CODE

6VGSKT

T&C:

» Click to show Spoiler - click again to hide... «

Do comment if you've used it as it says one time use only.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 19 2019, 12:34 PM Jan 19 2019, 12:34 PM

Return to original view | Post

#1

|

Senior Member

1,042 posts Joined: Jan 2003 |

Anyone who wants to make use of the 0.5% sales charge code (valid 19 Jan 2019 only), please feel free:

CODE 6VGSKT T&C: » Click to show Spoiler - click again to hide... « Do comment if you've used it as it says one time use only. |

|

|

|

|

|

Mar 24 2019, 05:26 PM Mar 24 2019, 05:26 PM

Return to original view | Post

#2

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(phoenix24 @ Mar 24 2019, 08:48 AM) Hi guise, I for one like to keep my fixed income really boring, my candidates:Was wondering which is the best bond fund in you guise opinion? I have affin hwang select bond fund .. but i crave for better performance in a bond fund hehe 1. AmBon Islam (the one I choose personally) 2. AmBond - Investment grade (AAA to BBB) rated and in MYR (no foreign currency risk) - AmBon Islam has a pinch higher sharpe ratio, lower volatility and higher YTD yield than the 'gold standard' Libra Asnita - AmBond has a pinch of higher risk and YTD yield than its Islamic sibling AmBon Islam and Libra Asnita |

|

|

May 13 2019, 08:48 PM May 13 2019, 08:48 PM

Return to original view | Post

#3

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(maxxng12 @ May 13 2019, 04:54 PM) QUOTE(David83 @ May 13 2019, 08:12 PM) Since Mar - plan to every 2 months switch Kenanga Bond 500 units to Kenanga Growth, but that's just my fun punting allocation trying to buy it while it dips This post has been edited by roarus: May 13 2019, 08:48 PM |

|

|

Jun 1 2019, 05:56 PM Jun 1 2019, 05:56 PM

Return to original view | Post

#4

|

Senior Member

1,042 posts Joined: Jan 2003 |

It would seem FSM has abandoned updating this section after launching managed portfolios locally?

https://www.fundsupermart.com.my/fsmone/res...commended-funds |

|

|

Jun 1 2019, 10:41 PM Jun 1 2019, 10:41 PM

Return to original view | Post

#5

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Krv23490 @ Jun 1 2019, 06:25 PM) Thanks! However, I'm looking for Malaysia specific equity funds to keep an eye on for now. Wondering if the recommended by FSM are still Eastspring Investments Equity Income and Kenanga Growth |

|

|

Jun 4 2019, 02:44 PM Jun 4 2019, 02:44 PM

Return to original view | Post

#6

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(frankzane @ Jun 4 2019, 01:52 PM) You'll always hold bond/fixed income, because you'll hold more as you approach retirement and beyond it as you glide down your risk from equity exposure.Well unless you can hold it in another platform that doesn't charge, then that will obviously be wiser |

|

|

|

|

|

Jun 5 2019, 09:29 PM Jun 5 2019, 09:29 PM

Return to original view | Post

#7

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Jackrau @ Jun 4 2019, 11:54 PM) Hi, I am newbie to FSM. May I know, if am not a sophisticated investor can I still invest on Nomura i-income fund and wholesale bond ? The paranoid side of me tells me just because none of the members got check randomly doesn't exclude you from being the first lucky one. This statement that you agree to is worrying - while you're able to buy, can FSM reject your sell instruction later on?QUOTE If any information is found false or misleading, or if the need to obtain further information/documents is not met, iFAST may reject any of my application and/or instructions including but not limited to, any transactional-related activities. |

|

|

Jun 7 2019, 01:46 AM Jun 7 2019, 01:46 AM

Return to original view | Post

#8

|

Senior Member

1,042 posts Joined: Jan 2003 |

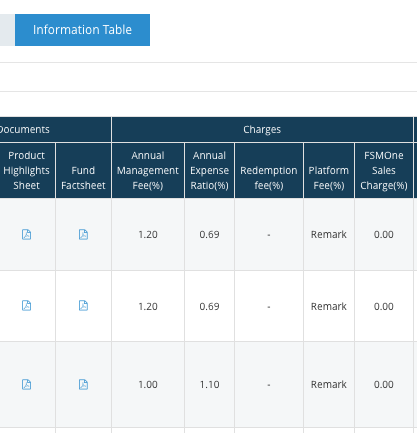

QUOTE(frankzane @ Jun 7 2019, 12:54 AM) Go to https://www.fundsupermart.com.my/fsmone/fun...d-selector/////1. Assets Class - select Fixed Income 2. Click button Generate Funds Table 3. By default table generated displays Annualised Performance Table, switch to Information Table view 4. Check out the column Platform Fee(%)  Alternative platform, eunittrust.com.my it has its own thread (https://forum.lowyat.net/index.php?showtopic=4268975) you may direct your questions specific to the platform there |

|

|

Jun 7 2019, 03:50 PM Jun 7 2019, 03:50 PM

Return to original view | Post

#9

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Red_rustyjelly @ Jun 7 2019, 02:36 PM) I'd say Islamic Bonds (general category - as long as investment grade) is pretty safe and strong performer in Malaysia. Default will happen but the fund still holds a whole bunch of other performing bonds.RHB Islamic Bond fund has already recovered almost back to it's pre-dip value within 1 week. Also noticed more local funds (e.g. AmBond, AmBon Islam) have picked up Malaysian Government Securities since the 1 month or so after being let go by foreign fund(s). |

|

|

Jun 7 2019, 10:17 PM Jun 7 2019, 10:17 PM

Return to original view | Post

#10

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Sep 18 2019, 03:35 PM Sep 18 2019, 03:35 PM

Return to original view | Post

#11

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Sep 26 2019, 11:24 AM Sep 26 2019, 11:24 AM

Return to original view | Post

#12

|

Senior Member

1,042 posts Joined: Jan 2003 |

Black: AmBon Islam Orange: Libra Asnita Blue: Eastspring Investments Bond Update: My bad, their distribution is semi-annually @ Mar & Sep. I thought it was annually @ Mar This post has been edited by roarus: Sep 26 2019, 11:34 AM |

|

|

Oct 25 2019, 01:24 PM Oct 25 2019, 01:24 PM

Return to original view | Post

#13

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

|

|

|

Nov 2 2019, 10:58 PM Nov 2 2019, 10:58 PM

Return to original view | Post

#14

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Nov 25 2019, 11:47 AM Nov 25 2019, 11:47 AM

Return to original view | Post

#15

|

Senior Member

1,042 posts Joined: Jan 2003 |

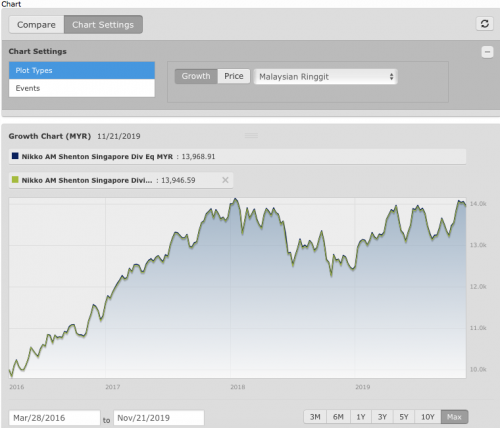

QUOTE(pigscanfly @ Nov 24 2019, 09:28 PM) Hi sifus. I would like to ask your advice regarding Nikko AM Singapore Dividend Equity Fund. Apparently this unit trust has MYR class and is also offered in Malaysia, in addition to SGD class. I have accounts in FSM MY and POEMS SG, allowing me to buy UT either in MYR or SGD class. There's no hedging for the version of fund sold via FSM - MYR class will be converted to base currency (SGD). As you can see both moves almost tick to tick after conversion to MYR:I have made comparisons between the two classes, and both offer dividend yields of 5.13% 3 year annualized votalitiy 9.62 (MYR) vs 9.20 (SGD) 3 year Sharpe ratio 0.58 (MYR) vs 0.62 (SGD) Are there any other factors that I need to consider (besides currency exchange fees) when choosing MYR or SGD class? Are there any advantages of choosing the SGD class over MYR? In dilemma right now Your comments are highly appreciated  Based on prospectus, it mentions no hedging too: QUOTE Foreign Currency Risk Conclusion: If you dead set on buying it - buy MYR if you're earning MYR, buy SGD if you're earning SGDThe Managers do not actively hedge the foreign currency exposure of investments of the Fund and therefore, the Fund may be exposed to exchange rate risks. |

|

|

Nov 25 2019, 05:17 PM Nov 25 2019, 05:17 PM

Return to original view | Post

#16

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(pigscanfly @ Nov 25 2019, 02:26 PM) Thanks for the detailed explanation roarus. But could you please explain why "buy MYR if you're earning MYR, buy SGD if you're earning SGD"? Wouldn't it be better to buy in the base currency of the fund, to avoid any further foreign exchange risk (considering that non-SGD classes are not hedged as you pointed out)? What I meant was to simply fund it in whichever currency you have access to easily. Since from morningstar you can see both moving concurrently together after currency conversion, it'll be more efficient to let the fund manager handle the currency conversionAnd wouldn't it be advantageous to us if we buy SGD, and SGD appreciates against MYR? The moment you transact (regardless of MYR or SGD), you end up holding the same underlying things - a mixpot of stocks in DBS, UOB, OCBC, Keppel, Venture Corp, Sing Tech, Capitaland, Thai Bev, SingTel, etc. Stocks are part ownership in company and not hard currency This post has been edited by roarus: Nov 25 2019, 05:19 PM |

|

|

Nov 26 2019, 10:52 AM Nov 26 2019, 10:52 AM

Return to original view | Post

#17

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(pigscanfly @ Nov 26 2019, 12:46 AM) Thanks for the clarification roarus. After reading WhitE LighteR and your comments, I was considering buying the MYR class. But I realised FSM MY imposes sales charge, so does Phillip Mutual. However Phillip Mutual is having a zero sales charge promotion ending 29/11/2019. Unfortunately I do not have a Phillip Mutual account. Why not consider opening eunittrust account? It's about the same process as FSM, all done online. They have 0 fee promo every few months or so if you're not in a hurry, and you can park money in their fixed price money market fund in the meantime.Good thing that POEMS SG has 0% sales charge and 0% platform fees Thanks for your enlightenment sifus. Much appreciated |

|

|

Nov 27 2019, 08:42 PM Nov 27 2019, 08:42 PM

Return to original view | Post

#18

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Drian @ Nov 27 2019, 07:39 PM) https://www.fundsupermart.com.my/fsmone/art...formance-Review Each fund have their own published strategy, asset type/ratio and geographical coverage e.g. if Malaysia region market performs bad compared to the rest of the Asia Pac countries - Malaysia region funds will suffer while Asia Pac funds will breakaway.Are PRS fund managers that bad? I'm seeing negative and low 2-4% return rates. I personally like Asia Pac region funds - it's the widest net you can cast with PRS at the moment. I'll dial it down and switch to moderate/conservative later when I'm older. |

|

|

Dec 2 2019, 03:36 PM Dec 2 2019, 03:36 PM

Return to original view | Post

#19

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Dec 3 2019, 02:18 PM Dec 3 2019, 02:18 PM

Return to original view | Post

#20

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(NotHideOnBush @ Dec 2 2019, 11:59 PM)  Now buy PRS via FSM no need to fill forms? Link: https://www.fundsupermart.com.my/m/research/article/11460 |

| Change to: |  0.0486sec 0.0486sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:07 PM |