QUOTE(kenny79 @ Mar 1 2018, 08:35 AM)

Why not try eUT ? 0%FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 1 2018, 10:49 AM Mar 1 2018, 10:49 AM

Return to original view | Post

#81

|

Junior Member

338 posts Joined: Nov 2014 |

|

|

|

|

|

|

Mar 1 2018, 10:59 AM Mar 1 2018, 10:59 AM

Return to original view | Post

#82

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(MUM @ Mar 1 2018, 10:54 AM) maybe some people got turned off bcos of this..... Priority customer surely got 5k? and maybe some people does not have enough money to top up to qualify for the 0% SC. But you get what you pay for, if the advice by the RM there is really good then the 0.5% might be worth it |

|

|

Mar 6 2018, 11:32 AM Mar 6 2018, 11:32 AM

Return to original view | Post

#83

|

Junior Member

338 posts Joined: Nov 2014 |

Selling my funds today as the prices went up. Good idea?

|

|

|

Mar 6 2018, 11:51 AM Mar 6 2018, 11:51 AM

Return to original view | Post

#84

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(MUM @ Mar 6 2018, 11:44 AM) 1) has the fund(s) made enough for your initial targeted returns? 2) now realized initially purchased the wrong fund(s) or need to reorganise your port so the fund(s) need to be kicked out? 3) feeling to hot for the current environment, thus needs to sold off the fund(s) and stay on the sidelines while waiting for opportunities to reenter? 4) in need of cash for having dumped too having into the investment? 5) why you need to sell when the prices are up?....isn't that is your purpose of UT investment? you don't like the NAVs to go up? or you think the NAV has upped to long and to drastic thus may go down again very soon? Sell now because I don't think the prices will go up any higher. |

|

|

Mar 6 2018, 04:59 PM Mar 6 2018, 04:59 PM

Return to original view | Post

#85

|

Junior Member

338 posts Joined: Nov 2014 |

|

|

|

Mar 7 2018, 01:41 PM Mar 7 2018, 01:41 PM

Return to original view | Post

#86

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(wankongyew @ Mar 7 2018, 01:25 PM) The resignation of Cohn from the Trump White House seems like a significant event to me and the best indication yet that the tariffs are coming for real. We've been waiting for the tipping point of the next big crisis for a while now. It seems to me that we could be looking at it. So what would your advice be ? Sell all China funds ? |

|

|

|

|

|

Mar 9 2018, 11:03 AM Mar 9 2018, 11:03 AM

Return to original view | Post

#87

|

Junior Member

338 posts Joined: Nov 2014 |

Sold a little bit too early. Should have waited for a few more days .....

This post has been edited by jfleong: Mar 9 2018, 11:03 AM |

|

|

Mar 12 2018, 01:05 PM Mar 12 2018, 01:05 PM

Return to original view | Post

#88

|

Junior Member

338 posts Joined: Nov 2014 |

Sold at the wrong time. After selling everything went up so fast....

|

|

|

Mar 12 2018, 01:38 PM Mar 12 2018, 01:38 PM

Return to original view | Post

#89

|

Junior Member

338 posts Joined: Nov 2014 |

|

|

|

Mar 13 2018, 11:57 AM Mar 13 2018, 11:57 AM

Return to original view | Post

#90

|

Junior Member

338 posts Joined: Nov 2014 |

Anyone here who is not a 'sophisticated-investor' bought a sophisticated-investor only fund?

Particularly Manulife Dragon MYR hedged ? Did they reject ? |

|

|

Mar 13 2018, 04:01 PM Mar 13 2018, 04:01 PM

Return to original view | Post

#91

|

Junior Member

338 posts Joined: Nov 2014 |

PRS :

Those who have not opened a PRS account and under 30 can consider opening via PPA instead of FSM, where the RM10+GST account opening charge will be waived, and no sales charge for those under 30 https://prsenrolment.ppa.my Terms & Conditions of PRS Online Enrolment: The PRS Online Portal is for execution only and does not provide advice. Please read and understand the Disclosure Document and Product Highlight Sheets (PHS) before selecting the PRS funds to invest. If you wish to seek further advice, please contact your respective PRS Consultant. Please also consider the applicable fees and charges before investing. For all online applications through PRS Online Enrolment, the PPA account opening fee of RM10.00 shall be waived till further notice. For applicants age 30 and below who perform self-enrolment, PRS Providers’ sales charge will be at 0% Upon the successful completion of your online transaction, your contributions will be forwarded to your Provider(s) for their onward processing at the next cycle. You will receive a separate acknowledgement from your Provider(s) once they have created the units in the relevant fund(s) for your benefit. Please note that successful completion of the online transaction does not guarantee the successful opening of the account. The respective Provider(s) may take up to 7 business days to confirm or reject the opening of the account and the contributors are obliged to provide all the necessary information (if requested by the respective Provider[s]) for the verification purposes. You may contact us if you wish to know the status of your transactions. Our contact details can be found here: Contact Us In the event you have insufficient funds for the transaction, the transaction will be rejected. Please note that payments for the units purchased must only be done from the applicant’s own bank account. No third party or joint account payment will be allowed. Please note that the PRS Online Enrolment under the purview of the PPA is only for Malaysian Citizens. For non-citizens, please contact the respective PRS Providers for further advice. Please note that the opening of PRS account is for the purpose of saving and investing for retirement. This post has been edited by jfleong: Mar 13 2018, 04:03 PM |

|

|

Mar 13 2018, 08:42 PM Mar 13 2018, 08:42 PM

Return to original view | Post

#92

|

Junior Member

338 posts Joined: Nov 2014 |

|

|

|

Mar 14 2018, 01:48 PM Mar 14 2018, 01:48 PM

Return to original view | Post

#93

|

Junior Member

338 posts Joined: Nov 2014 |

Hang Seng dropped quite a bit today, any predictions for tomorrow ?

Also I tried to switch to FSM by selling my eUT units, because I wanna buy Dragon fund at 0% Turns out this offer does not extend to wholesale fund ....backfired ! |

|

|

|

|

|

Mar 14 2018, 11:05 PM Mar 14 2018, 11:05 PM

Return to original view | Post

#94

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(i1899 @ Mar 14 2018, 10:57 PM) why not extend to wholesale fund?! What I got : All Retail Funds in Fundsupermart.com is entitle for above promotion EXCEPT Wholesale FundsBelow are FSM reply to me about the step of Transfer In: " You may follow the steps below : 1. First, you are required send us the redemption slip as supporting document for record purpose. 2. We will offer you 0% sales charge for the same redemption amount. 3. We will offer you 1 month buffer period (from the redemption date) to move in the funds. 4. This offer is applicable to all funds except for All Affin Hwang Asset Management Berhad wholesales funds. 5. When you want to utilize the offer, kindly send email to notify us to adjust sales charge manually after placing order online before 2:30pm. " But can consider some other Manulife fund then switch, but have to pay the RM25+GST switching fee |

|

|

Mar 19 2018, 01:13 PM Mar 19 2018, 01:13 PM

Return to original view | Post

#95

|

Junior Member

338 posts Joined: Nov 2014 |

Wrong post format

This post has been edited by jfleong: Mar 19 2018, 01:37 PM |

|

|

Mar 19 2018, 01:23 PM Mar 19 2018, 01:23 PM

Return to original view | Post

#96

|

Junior Member

338 posts Joined: Nov 2014 |

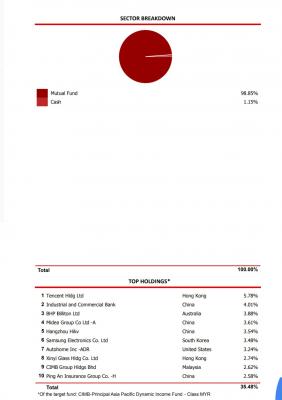

QUOTE(jfleong @ Mar 19 2018, 01:13 PM) Regarding CIMB PRS APAC ex-Japan After some calculations, it seems like the annual management fee for the PRS fund is negligible , assuming the proportion used to buy the target fund is fixed throughout the period as 98.85%, the annualised annual management fee of the PRS fund is , for 1,2,3 and 5 years are 0.07% , 0.05% , -0.08% and 0.65% respectivelyIt seems like most of the fund is just used to buy CIMB Asia Pacific ex-Japan fund, but there's an additional management fee to it ? So there's a management fee on the PRS fund, then another management fee on the mutual fund it buys ? Why not just buy the same proportionally as the target fund so as to save management fee ? Attached thumbnail(s)

|

|

|

Mar 23 2018, 09:39 PM Mar 23 2018, 09:39 PM

Return to original view | Post

#97

|

Junior Member

338 posts Joined: Nov 2014 |

cukur Dow Jones bounce back a little bit now

|

|

|

Apr 4 2018, 02:50 PM Apr 4 2018, 02:50 PM

Return to original view | Post

#98

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(j.passing.by @ Apr 4 2018, 02:45 PM) Plus EPF has tax relief too... which is double the amount of PRS? They are counted separately so why not both ? In comparing PRS to a normal UT fund... if normal UT fund is not found satisfactory in the returns for the risk taken, then PRS is found wanting too. The tax relief and the 1k incentive is just one time upfront benefits - which is just gains on paper since we can't hold and rub it between our fingers; similar to the shiok feeling of buying UT funds during promotions on service charge discounts. During a market downturn, if people are stress out on holding UT funds, it would be more stressful for those holding PRS and don't fully understood their initial objective of putting their money/savings into these financial vehicles except to gain the tax relief. There is a possiblity that PRS is dying a slow death if majority of those who are into PRS are solely for the tax relief, and if and when there is no more incentives or tax relief... Just my 2 cents. It's not one time benefit, it's tax relief every year too during market downturn can always switch to conservative funds from same fund house if you so desire It's still your money that can be withdrawn at 55 or passed on to your kids if you die before that |

|

|

Apr 4 2018, 03:30 PM Apr 4 2018, 03:30 PM

Return to original view | Post

#99

|

Junior Member

338 posts Joined: Nov 2014 |

QUOTE(j.passing.by @ Apr 4 2018, 03:16 PM) There is tax relief if you continue to purchase PRS every year. It is a one time benefit for the same invested money... since you don't get tax relief on the same invested money every year. I thought you were talking about incentives for investing instead of incentives for holing, my bad Conservative funds... that gives lower return than EPF? Please la, read through the previous posts. "passed on to your kids" has various meanings and implications. AFAIK, you can't transfer EPF to another person. Highly likely it is the same with PRS and those fixed-priced funds. This is the reason why I still advocate holding a portfolio of normal UT funds over PRS. Does UT give you any incentive for holding (other than investment profits, which is also available through PRS) Still better than normal UT with no incentive at all, plus sales charge lagi (even though >5k no SC through eUT during promo period, but for PRS no sales charge any amount, any time, you might even get a pair of free movie tickets for 3k during promo period) QUOTE during market downturn can always switch to conservative funds from same fund house if you so desire I said if that's what you want - you can choose any fund depending on your appetite / risk aversion I always hold on to the one with maximum risk, because that's a rather insignificant amount of money that I can afford to lose QUOTE It's still your money that can be withdrawn at 55 or passed on to your kids if you die before that No one said anything about transferring between persons , I said if you die your kids can still inherit the money Again this all depends on your risk, how much you wanna save etc Obviously max out the 6k EPF first , but I've already done that through normal salary If you have extra then can consider PRS, it might be worth it for those with high marginal tax rates This post has been edited by jfleong: Apr 4 2018, 03:37 PM |

|

|

May 16 2018, 09:58 AM May 16 2018, 09:58 AM

Return to original view | Post

#100

|

Junior Member

338 posts Joined: Nov 2014 |

Currently holding bond fund. Which is faster to reach my account ? Switch to CMF then withdraw or straight away withdraw ?

Which bank faster ? |

| Change to: |  0.0536sec 0.0536sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 09:34 PM |