Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

WhitE LighteR

|

Mar 16 2022, 11:16 AM Mar 16 2022, 11:16 AM

|

|

QUOTE(Avangelice @ Mar 16 2022, 10:45 AM) Going to dca? Or tutup mata and let it ride in blood? ride in blood babeh... average now also no gurantee will recover anytime soon. better stay in MMF and collect interest. hhahaha maybe once got more clearer sign of hostilities over only go back in to average out |

|

|

|

|

|

WhitE LighteR

|

Apr 8 2022, 12:34 PM Apr 8 2022, 12:34 PM

|

|

QUOTE(effectz @ Apr 7 2022, 12:26 PM) I suggest Eastspring Dinasti this fund jst got kicked out of epf list  |

|

|

|

|

|

WhitE LighteR

|

Apr 12 2022, 12:43 PM Apr 12 2022, 12:43 PM

|

|

QUOTE(!@#$%^ @ Apr 12 2022, 11:44 AM) so old d still play high risk stuffs? u be suprise that older ppl usually take even higher risk coz they think they are out of time and the false assumption that its easy money to be made in the market. |

|

|

|

|

|

WhitE LighteR

|

Apr 14 2022, 07:48 PM Apr 14 2022, 07:48 PM

|

|

QUOTE(xander83 @ Apr 14 2022, 05:55 PM) Payment order flow and collateral short selling  IBKR is not that easy manipulate as compared to single companies whereby regulations are not as strict because SECC will be watching after what happened to Robinhood For IBKR to have 5 major financial hub licensed in the world no easy feat as it is highly scrutinised and it almost 50 yrs track records the doubt is less from there as compared to new brokers which can easily shut down in no time if liquidity issues happens  i thought payment for order flow is a common thing out west. its just business. the impact to investor is minimal if any iinm. u pay slight higher spread in exchange for the 0% sales fee. |

|

|

|

|

|

WhitE LighteR

|

May 6 2022, 12:12 PM May 6 2022, 12:12 PM

|

|

Damn heavy damage last month.  Down another 3.67% from March |

|

|

|

|

|

WhitE LighteR

|

May 13 2022, 11:28 AM May 13 2022, 11:28 AM

|

|

QUOTE(YoungMan @ May 13 2022, 10:42 AM) I also think have to switch to FD at the moment otherwise will bleed even more as long as u dont lock losses. remember whatever u see now is all jst paper loss |

|

|

|

|

|

WhitE LighteR

|

May 13 2022, 01:41 PM May 13 2022, 01:41 PM

|

|

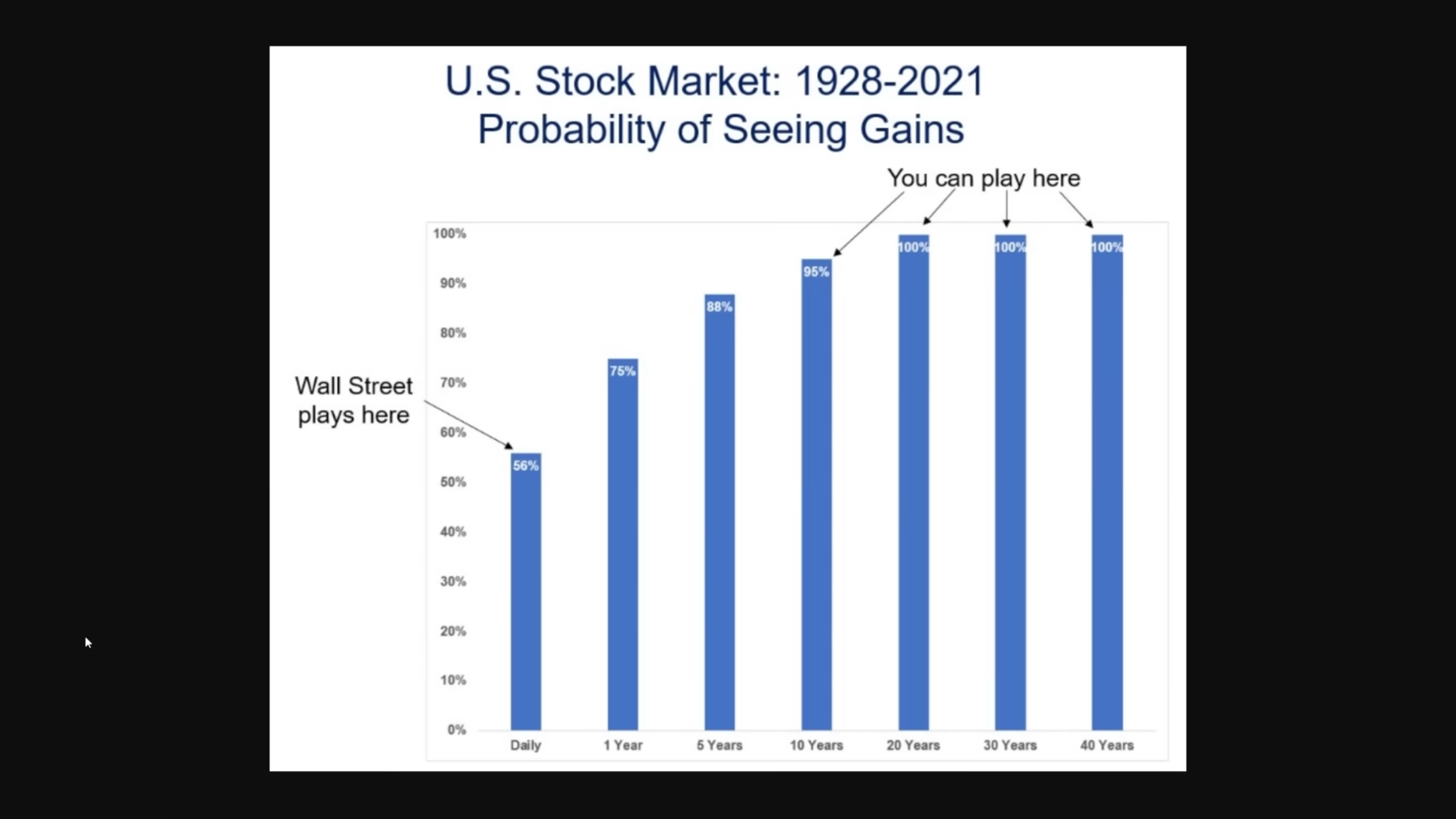

QUOTE(YoungMan @ May 13 2022, 11:47 AM) Yes true. Just that I cannot pump in anymore and see more paper losses. Current paper lossest is to be kept there for don't know how many years until it can turn profit again. dont be so negative man. history shown us that the market always go up eventually » Click to show Spoiler - click again to hide... « This post has been edited by WhitE LighteR: May 13 2022, 01:41 PM |

|

|

|

|

|

WhitE LighteR

|

May 16 2022, 06:03 PM May 16 2022, 06:03 PM

|

|

QUOTE(james.6831 @ May 16 2022, 05:17 PM) yea paper loss is still paper loss...but seeing your loss down 32% hurts like a #$!#@ haha It's like that de la. U either monitor and totally logout. |

|

|

|

|

|

WhitE LighteR

|

May 18 2022, 08:53 PM May 18 2022, 08:53 PM

|

|

QUOTE(james.6831 @ May 18 2022, 06:51 PM) affin hwang? that one invest in arkk iirc, which has holland kao kao... ARKK down 70% from the top I think. Really fuu.. |

|

|

|

|

|

WhitE LighteR

|

May 18 2022, 09:15 PM May 18 2022, 09:15 PM

|

|

QUOTE(james.6831 @ May 18 2022, 09:11 PM) cathie wood really bring ppl holland haha High risk, high reward strategy |

|

|

|

|

|

WhitE LighteR

|

Jun 22 2022, 06:51 PM Jun 22 2022, 06:51 PM

|

|

QUOTE(bcombat @ Jun 22 2022, 04:38 PM) Are there any advantage to invest in unit trust rather than ETF if both having more and less same type of assets? Unit trust fees are higher. ETF is only cost efficent using overseas platfom to buy n sell. FSM platform is too expensive for ETF especially for small amount. |

|

|

|

|

|

WhitE LighteR

|

Jun 23 2022, 03:42 PM Jun 23 2022, 03:42 PM

|

|

QUOTE(Drian @ Jun 23 2022, 11:54 AM) It’s all about statistics. What is the % of fund managers that beats ETF, and by how much. Most can't even beat their own benchmark.  |

|

|

|

|

|

WhitE LighteR

|

Jun 27 2022, 11:34 AM Jun 27 2022, 11:34 AM

|

|

QUOTE(Jitty @ Jun 27 2022, 11:31 AM) any good funds recently? the one proposed by FSM Q3 2021 went badly. want to top up some now i just top up some china recently. but overall market still down. expect to hold in red a while longer for all funds. only active trading funds is making money this days. long only funds mostly in the red. |

|

|

|

|

|

WhitE LighteR

|

Jul 12 2022, 03:07 PM Jul 12 2022, 03:07 PM

|

|

The market seems to be taking a turn for the worst recently.

|

|

|

|

|

|

WhitE LighteR

|

Jul 12 2022, 03:47 PM Jul 12 2022, 03:47 PM

|

|

QUOTE(bcombat @ Jul 12 2022, 03:43 PM) Ya. China woes still not yet end. Energy crisis seems to be back to bad due to heatwave. Earning reporting is coming soon too. |

|

|

|

|

|

WhitE LighteR

|

Jul 21 2022, 12:20 AM Jul 21 2022, 12:20 AM

|

|

QUOTE(guy3288 @ Jul 20 2022, 08:43 PM) Hi bro are you still invested in Amprecious Metal aka Precious Metal Securities ? It has gone down quite alot now RM0.411 seems like a good buy? The world still worries about inflation. That's y the price is low. If u buy now make sure u willing to hold on for a longer time |

|

|

|

|

|

WhitE LighteR

|

Sep 1 2022, 07:30 PM Sep 1 2022, 07:30 PM

|

|

QUOTE(james.6831 @ Aug 31 2022, 01:04 PM) anyone else stuck -25%...i know market is down but losing trust in these fund managers...when market recovers, the fund ciput recovery....now back down, continue holland again sigh just consistent with your DCA. others is just noise |

|

|

|

|

|

WhitE LighteR

|

Oct 3 2022, 03:07 PM Oct 3 2022, 03:07 PM

|

|

QUOTE(TZ1234 @ Oct 3 2022, 10:12 AM) All trust funds had been in red for mostly a year. The trend may continue don't know for how long. Wonder it would take how many years just to gain back the capital. Sigh... We can't do anything except to average down. Else just stay in cash. |

|

|

|

|

|

WhitE LighteR

|

Oct 4 2022, 12:47 PM Oct 4 2022, 12:47 PM

|

|

September is historically a bloody month. Im jst glad its over. Hopefully

|

|

|

|

|

|

WhitE LighteR

|

Oct 28 2022, 01:34 PM Oct 28 2022, 01:34 PM

|

|

QUOTE(frankzane @ Oct 28 2022, 01:26 PM) Hi all, I know it was mentioned before somewhere; e.g. a 50% drop in NAV needs X% increment to break even. What is the formula? Appreciate some examples. Thanking in advance. 50% drop need 100% increment to break even. Roughly double |

|

|

|

|

Mar 16 2022, 11:16 AM

Mar 16 2022, 11:16 AM

Quote

Quote

0.0655sec

0.0655sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled