thread

super newbie + very old

good with phone and computer as my job last time require me to do some stuff on computer

account open today after deposit RM1

now waiting for their confirmation email

|

|

|

|

|

|

majorarmstrong

|

Jul 20 2020, 11:34 PM Jul 20 2020, 11:34 PM

|

|

QUOTE(GrumpyNooby @ Jul 16 2020, 09:50 PM) this one after i read read i still tak faham meaning if u put RM1k there for 1 year they gonna give you RM24? but it say got annual management fee and trustee fee 0.5% + 0.03% = 0.53% so 2.4% - 0.53% = 1.97% again how it works i really have no idea even if i put 1 month or 2 months then withdraw out also u will get the average or u need to keep till at least 3 months or 1 year?  |

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 09:03 AM Jul 21 2020, 09:03 AM

|

|

QUOTE(Ramjade @ Jul 21 2020, 06:23 AM) Yes. Provided the interest don't change cause their interest change monthly. 2.4% is net management fees already. So yes you will get the real 2.4%. Keep for one day also you will get interest which wi be credited next month. 1000 X 0.024 X 1/365 = RM0.06 per day that's provided next month interest remain the same. Thank you Uncle just put rm1 inside to open account that is why I curious go check check What about withdrawal how many days? |

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 12:20 PM Jul 21 2020, 12:20 PM

|

|

My rm1 put yesterday still cannot see inside

|

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 04:40 PM Jul 21 2020, 04:40 PM

|

|

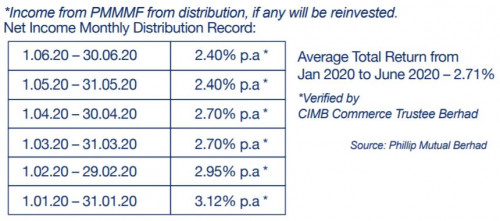

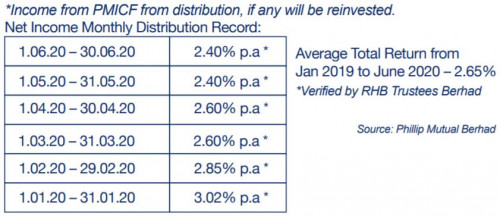

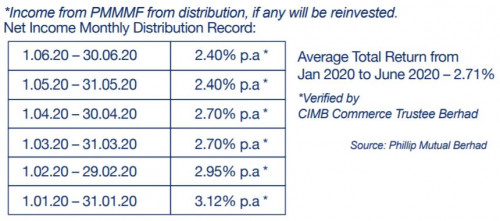

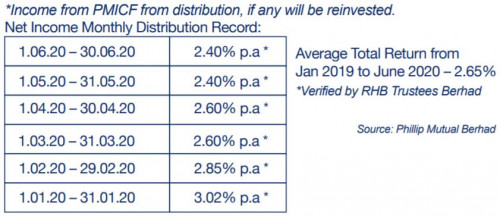

QUOTE(GrumpyNooby @ Jul 21 2020, 01:32 PM) This procedure is for account validation only right? i believe so and now my account open my RM1 hilang transaction history also no show got RM1 i also dont know how, maybe they cheat if RM1 also want to cheat let it be la i have more question, does the below 2 fund also give 2.4%?  |

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 04:40 PM Jul 21 2020, 04:40 PM

|

|

or should i just put money inside PMMMF?

|

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 04:55 PM Jul 21 2020, 04:55 PM

|

|

QUOTE(GrumpyNooby @ Jul 21 2020, 04:46 PM) Have you checked your bank account if the RM 1 has been reversed?  i just login my maybank check got RM1 deducted yesterday but today tak ada duit masuk balik  |

|

|

|

|

|

majorarmstrong

|

Jul 21 2020, 08:44 PM Jul 21 2020, 08:44 PM

|

|

thanks for all sifu info

so my next question is both PMMMF vs PMICF same same?

|

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 12:12 AM Jul 22 2020, 12:12 AM

|

|

QUOTE(GrumpyNooby @ Jul 21 2020, 08:51 PM) PMMMF Mandate: Primarily in government / government-backed securities, bills of exchange, negotiable certificate of deposits, promissory notes, call deposits and other short-term government/ bank-backed securities and money market instruments. There is no minimum asset allocation for Phillip Master Money Market Fund as it is 100% invested in fixed income securities and / or money market instruments.  https://www.eunittrust.com.my/pdf/Factsheet...00072020_fs.pdf https://www.eunittrust.com.my/pdf/Factsheet...00072020_fs.pdfPMICF Mandate: 1. At least 90% of the NAV of the Fund will be invested in Islamic money market instruments and Islamic Deposits which have a remaining maturity period of not more than 365 days. 2. Up to 10% of the NAV of the Fund will be invested in Islamic money market instruments and Islamic Deposits which have a remaining maturity period of more than 365 days but fewer than 732 days.  https://www.eunittrust.com.my/pdf/Factsheet...06072020_fs.pdf https://www.eunittrust.com.my/pdf/Factsheet...06072020_fs.pdfI don't see much huge difference between them. Thanks for the info learn something new today |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 09:03 AM Jul 22 2020, 09:03 AM

|

|

Good morning today it reflected 2 units of PMMMF so they did not cheat my money

2 units mean rm1

|

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 09:45 AM Jul 22 2020, 09:45 AM

|

|

QUOTE(GrumpyNooby @ Jul 22 2020, 09:29 AM) If there's element of fraud, can always lodge a complaint to SIRDEC. No fraud don't worry |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 11:51 AM Jul 22 2020, 11:51 AM

|

|

QUOTE(chichabom @ Jul 22 2020, 11:23 AM) actually the user interface is not as bad as i have read here. still acceptable to me.if they have an app for this in future then would be even better. compare to FSM then teruk compare to OpusTouch i think same same |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 03:47 PM Jul 22 2020, 03:47 PM

|

|

promotion of zero 0% will extend or not?

after this promotion how eut gonna fight with FSM 0.5%?

|

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 03:49 PM Jul 22 2020, 03:49 PM

|

|

QUOTE(Blues03 @ Jul 22 2020, 02:09 PM) since they have a promotion of 0% sales charge, I decided to try them. Any advice from sifu disadvantage of this eUT compared with FSM? i think is look and feel btw i am 1 week old into eut |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 03:58 PM Jul 22 2020, 03:58 PM

|

|

QUOTE(ironman16 @ Jul 22 2020, 03:55 PM) Don't worry, uncle. They frequently offer 0% sales charge, only minimum is rm5k start oh icic - thanks for the info anyway got any good fund in eUT to intro? I invested in the below 2:  |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 04:02 PM Jul 22 2020, 04:02 PM

|

|

QUOTE(ironman16 @ Jul 22 2020, 03:59 PM) FI? Nomura not bad, amincomeplus oso good for short term parking Uncle can use their sorting filter to filter it ma, find the highest return with lowest volatility lo eut ada nomura? amincomeplus i see i scare  |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 04:08 PM Jul 22 2020, 04:08 PM

|

|

QUOTE(ironman16 @ Jul 22 2020, 04:03 PM) Why scared? The drop is due to distribution??? Check first i tak tahu is it due to distribution or not but drop so consistent i guess must be lo anyway how to check? inside eut tak tulis |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 04:18 PM Jul 22 2020, 04:18 PM

|

|

QUOTE(ironman16 @ Jul 22 2020, 04:09 PM) Boleh guna FSM tengok le Uncle go read the fund factsheet My hp can't upload pic 😂 the % of calendar year return show about 3.xx does it include the income distribution or not, if not then would be higher, if yes then this fund so so saja  |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 09:06 PM Jul 22 2020, 09:06 PM

|

|

QUOTE(GrumpyNooby @ Jul 22 2020, 06:32 PM) Malaysia 10-year MGS yields fall to record lowKUALA LUMPUR (July 22): The 10-year Malaysian Government Securities (MGS) yields have fallen to a record low of 2.63%, after the nation registered in June 2020 its highest net foreign inflow in six years since May 2014. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029, fell one basis point to close at 2.63% yesterday (July 21). https://www.theedgemarkets.com/article/mala...fall-record-lowThis may impact those FI funds that invest heavy in MGS and/or MGII. then got impact OPUS or not? |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 09:42 PM Jul 22 2020, 09:42 PM

|

|

QUOTE(GrumpyNooby @ Jul 22 2020, 09:08 PM) It may impact OPUS Shariah Short Term Low Risk Asset Fund. Fund Mandare: The fund seeks to achieve higher returns compared to the benchmark over the short term* while preserving capital** by investing in sukuk issued or guaranteed by the government of Malaysia and/or Bank Negara Malaysia. https://www.opusasset.com/wp-content/upload...v=1595423236551Below is what i have so far i still dont know which one got invest in MGS 1. AmanahRaya Syariah Trust Fund 2. AmanahRaya Unit Trust Fund 3. Phillip Master Money Market Fund 4. OPUS IPF 5. OPUS MPF 6. ASN Equity 3 Fund 7. ASN Sara 1 Fund 8. P e-INCOME 9. P e-ISLAMIC INCOME 10. P BOND 11. P ISLAMIC ASIA TACTICAL ALLOCATION 12. PB AIMAN SUKUK |

|

|

|

|

Jul 20 2020, 11:30 PM

Jul 20 2020, 11:30 PM

Quote

Quote

0.0486sec

0.0486sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled