QUOTE(ruffell @ Jul 16 2020, 02:25 PM)

Can someone help me to understand the EPF investment through FSM platform.

There is a note in EPF website that the investment sum will be locked for 3 months after purchase. I am wondering if we buy and sell the funds let's say within one month, will the whole amount still be locked by EPF or we can repurchase anytime after selling? Thanks Gurus

After you have redeemed the investment, that fund will not be made available to you for reinvestment until the next cycle which is refreshed every 3 months. The way epf-mis counts it is from the first day you made investment. E.g;

1st july: buy rhb big cap ( first investment)

16th july; buy principal greater china

And you decide to redeem rhb big cap on 17th july, you will not be able to reinvest that fund again until 1st of july + 3 months.

For clarity, if you decide to redeem principal greater china on 20th august for example, you will be also be unablento reinvest that amount back until 1st july + 3 months

How to avoid this? Switch the fund instead of reedeming it. My strategy is switching back and forth from equity to bond taking advantage of the 0% sales charge and 0% switching fee( only for principal and kenanga), RHB still has rm25 fee.

Another thing is, please also understand the math involved in the calculation to determine the amount allowed to be invested. If let say you are elligible for 70k on this cycle and invested all of it in the beginning before deciding to redeem 30k out of the investment. That whole 30k will not be elligible directly in the next cycle, for example only 30% of that 30) can be invested directly in the next cycle.

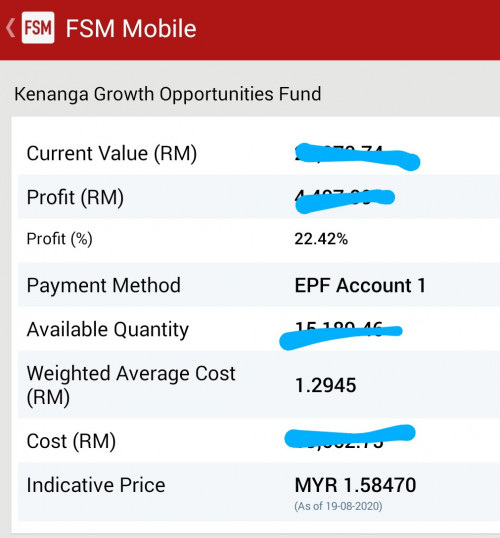

This post has been edited by backspace66: Jul 16 2020, 03:13 PM  when compared to my DIY UT portfolio in FSM

when compared to my DIY UT portfolio in FSM  those butthurts cannot report liao

those butthurts cannot report liao

Jul 13 2020, 04:27 PM

Jul 13 2020, 04:27 PM

Quote

Quote

0.0697sec

0.0697sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled