Hi, anyone know if we can use BigPay to buy FSM funds?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 20 2018, 09:04 AM Dec 20 2018, 09:04 AM

Return to original view | Post

#161

|

Senior Member

755 posts Joined: Dec 2016 |

Hi, anyone know if we can use BigPay to buy FSM funds?

|

|

|

|

|

|

Jan 25 2019, 10:32 PM Jan 25 2019, 10:32 PM

Return to original view | Post

#162

|

Senior Member

755 posts Joined: Dec 2016 |

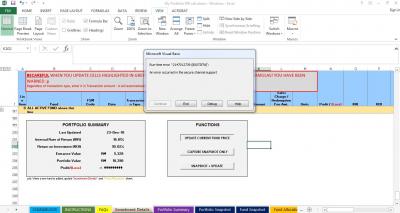

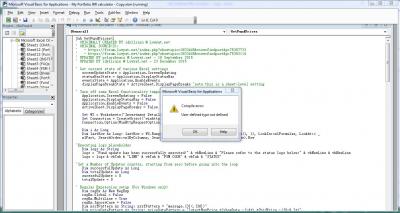

QUOTE(idyllrain @ Dec 21 2018, 05:11 PM) Thanks yklooi. That’s good to know. It gives us some tome to incorporate changes to accommodate the new site. I’ll discuss with polarzbearz to see if we can make this transition as smooth as possible for everyone using the spreadsheet. Hi, I was trying to do the update myself - and it returned-- EDIT -- As of 8:30PM, we can no longer get NAV prices from the old link at https://www.fundsupermart.com.my/main/fundi....tpl?id=MYKNGGF This means that if you're using the old Windows or Mac versions of this spreadsheet, it will no longer retrieve the latest prices since that page is no longer there. -- EDIT2 -- I have a working solution ready for Windows. If you're feeling adventurous or impatient, below are the steps to modify your own copy of the Excel Spreadsheet to cater for changes in the new FSMOne site. By doing this yourself, you won't have to deal with migrating your existing data into a new updated file. It's pretty straightforward: MAKE A COPY OF YOUR FILE BEFORE YOU DO THIS! Just in case... » Click to show Spoiler - click again to hide... « Attached is an updated base file for Excel 2016 for Windows. Note that this file does not contain functionality that polarzbearz added when she published her beta version a while ago. This is merely the previous spreadsheet with the FSM retrieval code updated. If you do not want to start afresh, I would recommend following the instructions above to update your own file. [attachmentid=10144384] -- EDIT3 -- Instructions for Mac version are available here: https://forum.lowyat.net/index.php?showtopi...post&p=91308800 -- EDIT4 -- I updated the instructions and base file above. Changes - Switched to using a different date value in the API response. - Fixed timezone issues in date calculation - Optimized regular expressions - Removed TLS1.2 connection setting Thanks to yklooi for discovering these issues. I should've been more careful. Those who followed my instructions above will have to redo them again. I'm terribly sorry for the trouble; please forgive me. QUOTE Run-time error '-2147012739 (80072f7d)' When I tried download the new spreadsheet and without doing anything, click on the button, same thing happens. Any idea?An error occurred in the secure channel support

|

|

|

Jan 27 2019, 02:05 AM Jan 27 2019, 02:05 AM

Return to original view | Post

#163

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(idyllrain @ Jan 26 2019, 08:41 PM) Hi 2387581, find this line in the GetFundPrices() routine (it's somewhere in the first 25 lines): I have done with the line above. Now there's another error.CODE 'Connection.Option(WinHttpRequestOption_SecureProtocols) = 2048 Remove the ' (single quote) from the front of that line to activate that line. Save and try again. That should stop the error. Edit (In case you're wondering why you're seeing that error and what that line does): You're seeing the error because FSM requires a secure connection established using the TLS 1.2 protocol and your computer attempted the connection using some other protocol (probably TLS 1.1). What that line does is to force the connection to be established using TLS 1.2. Btw, if the error still occurs, you will most likely need to update your copy of Windows as per this article: https://support.microsoft.com/en-my/help/31...protocols-in-wi

I have also checked the said windows update, which was already installed in my Windows 7 x64 laptop at home. I have also tried the same excel file in my office desktop, which is running Windows 10 x64 (via AnyDesk), same error as above happens - Tried with the quote mark (deactivated line), the same error as above returns. |

|

|

Dec 9 2019, 11:47 PM Dec 9 2019, 11:47 PM

Return to original view | Post

#164

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(icecreamcake @ Dec 8 2019, 10:33 AM) CIMB Asia Pac PRS quite lousy. One year on, still in the red. And you don't even get to exit without paying the hefty fee if you are not reaching retiring age. If your main purpose is for tax rebate, by all means go ahead, but you may lose more money in capital depreciation than the tax savings. If you want to do it, you would have chosen an earlier time of the year to put your money in it when it was low. |

|

|

Dec 10 2019, 12:16 AM Dec 10 2019, 12:16 AM

Return to original view | Post

#165

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(adele123 @ Dec 9 2019, 11:52 PM) beginner's common mistake. investing in PRS or unit trust is not get rich scheme. I was offering another perspective. so, take a step back and ponder on the decision. My investment since 2014. IRR 6.4% Cheers. I admit that I timed the market wrongly, that's why I'm paying dearly for it. But good for you, that is entitled to brag. Just don't undermine others and spray salt on his wound. |

|

|

Dec 10 2019, 09:38 AM Dec 10 2019, 09:38 AM

Return to original view | Post

#166

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(adele123 @ Dec 10 2019, 12:38 AM) I'm sorry you take it as bragging. Looking back at the chart, the time my lump sum bought in was around June 2018, which is the at high side. Say you time it better than I do, at Jan 2019, you are at least at 12% profit after 1 year compare to my -0.18% after 1.5 years. That's a lot of lost opportunity.The point is not to look at things short term, which is really common though. And it should not be about timing the market.  |

|

|

|

|

|

Jan 15 2020, 02:09 PM Jan 15 2020, 02:09 PM

Return to original view | Post

#167

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(yklooi @ Jan 15 2020, 01:18 PM) never realised KGF is lagi teruk than yr fund for the past 2 years, until I explored abit more.. but then, for the past 1 yr performance...they are of a big different insight, who will be "better" in 2020?  That's why timing is very important. Look at entry time between Jan-2018 vs Jan-2019. I'm also a victim of KGF at 2018. Sold all already. |

|

|

Jan 15 2020, 04:05 PM Jan 15 2020, 04:05 PM

Return to original view | Post

#168

|

Senior Member

755 posts Joined: Dec 2016 |

|

|

|

Jan 15 2020, 10:18 PM Jan 15 2020, 10:18 PM

Return to original view | Post

#169

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(WhitE LighteR @ Jan 15 2020, 07:52 PM) Agreed. Timing is very important. But it's also hard to predict when it comes to timing. So some say better stay invested. But where u stay invested makes a lot of difference Yep. Only what those who made money said will be valid, even if you practice the right way, yet still lose money, you are invalid |

|

|

Jan 20 2020, 09:31 AM Jan 20 2020, 09:31 AM

Return to original view | Post

#170

|

Senior Member

755 posts Joined: Dec 2016 |

|

|

|

Jul 18 2020, 10:44 AM Jul 18 2020, 10:44 AM

Return to original view | Post

#171

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(xcxa23 @ Jul 16 2020, 11:55 AM) I haven't been checking FSM portfolio for a while.My Principal Greater China, first bought Jan 2017, top up Feb 2018. Then no action until today. Currently +50%, good time to top up? At the moment this fund is about 10% of my portfolio. I feel like I'm a blind now haven't been following market for some time. |

|

|

Jul 18 2020, 12:03 PM Jul 18 2020, 12:03 PM

Return to original view | Post

#172

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(MUM @ Jul 18 2020, 10:47 AM) you now have 10% of it in your portfolio.. It is inclusive of the 50% gain. this 10% is inclusive of that 50% gain too? how many % do you want to top up in relation to your total value in your port? ex: if your portfolio amount is RM10000 and you just want to top up RM200....then if for me, i don't need to consider .... Currently my portfolio consist of 6.6% - Eastspring Investments Global Emerging Markets Fund (-2%) 21% - Manulife Investment U.S. Equity Fund (+8.5%) 8.5% - Principal ASEAN Dynamic Fund (-6%) 22% - Principal Asia Pacific Dynamic Income Fund (+8.8%) 10% - Principal Greater China Equity Fund (+50%) 15% - RHB Asian Income Fund (+10%) 7% - TA Global Technology Fund (+60%) Now considering to dump these EI GEM and Principal ASEAN in favour of better funds/sector. But not sure where to park since I already have about a large % the Asia Pac ex-Jap, not sure if good to have a single geographical sector too large in my portfolio. And also the psychological fear if I were to increase exposure to and Principal Greater China and TA Global Tech, because the % gain looks good, topping up feels like averaging up. I feel so dumb cause exposure my better performing funds are the smallest portion. QUOTE(xcxa23 @ Jul 18 2020, 11:44 AM) wow.. such opportunity loss during the covid dip I have to say the fear was real and it was quite gloom. And I thought the 10 year recession thing is gonna last for a while, who knows it rebounded into bull in just a few weeks.that's why never encourage ppl to just dump in fund and forget about it. as for good time or not, i assume you meant DCA? personally i would say yes reason, i believe the fund will still perform well in the coming future, as per my current knowledge of china many say china will be doom due to covid, ban, boikot, many manufacturer are moving out from china. but i recommend they do more extensive research on china one belt one road and china expansion plan before coming to conclusion based on mainstream media report as usually, never trust 100% from stranger online. do your own research, analyse and make your own conclusion. Hindsight is always 20/20. But at the time keeping cash for daily expenses is so important as my industry (construction) is badly hit and I got 50% pay cut. And at the time covid dip I have to stomach a lot of loss and emotion (I invested quite heavily on Airasia and Genm since long time ago, still holding paper loss yeah so) But anyway we have to move on and review on my investment strategies which is why I'm back lurking around lol. |

|

|

Jul 18 2020, 12:08 PM Jul 18 2020, 12:08 PM

Return to original view | Post

#173

|

Senior Member

755 posts Joined: Dec 2016 |

|

|

|

|

|

|

Jul 18 2020, 08:12 PM Jul 18 2020, 08:12 PM

Return to original view | Post

#174

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(WhitE LighteR @ Jul 18 2020, 12:16 PM) In my opinion with market in all time high, it's probably a good time to cut loss for underperforming funds. But switching to another fund now might be problematic depending on how the market move from here on. If there is a deep pullback, the pain can be quite serious. But given a long enough horizon maybe less so. Yes..I may end up selling it for cash.QUOTE(ironman16 @ Jul 18 2020, 12:52 PM) If this is my portfolio, Certainly that's what I have in mind to dispose GEM and ASEAN. I will switch out the performing fund n left some in case it still can rally 😁 I will top up some under performing fund if i still confident with it in future. Or i will search for some under value fund n invest like REITs or Malaysia fund if u confident with it future. I definitely don't like global emerging n Asean fund, i don't know what u gonna do with it. Not a bad idea if big portion in global or asia pac fund bcoz this is midfield player, single country or sector fund is striker 😝 Only if this is my portfolio 😁 Honestly, i oledi switch some of my TA global tech n eas dinasti a few week b4 n dumb in global or asia Pacific fund. By global do you mean TA Global Tech or other Global fund (not tech/specific sector) QUOTE(xcxa23 @ Jul 18 2020, 04:30 PM) i would advise considering cut off Eastspring Investments Global Emerging Markets Fund, based on my observation, it does not perform well even when market are in bull. Nothing wrong with being excited when market dip if you are well prepared and cash rich.increase exposure in tech sector and china market if you feel the market will fluctuate, spread the DCA to weekly/bi-weekly/monthly to be honest, when the dip happen, i seeing the market dip, instead of feeling fear and worry, i felt happy and excited ouch for the airsasia and genm. but during the mco, up until this day, its very juicy in stock market. I was about 60% invested and 40% cash during March but did not act upon anything. |

|

|

Jul 21 2020, 01:45 PM Jul 21 2020, 01:45 PM

Return to original view | Post

#175

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(GrumpyNooby @ Jul 21 2020, 07:21 AM)   based on Trading Economics, the past 5 years FD rate averaged 3%. 5 years would amount to 16% say you bought Affin Hwang Select Asia (Ex Japan) Opportunity Fund - MYR, over the past 1 year you could have made 16.97% gain. Of course this is just an example. As I was looking at this Affin Hwang fund, compared to the Principal Asia Pacific Dynamic Income fund, it looks like Affin Hwang outperformed Principal. Should I dump the Principal one and move to Affin Hwang? Both of them heavy on China/HK, Principal got about ~31% China/HK vs Affin Hwang ~60%, AH got US exposure. Principal - consumer/real estate/IT (~43%) fund size 3.06bil Affin Hwang - IT/consumer/financial (~80%) fund size 647.5mil Any sifu shed some light between these two funds? Both are in FSM recommended fund Core portfolio Asia ex-Japan.  This post has been edited by 2387581: Jul 21 2020, 01:46 PM |

|

|

Jul 25 2020, 05:59 PM Jul 25 2020, 05:59 PM

Return to original view | Post

#176

|

Senior Member

755 posts Joined: Dec 2016 |

why u guys all so rich to top up this top up that one

|

|

|

Aug 31 2020, 10:31 AM Aug 31 2020, 10:31 AM

Return to original view | Post

#177

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(MUM @ Aug 12 2020, 09:59 AM) well, according this this fund house, .... Just searching the forum for "RHB". From my own experience, I bought this fund lump sum since August 2016, never top up since then. Currently the return is 11.51%, means annualised 2.71%, even worse than putting in FD. If you look at the performance chart, it reached a high before the 18 March crash, but unable to recoup the losses. Wanted to sell all but can't find a better place to deploy the money. And heck RM25 switching fee!https://www.interpac-asset.com.my/investor-...ement%20company. |

|

|

Aug 31 2020, 11:23 AM Aug 31 2020, 11:23 AM

Return to original view | Post

#178

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(yklooi @ Aug 31 2020, 11:00 AM) if you had been following this thread, i believes many did not stick to "past" hero or heroine for sentimental purposes when it is money involved. No. I'm in the process of tuning my portfolio after neglecting it for a while, if you are long timer here, I was active here a few years ago, then quiet and then now lurking here again. another example is the KGF or Reits funds so if you had been having good returns with that RHB for some years, and then when it performance deteriorated for a the last few years and yet you still held on to it,...then it was your choice (same with those that had put money in FD instead of that RHB during those past good ROI years) I was planning to redeploy the money from that fund elsewhere, when there are fellow forummers mentioned the fund I tried to offer my painful experience with them in hope that less people had to learn it the hard and expensive way. I'd appreciate if others offer actionable replies instead of sprinking salt on my wounds! |

|

|

Sep 3 2020, 05:35 PM Sep 3 2020, 05:35 PM

Return to original view | Post

#179

|

Senior Member

755 posts Joined: Dec 2016 |

|

|

|

Dec 11 2020, 01:17 PM Dec 11 2020, 01:17 PM

Return to original view | IPv6 | Post

#180

|

Senior Member

755 posts Joined: Dec 2016 |

QUOTE(MUM @ Dec 10 2020, 10:42 AM) maybe this can helps you to plan your portfolio allocation for the new year...... Please also beware that it is already mid-December now and time for window dressing.https://www.klsescreener.com/v2/news/view/7...up-from-slumber To see if they are really recovery, typically you have to wait until the January profit-taking season to pass. |

| Change to: |  0.0628sec 0.0628sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 07:14 AM |