what is the frequency in which profits are obtained in the cash management funds?

sorry my knowledge very bad, read liao still not 100% understand

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jun 28 2018, 03:30 PM Jun 28 2018, 03:30 PM

Return to original view | Post

#1

|

Senior Member

1,184 posts Joined: Sep 2009 |

what is the frequency in which profits are obtained in the cash management funds?

sorry my knowledge very bad, read liao still not 100% understand |

|

|

|

|

|

Jun 28 2018, 03:42 PM Jun 28 2018, 03:42 PM

Return to original view | Post

#2

|

Senior Member

1,184 posts Joined: Sep 2009 |

QUOTE(MUM @ Jun 28 2018, 03:41 PM) if you mean, the frequency of which you would like to withdraw from cash management fund? if yes,..as long as there is profit, you can withdraw subjected to Minimum Redemption Amount RM 100 Minimum Holding RM 100 |

|

|

Jun 28 2018, 05:12 PM Jun 28 2018, 05:12 PM

Return to original view | Post

#3

|

Senior Member

1,184 posts Joined: Sep 2009 |

QUOTE(ChessRook @ Jun 28 2018, 04:44 PM) Lets take the RHB cash management fund 2 at Fundsupermart. The interest returns are accrued daily. Because this money market funds invest in "predominantly assets in Malaysian Ringgit deposits (not more than 365 days) with financial institutions in Malaysia" meaning fixed deposits, it is relatively low risk. very very good explanation! thanks so much. Will place some of my excess funds into it rather than just sitting at my regular savings account. Amount not big enough for FD.It may not match some FD rates like 4.1-4.25% of certain banks but given that it is fairly liquid in getting back the money in +2 business days. It also has the advantage of not losing some portion of my interest if I want to withdraw early unlike FD. The current rate of RHB cash management fund 2 is about 3.45%. Another positive, is that there is less requirements than FD. It only requires min RM500 to invest and RM100 for subsequent investments. Some FD requires some min amount before getting a good rate. Honestly, I put part of my emergency savings into this. For UT are the returns daily or monthly? |

|

|

Jun 28 2018, 05:12 PM Jun 28 2018, 05:12 PM

Return to original view | Post

#4

|

Senior Member

1,184 posts Joined: Sep 2009 |

QUOTE(ChessRook @ Jun 28 2018, 04:44 PM) Lets take the RHB cash management fund 2 at Fundsupermart. The interest returns are accrued daily. Because this money market funds invest in "predominantly assets in Malaysian Ringgit deposits (not more than 365 days) with financial institutions in Malaysia" meaning fixed deposits, it is relatively low risk. very very good explanation! thanks so much. Will place some of my excess funds into it rather than just sitting at my regular savings account. Amount not big enough for FD.It may not match some FD rates like 4.1-4.25% of certain banks but given that it is fairly liquid in getting back the money in +2 business days. It also has the advantage of not losing some portion of my interest if I want to withdraw early unlike FD. The current rate of RHB cash management fund 2 is about 3.45%. Another positive, is that there is less requirements than FD. It only requires min RM500 to invest and RM100 for subsequent investments. Some FD requires some min amount before getting a good rate. Honestly, I put part of my emergency savings into this. For UT are the returns daily or monthly? |

|

|

Jun 29 2018, 07:58 AM Jun 29 2018, 07:58 AM

Return to original view | Post

#5

|

Senior Member

1,184 posts Joined: Sep 2009 |

QUOTE(ChessRook @ Jun 28 2018, 08:06 PM) For UT funds, the returns you get is from the upward movement in nav prices. NAV = net assest value of the UT fund. But Nav prices can also go down or remain almost the same also. means it is like trading in stocks? whereby one needs to contemplate when to enter and when to exit? |

|

|

Mar 7 2021, 11:51 AM Mar 7 2021, 11:51 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,184 posts Joined: Sep 2009 |

My china funds from profit 800 to now slight loss over the last 2 weeks despite averaging down several times Really crazy and learning lesson to me, should've been fast hands like stock market datolee32 liked this post

|

|

|

|

|

|

Mar 9 2021, 09:38 PM Mar 9 2021, 09:38 PM

Return to original view | Post

#7

|

Senior Member

1,184 posts Joined: Sep 2009 |

QUOTE(encikbuta @ Mar 9 2021, 03:48 PM) if it helps a little, the drop in Principal Greater China is coz of income distribution some time in 3rd March. it caused a 3% - 4% drop in the fund. once the income distribution comes in, expect the fund to go back up 3% - 4% Thanks bro, didnt know that. Feel a bit better now hehbut yea, hang in there man. How can one know about the income distribution one? Sorry newbie here |

|

|

Mar 9 2021, 10:08 PM Mar 9 2021, 10:08 PM

Return to original view | Post

#8

|

Senior Member

1,184 posts Joined: Sep 2009 |

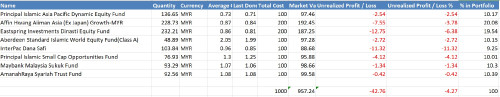

QUOTE(kazekage_09 @ Mar 9 2021, 09:38 PM) Here is my current portfolio. Just entered last month after asking few questions is this thread. All swimming in red. at least your entry point is very low, very easy to recoup your losses if you average down and when it rebounds. I personally kept buying increasingly when the price went up since last few months of 2020 until this month, profits all wiped already. |

|

|

Mar 11 2021, 10:01 AM Mar 11 2021, 10:01 AM

Return to original view | Post

#9

|

Senior Member

1,184 posts Joined: Sep 2009 |

|

|

|

Feb 28 2022, 06:58 PM Feb 28 2022, 06:58 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,184 posts Joined: Sep 2009 |

-20% unrealised loss position for my UTs (half China equity, half global balanced) in view of worrisome global news. Hope this doesn't become falling knife, don't have the stomach to average down at the moment This post has been edited by diversity: Feb 28 2022, 06:58 PM cempedaklife and james.6831 liked this post

|

|

|

Mar 16 2022, 02:34 PM Mar 16 2022, 02:34 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,184 posts Joined: Sep 2009 |

My principal Greater China from +10% early last year to nearly - 30% now. No eye see.

This post has been edited by diversity: Mar 16 2022, 02:34 PM |

| Change to: |  0.0607sec 0.0607sec

0.98 0.98

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:16 PM |