QUOTE(Sunny zombie @ Jul 5 2017, 11:58 PM)

I left out one sentence, the inpatient cost a lot, the insurance has approve my claim, but will still need a lot in future...

From company point of view, do they reserve the right to not renew the policy looking at this is a loss-making policy.

For consumer point of view, what assurance we have, provided did not breach the two condition you mention?

every year there will be 990000 available, tak pakai then burn, the next year renew again. there will be some small 10% increment to annual limit every 3 years if no claim made within that 3 years.

"guarantee renewable" is not put in the policy clause, but they do not have the rights to reject you

Ini boleh refer BNM guidelines - Financial Services Act

financial services acthttp://www.bnm.gov.my/documents/act/en_fsa.pdf

go to pg 164, "non contestability for life insurance contract" :-

QUOTE

Non-contestability

Non-contestability for life

insurance contracts

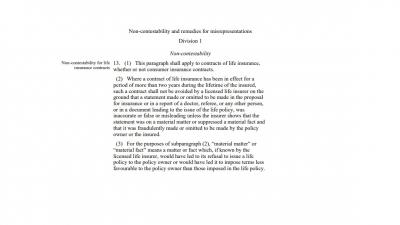

13. (1) This paragraph shall apply to contracts of life insurance,

whether or not consumer insurance contracts.

(2) Where a contract of life insurance has been in effect for a

period of more than two years during the lifetime of the insured,

such a contract shall not be avoided by a licensed life insurer on the

ground that a statement made or omitted to be made in the proposal

for insurance or in a report of a doctor, referee, or any other person,

or in a document leading to the issue of the life policy, was

inaccurate or false or misleading unless the insurer shows that the

statement was on a material matter or suppressed a material fact and

that it was fraudulently made or omitted to be made by the policy

owner or the insured.

(3) For the purposes of subparagraph (2), “material matter” or

“material fact” means a matter or fact which, if known by the

licensed life insurer, would have led to its refusal to issue a life

policy to the policy owner or would have led it to impose terms less

favourable to the policy owner than those imposed in the life policy.

EVEN if you do not disclose your health and financial statement fully and the policy is inforce for 2 years, the insurance company have no GROUNDS to reject your claim unless they can provide PROOF that you intentionally/unintentionally deceives the insurance company into entering a contract

So what to worry on renewability IF you pay your premium ON TIME?

"Trust ONLY the professionals!!!"

QUOTE(clickNsnap @ Jul 6 2017, 07:24 AM)

Insurance company cannot "reserve the right not to renew the policy". ....This apply to ILP medical card, does this apply to non-ILP, standalone medical card from life insurance companies, such as Prudential, GE and AIA?

Will the life insurance company gives priority to ILP medical card than standalone medical card customers, if both medical card plan is the same product?

non ILP medical card will lapse if it is a standalone medical card.

Some medical cards are bundled into a main plan (traditional plan), therefore you need to check the availability of surrender value. If the surrender value is sufficient to cover your cost of insurance, then it might go on for a few years.

That is the rational most insurance company design the best medical card to be included into ILP policies, to avoid the policies getting lapsed. In another word, as u said, give priority to ILP medical cards

Jul 7 2017, 12:05 PM

Jul 7 2017, 12:05 PM

Quote

Quote

0.1690sec

0.1690sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled