QUOTE(ironman16 @ Jan 27 2021, 11:29 AM)

Any reason why u like balanced fund? 20% = just split it 10% to bond fund + 10% to equity fund

if i actively manage i fund i will avoid balance fund (except United Malaysia = flexi balance

)

Because in term of return, this fund seem giving on par return vs those good EQ shariah funds on long term > 5 years

QUOTE(2387581 @ Jan 27 2021, 11:51 AM)

To me 25% Malaysia is too high. I'm not sure what is the % of US in this list of funds. Maybe because the US funds are not shariah compliant. But many of the equities are US-listed China companies too...

From a glance it looks many of the APxJ funds are overlapping each other, with many of the top holdings being Tencent, Alibaba, Samsung, TSMC, and their performances are somewhat tracking each other.

To me I would just pick one or two of them. I personally believe those funds inside FSM recommended fund list is good enough.

Thanks for the suggestion. I pick principal islamic asia pasific dynamic equity fund and affin hwang aiiman asia (ex japan) growth fund and replace the remaining with previous metal and bimb arabesque i global dividen fund 1

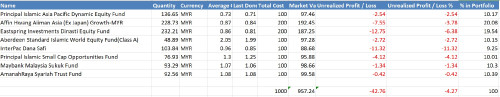

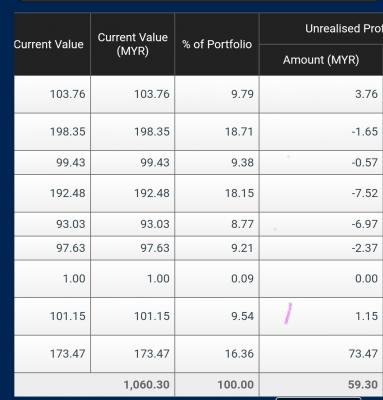

AmanahRaya Shariah Trust Fund 5%

Maybank Malaysia Sukuk Fund 5%

Dana Makmur Pheim 5%

Aberdeen Standard Islamic World Equity Fund 20%

Eastspring Investments Dinasty Equity Fund 15%

Principal Islamic Asia Pasific Dynamic Equity Fund 15%

Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund 15%

Precious Metal Securities 10%

BIMB-Arabesque i Global Dividend Fund 10%

10% FI

5% Balanced

85% EQ

15% Malaysia

30% asia ex japan

15% greater china

40% global

Feb 14 2017, 10:05 AM

Feb 14 2017, 10:05 AM

Quote

Quote

0.0572sec

0.0572sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled