QUOTE(fapman @ Apr 8 2018, 12:36 AM)

Interested to know about this.

How to declare the money receive is due to retrenchment?

I can’t find any column in the e-filing form which relates to retrenchment.

Here I explain simple for you.

Condition: Lets say you already get you money (means CP22A etc is cleared)

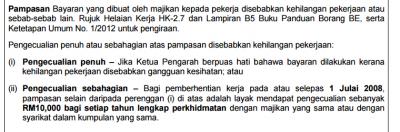

1. You DONT declare what you received during efilling if what you get is LESS than 10K a year.Example, you already work 10 years, and you received 90K retrenchment benefit. Meaning 90K / 10years is only 9K a year.

So that means you no need to declare that 90K.

2. You NEED declare what you received during efilling if what you get is MORE than 10K a yearExample, you already work 10 years, and you received 120K retrenchment benefit. Meaning 120K / 10years is 12K a year.

So that means you need to declare the 20K.

Yes, only the 20K is taxable.

The 20K should be plus with your Basic yearly salary.

Summary:

10K a year (X your service years), anything less no need declare, anything more, need to declare the balance.

I know what some of you thinking during Efilling:

Basic + Retrenchment Benefit minus Retrenchment Benefit non taxable.

But actually in Efilling dun have column like that.

So its Basic + balance of the Retrenchment Benefit (thats more than 10K).

Thats all.

This post has been edited by azbro: Apr 10 2018, 04:00 PM

Mar 14 2017, 05:42 PM, updated 8y ago

Mar 14 2017, 05:42 PM, updated 8y ago

Quote

Quote

0.0313sec

0.0313sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled