QUOTE(ChAOoz @ Sep 13 2020, 07:55 PM)

Both have the same direction, but each choose their TP based on different timing.

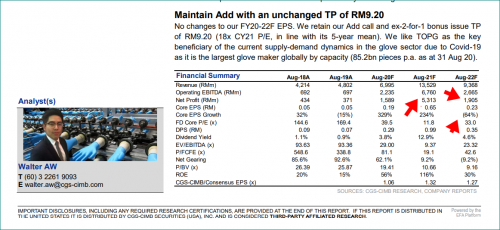

Cimb choose to go with a TP at the max earning curve, while Big Mac choose to go with an ASP normalized assumption timing.

Both actually have same down direction long run. Not surprise to see CIMB put it from overweight -> Neutral -> Underweight -> Sell in future to come.

Also i know you don't care about their TP, so when you read both report it will look like both telling the same story, but gave different ending conclusion haha.

Yes, I do not really care about TPs and in fact, to be honest, I have been reading much lesser reports....

Guilty as hell! Lazy as hell! LOL!

But in this moment.. TG and Superman fortunes lies heavily on the TPs... yeah oh well... it is what it is...

and the article on the Star blaming M for their 'brave' downgrade and thus, blaming M for the sharp correction on TG is simply ridiculous in my 3 sen opinion.

Stocks always needs to consolidate. That's a fact of life. And them glove stocks never had one good consolidation until recently... So that consolidation was much needed.

And the biggest brain damage for me was why blame M soley? Yes, it was a drastic downgrade .. but look at where we are... FY 21 numbers will be coming in soon... and to give a review on TG based on 21 numbers, is for me, seriously near sighted....

stocks are priced/valued based on their future earnings... and fy22 numbers are not far away... what? some 4 or 5 quarters away only what... so to based their call on fy22 numbers is logical....

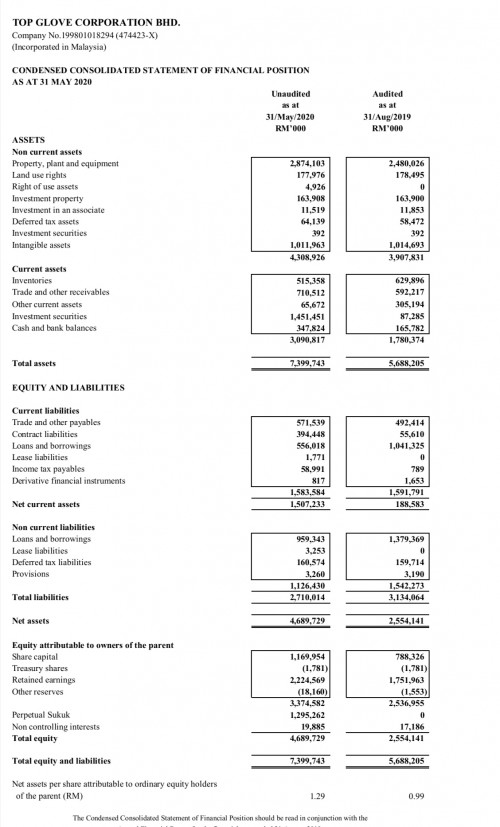

and yes... CIMB had basically the same set of numbers. In fact, their fy22 numbers is even lower than M...

so why didn't CIMB had the balls to call it out as it is? I cannot brain that. It's in their OWN tables... their own estimates.... which showed a massive earnings downtrend comes fy22.... so why...oh why... doesn't it have the courage to call it as it is?

and you know what... if these jokers are correct in their estimation.... ahem... sooner .... others will have to start calling the DOWNGRADES!

no?

btw... see... these stocks were trading in a very lackluster manner recently...

stocks were hitting the peak but on the low volume...

why tarak interest from the big boys?

were they all aware of the coming normalisation of the ASP ? which meant drastic decline in earnings is in the forcast?

could this be why?

lol ... just had a nice bowl of curry...

so a bit spicy my comments... LOL!!!

and wow... the market is rather so kind to Genting M...

looks like their all okay for Genting M to be the designated ATM machine...

Sep 10 2020, 10:55 AM

Sep 10 2020, 10:55 AM

Quote

Quote

0.2010sec

0.2010sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled