Btw what do you guys think of the fact that many personal finance influencers often demonise investing in unit trusts. How have your experiences been with UTs, robos(most are practically mutual funds in a way), other collective investment schemes vs your own direct investments in stocks?

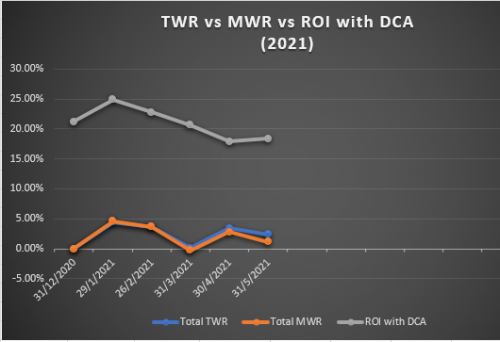

I feel this is really bad as the younger investors would then be led to think that if they just do “the work” they would be the next warren buffet. Meanwhile they’d be missing out on the comppunding effect that is absolutely crucial in the early years. I would generally encourage investors, especially newbies to start out with UTs. Set up the min and dca the minimum in that collective investment scheme. But then eventually if one has extra I feel they should use it to invest in stocks directly. That way they can see if they can do better than a ut. If they can then great! You’re part of that 1%. However, if we are honest about our returns, I’m sure the majority 60-80% of retail investors actually have terrible returns in the stock market, but keep it a secret. There’s nothing wrong with that tho. Learning how to choose a decent ut and dca-ing into them would easily put you miles ahead of your poor performance from pretending to be a fund manager. Nothing wrong with 5-8% annual returns vs hoping to make double digit returns but effectively making -ve returns or 3–6% returns at best.

Back in the days they’d say those who say UTs are great and downplay direct stock investing are probably agents whore trying to make money out of you. However these days it seems to be the reverse. Most of those who trash UTs are probably selling you a course, making lien y from YouTube videos about stocks etc.

Guess the moral of the story is, be honest with yourself, what’s your actual capability. Not everyone is made for stock investing and there’s nothing wrong with that. Just look for the alternative that has the highest chance of success instead of looking for the highest potential outcome.

The statics have been well studied. The majority of investors are plain bad at investing. Most of us here (personal finance nerds hahaha) are what those statistics refer to. Yes it’s us the personal finance nerds, who think we may be the next warren buffet. Reality check tho, these stats are not referring to the general public, cz the general public don’t invest to begin with. Be honest with your capabilities guys. Serious stock investing is a full time job (the job here being studying mostly). To quote William J. Bernstein “ No one in his right mind would walk into the cockpit of an airplane and try to fly it, or into an operating theater and open a belly. And yet they think nothing of managing their retirement assets. I've done all three, and I'm here to tell you that managing money is, in its most critical elements even more demanding than the first two”

That being said, don’t get me wrong, I’m not discouraging people from investing in stocks. I’m all for it actually. I think we should all try. It certainly keeps our ears to the ground. Depdjimg on your performance you’d know which portfolio should be your core investment. What I’m outlining here is bashing UTs and other collective investment schemes.

Hahaha sorry for the unnecessarily long rant that no one asked for guys. Just thinking about how I would’ve done things differently.

1. Actively Managed Funds (Unit Trust / Mutual Fund / Active ETF): Good for inefficient & unstable markets where price discovery (i.e. discounts) can be found by skilled & well connected fund managers. Malaysia is a prime example. The local reputable mutual funds perform WAAAYYY better than the KLSE index.

2. Self-Investing (stock picking): Can only speak from own experience. It sucked balls. In 3 years dabbling in Bursa, while I managed to earn like 50 - 100% returns in about 5x stocks, I lost 20 - 30% in the other 20x stocks. Overall, I made only 1% p.a. in 3 years, lol. I personally believe that commoners like us have very little chance against the whales of the stock market. With enough time & effort, good returns can be made but you'd have upgraded yourself to a professional fund manager, not really a part-time investor.

3. Passive Funds (Index Mutual Funds, Passive ETFs): Good for efficient & developed markets (i.e. USA & Eur) where price discovery opportunities are very low.

Apr 2 2021, 03:32 PM

Apr 2 2021, 03:32 PM

Quote

Quote

0.9079sec

0.9079sec

0.97

0.97

7 queries

7 queries

GZIP Disabled

GZIP Disabled