Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

AvenueX

|

Oct 20 2018, 10:28 PM Oct 20 2018, 10:28 PM

|

Getting Started

|

DCA is the way to go for long term investment. Just set aside some every month. You can't time the bottom and you can't time the top. https://data.qz.com/2015/time-the-market/?v=4 |

|

|

|

|

|

AvenueX

|

Dec 26 2018, 11:01 AM Dec 26 2018, 11:01 AM

|

Getting Started

|

QUOTE(Ancient-XinG- @ Dec 26 2018, 10:09 AM) like cloud.... gone with wind. no idea where he is now. maybe busy buy stock after wait so many months Staunch defender of lifestyle. Mr frugality. Mr earn 4k but I save so much its okay. He shall be missed. To be fair to him he's contributed some really good points. |

|

|

|

|

|

AvenueX

|

Jan 23 2019, 10:25 AM Jan 23 2019, 10:25 AM

|

Getting Started

|

Haha sorry OOTL.

Can anyone please break down what is Ponzi 2.0 and other nicknames

|

|

|

|

|

|

AvenueX

|

Jan 28 2019, 11:11 AM Jan 28 2019, 11:11 AM

|

Getting Started

|

QUOTE(yklooi @ Jan 28 2019, 10:02 AM) when the giants falls....most will falls with it... one can run but cannot hide. thus get out of EQ investing if one deemed the mkts will cotinue to falls. Top Markets 2018: A Tough Year for Markets https://www.fundsupermart.com.my/fsmone/art...ear-for-Markets2018: None Spared in Merciless Market https://www.fundsupermart.com.my/fsmone/art...erciless-MarketSo.. shall we pull out? Ady make some losses. |

|

|

|

|

|

AvenueX

|

Jan 28 2019, 11:36 AM Jan 28 2019, 11:36 AM

|

Getting Started

|

QUOTE(yklooi @ Jan 28 2019, 11:29 AM) "We?".... Depends on many variables..... One of the more importants......how do one sees the sentiments trends to be after the 2018 mkts trends....the amount of money invested in relation to one net worth, ...the need to use the money in the next few months, etc The wife and I.. Too much uncertainty, tempted to just withdraw from China & Asia Ex Japan and put into bond fund.. Can still stomach the current level of loss.. |

|

|

|

|

|

AvenueX

|

Jan 28 2019, 12:35 PM Jan 28 2019, 12:35 PM

|

Getting Started

|

QUOTE(xcxa23 @ Jan 28 2019, 12:20 PM) Depends on your view on the current and future possibilities of outcome Basically, investment is jz a form of gamble, as in you does not know the future but only predict based on information you obtained Personally I'm still DCA.. Tempted to pull out Half and rebuild port with DCA with the balance withdrawn. |

|

|

|

|

|

AvenueX

|

Jan 28 2019, 02:10 PM Jan 28 2019, 02:10 PM

|

Getting Started

|

QUOTE(xcxa23 @ Jan 28 2019, 12:54 PM) Hmm.. my portfolio was double digit negative two week back, now single digits.. Most likely due to I'm keep dca and Trump being silent.. And if the truce/lift trade war, probably will rise for like a week or two.. imo If u pull out and went in again, at same time frame, why would you do that? Or ixit something wrong with your holding allocation? Allocation.. A lot in equities.. around 90%.. Mine is single digits now too. Last month double digit.. |

|

|

|

|

|

AvenueX

|

Jan 28 2019, 03:20 PM Jan 28 2019, 03:20 PM

|

Getting Started

|

QUOTE(xcxa23 @ Jan 28 2019, 03:11 PM) There's some speculation 2019/2020 crisis will happen, as in like 2008.. Jux something I tot u might wanted to know.. Mine 95% equity.. lol Ya lo.... so I'm sitting over here thinking if a crash similar to 08 happening will we sh*t our pants or not.  Now single negative can be good chance to pull out some and go in again if anything happens. If pull out what to buy for 5-6%? |

|

|

|

|

|

AvenueX

|

Jan 29 2019, 11:43 AM Jan 29 2019, 11:43 AM

|

Getting Started

|

QUOTE(xcxa23 @ Jan 29 2019, 10:50 AM) I'm with 1) since early 2018.. My reasoning is tat, nothing ups nor down forever.. (as shown by historical data) So DCA is better than lump sum since we or at least I'm not able to predict when will it's peaks or bottom.. Anyway, happy CNY and happy holidays 😄 After thinking about it. we will keep our current portfolio allocation and DCA like you.  |

|

|

|

|

|

AvenueX

|

Jan 29 2019, 12:23 PM Jan 29 2019, 12:23 PM

|

Getting Started

|

QUOTE(xcxa23 @ Jan 29 2019, 12:11 PM) My appetite are more towards risky tho.. As long as you understand the risk, let's continue the path of DCA .. lol.. I'm in deep with equity fund. Only some reit and bond fund.. I think that's risky, then again we're still young. Take some risks.. Might pay off. |

|

|

|

|

|

AvenueX

|

Jan 29 2019, 03:58 PM Jan 29 2019, 03:58 PM

|

Getting Started

|

QUOTE(xuzen @ Jan 29 2019, 03:54 PM) DCA'ing into GEM now.... will slowly build it up to 30% of total port. piggybacking on the smart money into EM now. Anita & Selina to provide the stability. GEM for the " chiong " factor! What is GEM sifu Xuzen? Selina fly up very high ler, sustainable? |

|

|

|

|

|

AvenueX

|

Apr 2 2019, 02:52 PM Apr 2 2019, 02:52 PM

|

Getting Started

|

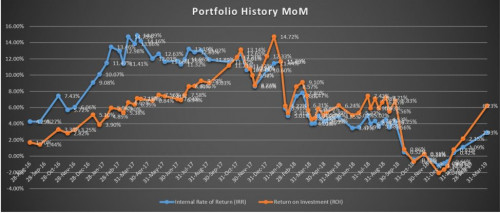

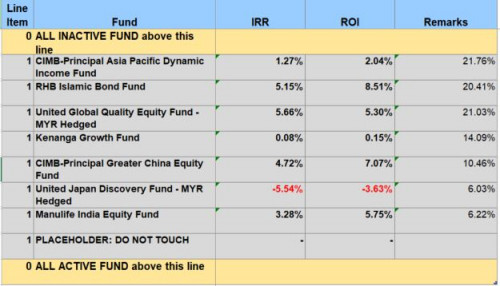

QUOTE(spiderman17 @ Apr 2 2019, 02:44 PM) Q1 2019 has so far been good to me. Ponzi-2 is having distribution now, so the actual performance is a little bit better.  port unchanged:  Hope for another good quarter  Hi bro, May I ask how we can keep track of our Returns year on year basis on FSM? Only manual tracking? |

|

|

|

|

|

AvenueX

|

Apr 2 2019, 03:19 PM Apr 2 2019, 03:19 PM

|

Getting Started

|

QUOTE(MUM @ Apr 2 2019, 03:04 PM) seems like a YES.... for FSM does not have individual account holder tracking "YET" for that function Anyone can point me in the right direction? Or just manual update the info once a year to track the yield? |

|

|

|

|

|

AvenueX

|

Apr 3 2019, 11:59 AM Apr 3 2019, 11:59 AM

|

Getting Started

|

QUOTE(yklooi @ Apr 3 2019, 10:27 AM) just did an update on my portfolio's allocation....  just realised my port is skewed towards GC & Asean....   no wonder my port is so volatile Your excel so power.. Can share some tips? |

|

|

|

|

|

AvenueX

|

Apr 4 2019, 12:08 PM Apr 4 2019, 12:08 PM

|

Getting Started

|

QUOTE(coolguy99 @ Apr 4 2019, 12:06 PM) And they say mutual funds are safe investments.. High risk high return lor. |

|

|

|

|

|

AvenueX

|

Apr 8 2019, 01:13 PM Apr 8 2019, 01:13 PM

|

Getting Started

|

QUOTE(kenny79 @ Apr 8 2019, 01:04 PM) Malaysia klse like nyawa ikan... Other Asian region share fly high just Malaysia klse was drop .. even the ytd was -2% plus..... Wired.. think to remove Malaysia region to global What goes down must come up. Could be time to go in  . But if you were already diversified, should be ok la. Just hang in there. |

|

|

|

|

|

AvenueX

|

Apr 8 2019, 04:08 PM Apr 8 2019, 04:08 PM

|

Getting Started

|

QUOTE(Ancient-XinG- @ Apr 8 2019, 01:24 PM) Jom bro! Lets go! |

|

|

|

|

|

AvenueX

|

Apr 11 2019, 12:39 PM Apr 11 2019, 12:39 PM

|

Getting Started

|

QUOTE(pmaxv @ Apr 11 2019, 11:31 AM) seriously anyone really earn money on UT? the fees they charge are really high and after taking off all the charges there's not much left. and most funds are not generating anything much. Of course man. Plenty to be made. If you really research and delve into it. Else why are we sini so many ppl invest UT?  |

|

|

|

|

|

AvenueX

|

Apr 12 2019, 12:19 AM Apr 12 2019, 12:19 AM

|

Getting Started

|

QUOTE(pmaxv @ Apr 11 2019, 10:54 PM) Public mutual also shows similar tables and charts. All giving very green futures. Public Mutual charge you 5% commission. Here you get charged 0.5% to 1.75%. You need to experience it for yourself bro.  |

|

|

|

|

|

AvenueX

|

Apr 18 2019, 12:12 AM Apr 18 2019, 12:12 AM

|

Getting Started

|

QUOTE(yklooi @ Apr 17 2019, 06:51 PM) variance abt 1.5% ~ 2% pa.... if have 100k inside...about 1.5k~2k pa variance. if less money inside and less duration inside.....  Although a big drop in value is unlikely. The situation now is unprecedented. I have moved my bond funds to CMF2 for the time being to monitor the situation. Possibly withdrawing to park into the mortgage offset account. Will continue DCA in Regional Eq funds. |

|

|

|

|

Oct 20 2018, 10:28 PM

Oct 20 2018, 10:28 PM

Quote

Quote

0.0743sec

0.0743sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled