QUOTE(yklooi @ Jul 11 2019, 07:50 AM)

Yes but if weaken by a miniscule amount of 5% I doubt it will make America great again.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jul 11 2019, 09:59 AM Jul 11 2019, 09:59 AM

Return to original view | Post

#161

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jul 16 2019, 10:39 AM Jul 16 2019, 10:39 AM

Return to original view | Post

#162

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

Jul 16 2019, 11:00 AM Jul 16 2019, 11:00 AM

Return to original view | Post

#163

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(WhitE LighteR @ Jul 16 2019, 10:55 AM) Before that there was an expectation that the rate cut will not happen.(July 5th). Then REIT started to fall on the following monday.https://www.latimes.com/business/la-fi-jobs...0705-story.html I don't know what is the story now. But if the rates do get cut , then REIT counters will go up again. |

|

|

Jul 16 2019, 01:27 PM Jul 16 2019, 01:27 PM

Return to original view | Post

#164

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(yeowhock @ Jul 16 2019, 11:15 AM) Rates up/down is not the only thing that affect REITs, basically it could be anthing that affect the land value, eg. Protesters You're thinking from a REIT operational point of view and not from an economics pov when funds flow to reits.https://financialhorse.com/singapore-reits-overvalued-2019/ |

|

|

Jul 17 2019, 10:30 AM Jul 17 2019, 10:30 AM

Return to original view | Post

#165

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(T231H @ Jul 17 2019, 10:09 AM) you/we guys had been bashing They (KIB) beh tahan liao... now they (KIB) come with this about KGF and what investors are advised to do amidst the uncertainty in equity markets. Consistent Outperformance is the Key Smart Investor (July 2019) https://www.fundsupermart.com.my/fsmone/art...he-Key-17-July- WINNING FUNDS: Kenanga Growth Fund Category: Core Equity – Malaysia MOST OUTSTANDING UNIT TRUST FOR 10-YEARS KENANGA GROWTH FUND QUOTE How can investors get value amidst the uncertainty in equity markets? This was exactly the same thing Public mutual agent for epf said when the funds are not performing and that you must hold for the long term.Investors need to be mindful investment instruments such as unit trusts are for mid-to-long term horizons and so, we advise them to hold onto these instruments to realise the targeted returns at the end of their investment period. This is why investors need to invest in stocks with good fundamentals / sound undervalued counters that are able to reap long-term profits instead of chasing short-term gains often associated with “word on the street” type of investing. Diversify your investments as a portfolio constructed of different kinds of assets will most likely yield higher long-term returns and lowers risk of any individual holding. After 6 years, the return was 4.1%, lost to EPF return and then the Public Mutual agent just kept quiet. |

|

|

Jul 19 2019, 09:31 AM Jul 19 2019, 09:31 AM

Return to original view | Post

#166

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jul 19 2019, 10:53 PM Jul 19 2019, 10:53 PM

Return to original view | Post

#167

|

Senior Member

4,999 posts Joined: Jan 2003 |

Guys any opinion on Stashaway ?

I know there is a seperate thread but prefer to hear opinions from FSM folks who uses it as well. |

|

|

Jul 20 2019, 10:59 AM Jul 20 2019, 10:59 AM

Return to original view | Post

#168

|

Senior Member

4,999 posts Joined: Jan 2003 |

My FSM Balanced managed portfolio since 5th April 2019 only went up +1.2%.

My own Anita bond enter at END MAY 2019 already +1.8%. My Normura i-income enter at END MAY 2019 alredy at +2.64% Few of the holdings in the managed portfolio must be doing very badly to drag down the returns. This post has been edited by Drian: Jul 20 2019, 11:02 AM |

|

|

Jul 23 2019, 09:49 AM Jul 23 2019, 09:49 AM

Return to original view | Post

#169

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(MUM @ Jul 23 2019, 01:06 AM) All boats rising: US stocks, bonds, oil, the dollar, gold ... you name the asset, and it's probably up this year. But how long can the euphoria last? Malaysia did not go up. In this market, nearly everything is up. How long can that last? https://edition.cnn.com/2019/07/21/investin...head/index.html This post has been edited by Drian: Jul 23 2019, 09:54 AM |

|

|

Jul 25 2019, 09:50 AM Jul 25 2019, 09:50 AM

Return to original view | Post

#170

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(yfiona @ Jul 23 2019, 06:08 PM) Noted on that, just trying to dig those "Under-valued" based on latest NAV, really pening go check it out 1 by 1 If you understand how funds work, this method won't work . It's s not share price. If the funds has 5 stocks which is 52 week high and 10 stocks which is 52 week low, how do you determine whether is low or high? If the Fund net asset value consist of 70% 52 week high stocks and 20% of stocks in their 52 week low 10% average , how do you calculate if it is low or high. |

|

|

Aug 1 2019, 10:07 AM Aug 1 2019, 10:07 AM

Return to original view | Post

#171

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

Aug 2 2019, 09:54 AM Aug 2 2019, 09:54 AM

Return to original view | Post

#172

|

Senior Member

4,999 posts Joined: Jan 2003 |

My Reit

Should have sold it when it was overpriced haha |

|

|

Aug 2 2019, 11:26 AM Aug 2 2019, 11:26 AM

Return to original view | Post

#173

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 2 2019, 01:45 PM Aug 2 2019, 01:45 PM

Return to original view | Post

#174

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(CardNoob @ Aug 2 2019, 07:15 AM) With this and another new trade war between SK and Japan, looks like bumpy times ahead. |

|

|

Aug 5 2019, 11:20 AM Aug 5 2019, 11:20 AM

Return to original view | IPv6 | Post

#175

|

Senior Member

4,999 posts Joined: Jan 2003 |

China stocks is not low enough. Shanghai index is still hovering 2800++.

|

|

|

Aug 6 2019, 09:33 AM Aug 6 2019, 09:33 AM

Return to original view | Post

#176

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

Aug 8 2019, 03:14 PM Aug 8 2019, 03:14 PM

Return to original view | Post

#177

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(CardNoob @ Aug 7 2019, 08:18 PM) 3 central banks cut rate: ringgit will drop againhttps://finance.yahoo.com/news/three-centra...-102336145.html https://finance.yahoo.com/news/asia-surpris...-074243061.html BNM tunggu apa lagi? |

|

|

Aug 8 2019, 04:20 PM Aug 8 2019, 04:20 PM

Return to original view | Post

#178

|

Senior Member

4,999 posts Joined: Jan 2003 |

anyway to buy pure hongkong funds?

|

|

|

Aug 9 2019, 09:36 AM Aug 9 2019, 09:36 AM

Return to original view | Post

#179

|

Senior Member

4,999 posts Joined: Jan 2003 |

|

|

|

Aug 13 2019, 11:32 AM Aug 13 2019, 11:32 AM

Return to original view | Post

#180

|

Senior Member

4,999 posts Joined: Jan 2003 |

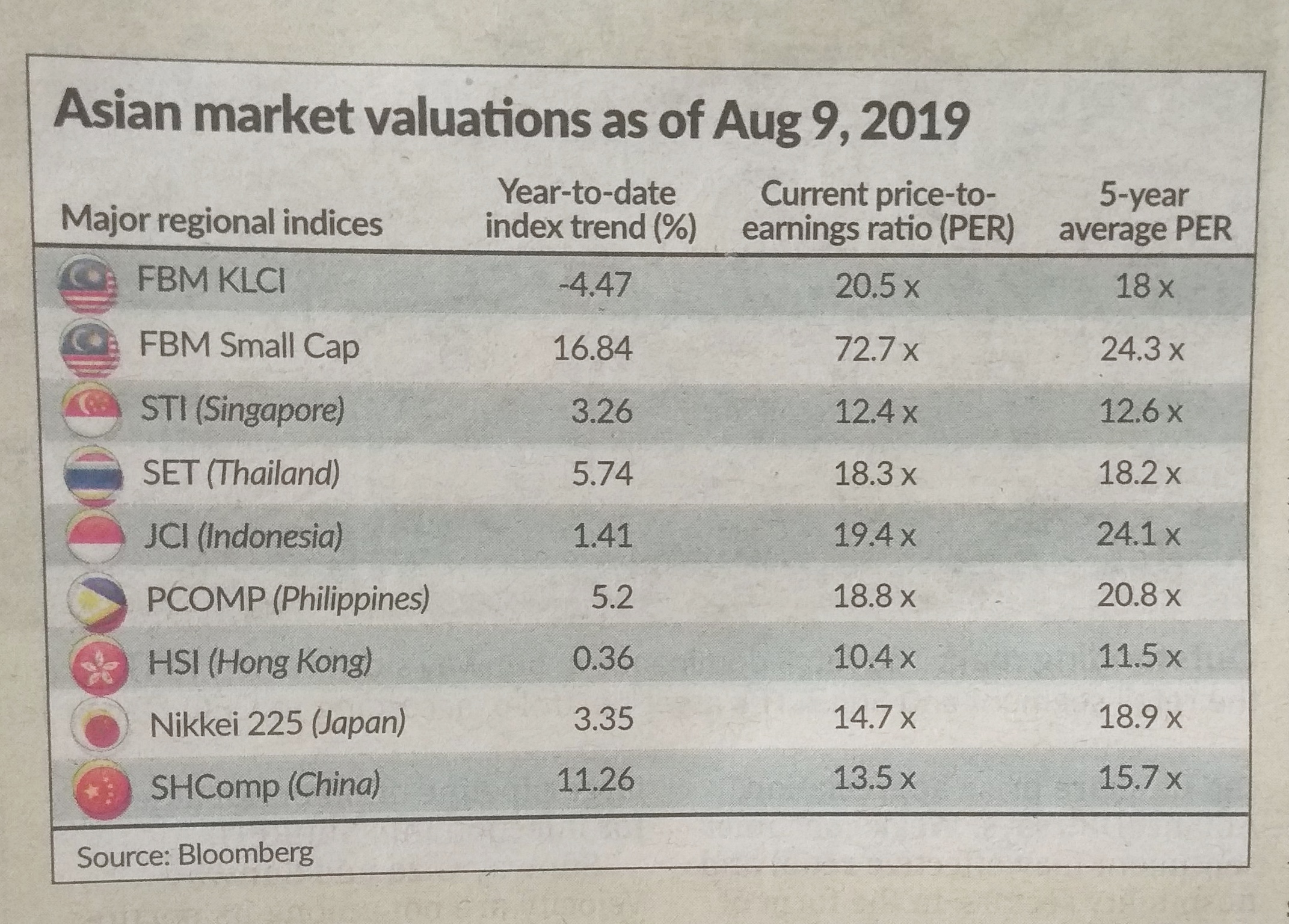

QUOTE(Ancient-XinG- @ Aug 10 2019, 04:57 PM) FSM Balanced return since April 2019 +0.02%Normura i-income return since late May 2019 +4.04% AM Dynamic Bond return since early August 2019 +0.35% Libra Anita Bond Fund return since late May 2019 +2.57% Stashaway ETF, risk index 6.5% since early August 2019 +1.6% Haih, really don't want to keep this managed fund but I need it as a benchmark for my own performance. My guess they are performing poorly because they put in too much allocation to malaysia equity scene which is the worst performing index in Asia.  Picture gotten from here. https://forum.lowyat.net/index.php?showtopi...orst+performing This post has been edited by Drian: Aug 13 2019, 11:42 AM |

| Change to: |  0.0638sec 0.0638sec

0.77 0.77

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 04:24 PM |