Outline ·

[ Standard ] ·

Linear+

Insurance Talk V4!, Anything and everything about Insurance

|

giggs_509

|

May 31 2017, 12:02 PM May 31 2017, 12:02 PM

|

|

Hi all. Plan to refinance house. So bank is proposing to take the MRTA. Is it adviseable to increase personal insurance coverage sum instead of taking home insurance MRTA?

This post has been edited by giggs_509: May 31 2017, 12:07 PM

|

|

|

|

|

|

giggs_509

|

May 31 2017, 12:09 PM May 31 2017, 12:09 PM

|

|

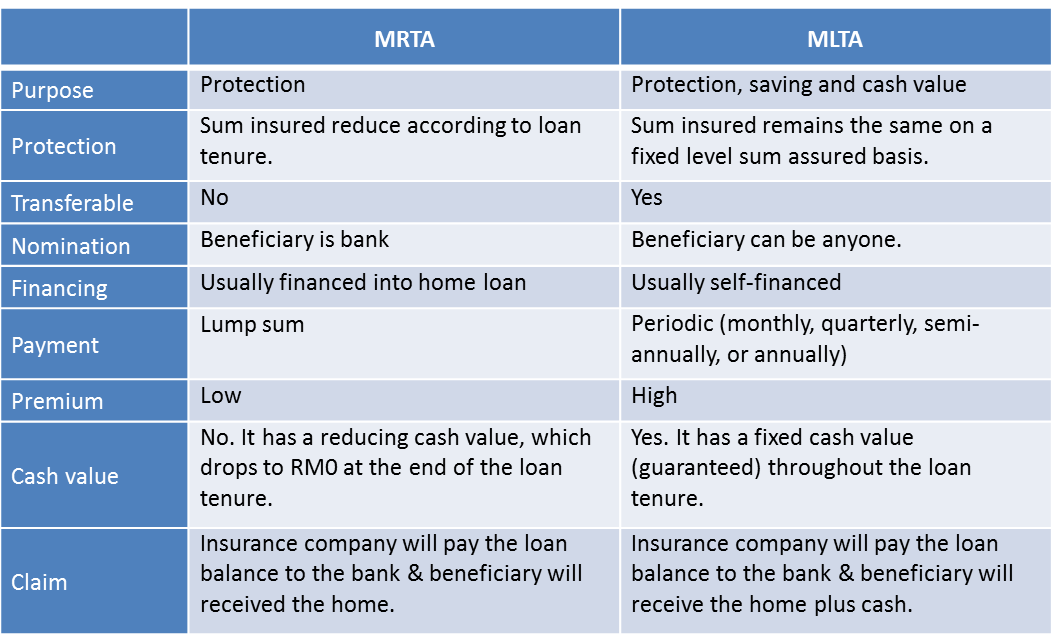

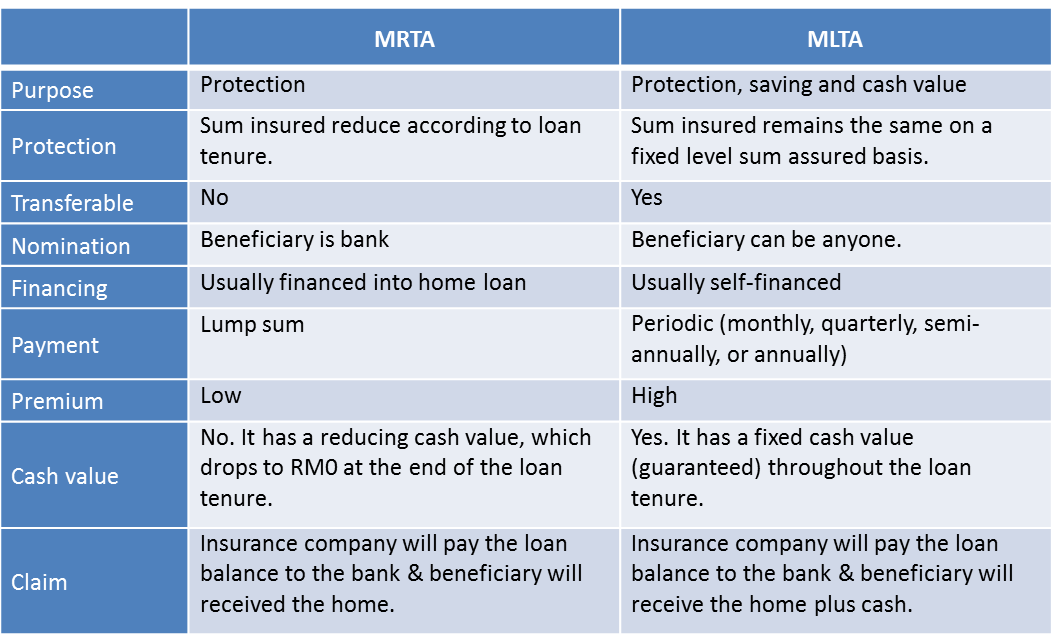

QUOTE(lifebalance @ May 31 2017, 12:05 PM)  You may refer to this. MLTA is too expensive for my age i guess. So now left MRTA vs personal insurance. |

|

|

|

|

|

giggs_509

|

May 31 2017, 12:21 PM May 31 2017, 12:21 PM

|

|

QUOTE(Holocene @ May 31 2017, 12:13 PM) Yes. Let say personal insurance cover death/TPD 500k. House loan at the time left 300k. So can settle house 300k and got balance 200k. Correct me ya. Noob here |

|

|

|

|

|

giggs_509

|

May 31 2017, 12:29 PM May 31 2017, 12:29 PM

|

|

QUOTE(lifebalance @ May 31 2017, 12:23 PM) Ya the only problem is you got less 300k to use as income replacement or to pass on to your next of keen because instead of buying additional coverage for the additional debt you incurred. Never mix up mortgage insurance and personal insurance So not adviseable? |

|

|

|

|

May 31 2017, 12:02 PM

May 31 2017, 12:02 PM

Quote

Quote

0.1033sec

0.1033sec

0.84

0.84

7 queries

7 queries

GZIP Disabled

GZIP Disabled