Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

WhitE LighteR

|

Oct 15 2021, 01:42 PM Oct 15 2021, 01:42 PM

|

|

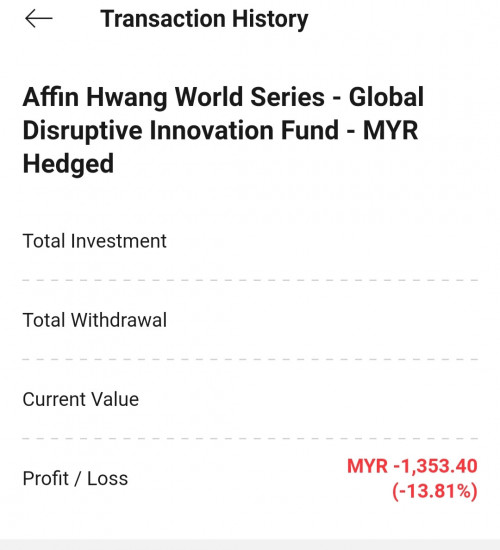

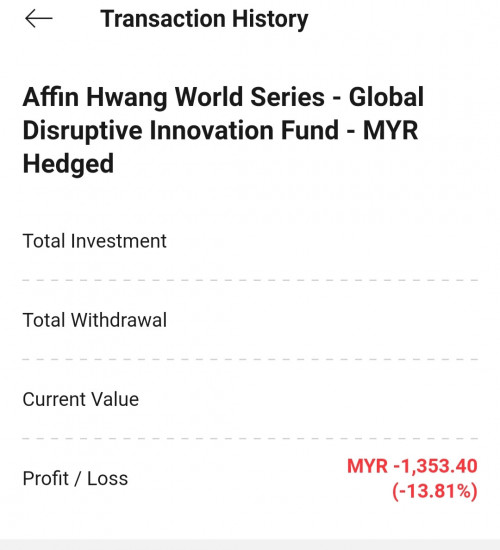

QUOTE(ganesh1696 @ Oct 15 2021, 01:30 PM) my affin global disruptive fund YTD.  am China a shares and affin next gen tech fund is down almost 10% each. Some malaysia and india funds have reduce my portfolio's loss. Those three underperforming funds are heavyweight in my portfolio. Almost 50% of my entire capital. To hold such funds u need heart of steel. |

|

|

|

|

|

WhitE LighteR

|

Oct 31 2021, 09:55 PM Oct 31 2021, 09:55 PM

|

|

QUOTE(shamino_00 @ Oct 31 2021, 08:27 PM) Better direct buy reit stocks yourself.You only need to keep an eye on the dividend per unit whether it's growing or very stable consistent, net asset value whether it's overprice or underprice though popular reit can be slightly overprice, it's share and it's debt to equity or gear ratio with too much debt, it can't grow as need to service debt. Time to time, read it's annual report whether it have healthy occupancy rate >80%, lastly determine which sector of reit you prefer, retail, office, industrial or mixture. Use a bit common sense like you evaluate properties. In other words instead of paying 2% for the fundamager to do this for u, u need to do it yourself. |

|

|

|

|

|

WhitE LighteR

|

Nov 2 2021, 10:11 AM Nov 2 2021, 10:11 AM

|

|

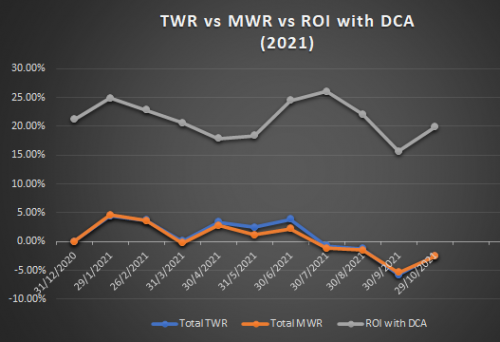

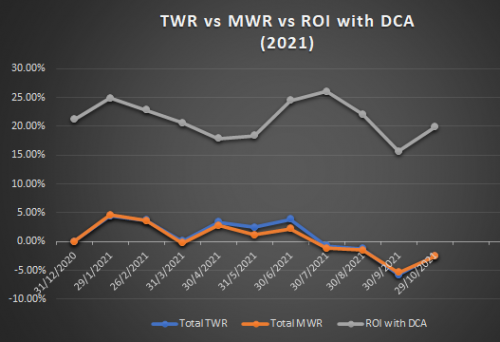

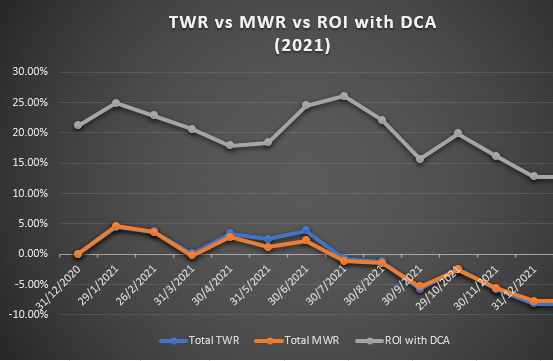

My port recovered slightly towards the end of October  YTD TWR : -2.47 % MoM Change TWR : +3.29 % YTD MWR : -2.55 % MoM Change MWR : +2.84 % ROI with DCA since start tracking : 19.84 % MoM Change : +4.21 % |

|

|

|

|

|

WhitE LighteR

|

Nov 26 2021, 10:02 PM Nov 26 2021, 10:02 PM

|

|

QUOTE(yklooi @ Nov 26 2021, 05:12 PM) on this, previously there is a forummers (Polarzbearz) made a spreadsheet that can allow the user to key in the country of allocation details from each of his selected funds and it will automatically compute and shows the details and separate it by country.... the "old" version can still be seen from post 1 It's nice to see but I stop updating it coz it's a pain in the ass to manually update the country allocation each month. |

|

|

|

|

|

WhitE LighteR

|

Dec 2 2021, 11:15 PM Dec 2 2021, 11:15 PM

|

|

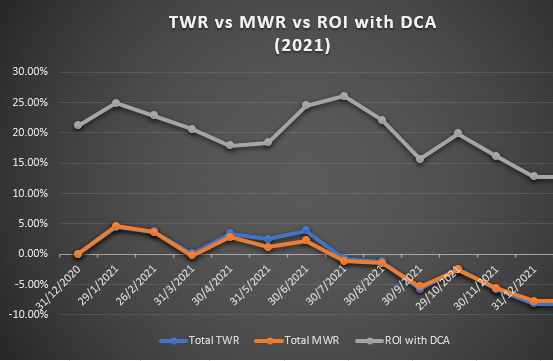

My port recovered slightly in early November only to dip at the end of it   YTD TWR : -5.79 % MoM Change TWR : -3.32 % YTD MWR : -5.59 % MoM Change MWR : -3.04 % ROI with DCA since start tracking : 16.14 % MoM Change : -3.70 % |

|

|

|

|

|

WhitE LighteR

|

Dec 7 2021, 10:04 AM Dec 7 2021, 10:04 AM

|

|

QUOTE(ganesh1696 @ Dec 7 2021, 01:25 AM) Hi, For your question on DCA. I'm OK with losses as stock market can go up and down. I was worried only when ARKK underperform index funds. I'm doing DCA on my "disruptive" fund to minimise my losses or the price would be at attractive value to enter in or who knows, ARKK's price may have bottomed out. Will have to wait another 6 - 12 months to see its performance. Anyhow if the performance of ARKK is not good as Cathie claims or if it hugely underperform the index funds I will just trim or dump this funds at no loss or profit (after DCA). my investment strategy might go wrong. Have to wait. one thing to keep in mind. if u believe in cathie wood, u need to understand that ARKK or any other funds under them in fact dont behave like index fund. They will never track index fund nor will it keep close to index fund performance. cathie wood funds works more closely like angel investment. they take much losses now for long period of time while the companies under the fund invest for growth n the once or i should say IF it do succeed it will just suddenly boom past the others. think tesla. so they dont do well year to year but once they do, it will be like 2020. n then suddenly they looks not so bad if u average it out. but while they making losses, the average will look very bad. that is like i say IF u believe in cathie wood skill in seeing the future. This post has been edited by WhitE LighteR: Dec 7 2021, 10:09 AM |

|

|

|

|

|

WhitE LighteR

|

Dec 16 2021, 08:17 AM Dec 16 2021, 08:17 AM

|

|

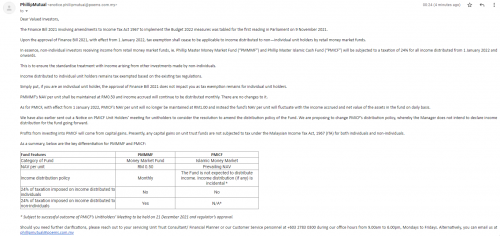

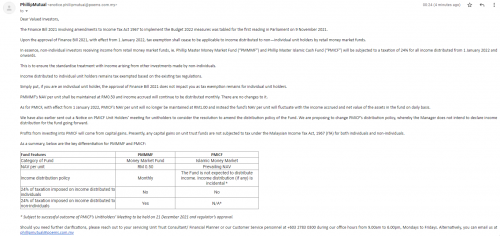

QUOTE(tadashi987 @ Dec 16 2021, 12:34 AM) Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF) DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... « Dear Valued Investors,

The Finance Bill 2021 involving amendments to Income Tax Act 1967 to implement the Budget 2022 measures was tabled for the first reading in Parliament on 9 November 2021.

Upon the approval of Finance Bill 2021, with effect from 1 January 2022, tax exemption shall cease to be applicable to income distributed to non—individual unit holders by retail money market funds.

In essence, non-individual investors receiving income from retail money market funds, ie. Phillip Master Money Market Fund (“PMMMF”) and Phillip Master Islamic Cash Fund (“PMICF”) will be subjected to a taxation of 24% for all income distributed from 1 January 2022 and onwards.

This is to ensure the standardise treatment with income arising from other investments made by non-individuals.

Income distributed to individual unit holders remains tax exempted based on the existing tax regulations.

Simply put, if you are an individual unit holder, the approval of Finance Bill 2021 does not impact you as tax exemption remains for individual unit holders.

PMMMF’s NAV per unit shall be maintained at RM0.50 and income accrued will continue to be distributed monthly. There are no changes to it.

As for PMICF, with effect from 1 January 2022, PMICF’s NAV per unit will no longer be maintained at RM1.00 and instead the fund’s NAV per unit will fluctuate with the income accrued and net value of the assets in the fund on daily basis.

We have also earlier sent out a Notice on PMICF Unit Holders’ meeting for unitholders to consider the resolution to amend the distribution policy of the Fund. We are proposing to change PMICF’s distribution policy, whereby the Manager does not intend to declare income distribution for the fund going forward.

Profits from investing into PMICF will come from capital gains. Presently, any capital gains on unit trust funds are not subjected to tax under the Malaysian Income Tax Act, 1967 (ITA) for both individuals and non-individuals.

As a summary, below are the key differentiation for PMMMF and PMICF:

[CHECK PICTURE]

* Subject to successful outcome of PMICF’s Unitholders’ Meeting to be held on 21 December 2021 and regulator’s approval.

Should you need further clarifications, please reach out to your servicing Unit Trust Consultant/ Financial Planner or our Customer Service personnel at +603 2783 0300 during our office hours from 9.00am to 6.00pm, Mondays to Fridays. Alternatively, you can email us at phillipmutual@poems.com.my

Thank you.

For and on behalf of

Phillip Mutual Berhad

non individual means registered as company account? |

|

|

|

|

|

WhitE LighteR

|

Dec 22 2021, 10:28 AM Dec 22 2021, 10:28 AM

|

|

QUOTE(tadashi987 @ Dec 22 2021, 09:38 AM) Do You Have SGD Ready for Trading?looking at the banner of FSM seems like SGX stock trading is available on FSM MY soon, hopefully the trans fee is competitive unlikely seeing how they still insist to have min charge on other markets as well. |

|

|

|

|

|

WhitE LighteR

|

Dec 22 2021, 07:34 PM Dec 22 2021, 07:34 PM

|

|

QUOTE(xander83 @ Dec 22 2021, 06:15 PM) Confirm follow back SG charge so of min $8.80 per trade or 0.8% whichever is higher Expected. Meh.. |

|

|

|

|

|

WhitE LighteR

|

Dec 30 2021, 09:22 PM Dec 30 2021, 09:22 PM

|

|

QUOTE(frankzane @ Dec 30 2021, 06:40 PM) Yes, you are right. Even FSM couldnt answer this..... MOF: Individuals to be exempted from tax on foreign-sourced income This post has been edited by WhitE LighteR: Dec 30 2021, 09:23 PM |

|

|

|

|

|

WhitE LighteR

|

Jan 4 2022, 04:00 PM Jan 4 2022, 04:00 PM

|

|

My port end 2021 in a disappointing manner.  Drag down by all China/HK funds, AH Innovation fund and precious metals. Well performing fund is US and Malaysia YTD TWR : -8.18 % MoM Change TWR : -2.39 % YTD MWR : -7.75 % MoM Change MWR : -2.16 % ROI with DCA since start tracking : 12.75 % MoM Change : -3.39 % Just to console myself. I try to see the 1 positive for this year.  2020 combined profits breakdown : 2020 combined profits breakdown :

Realized profit : 2020.20 Unrealized profit : 9853.99 2021 combined profits breakdown :

Realized profit : 7730.77 Unrealized profit : -3967.39 |

|

|

|

|

|

WhitE LighteR

|

Jan 10 2022, 03:43 PM Jan 10 2022, 03:43 PM

|

|

QUOTE(yycclin @ Jan 10 2022, 11:09 AM) Hopefully Ang Pow with CASH   please wake up from your dream.  |

|

|

|

|

|

WhitE LighteR

|

Feb 12 2022, 06:23 PM Feb 12 2022, 06:23 PM

|

|

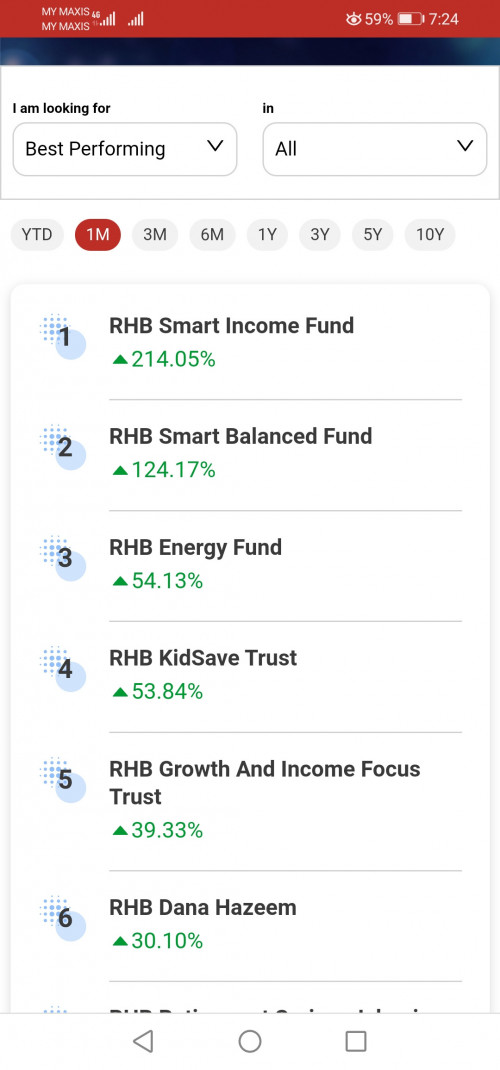

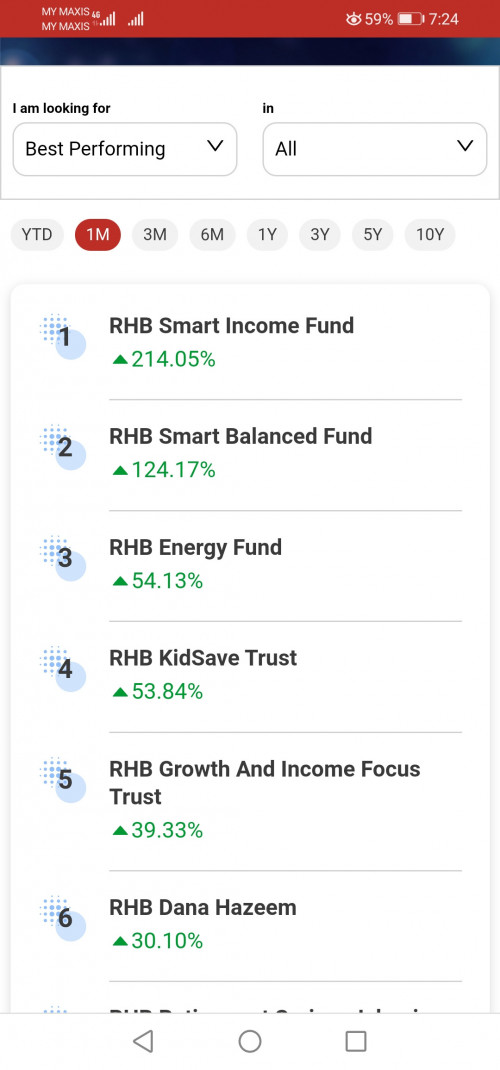

QUOTE(engyr @ Feb 11 2022, 07:25 AM) Rhb funds show so good performance within one month?  I also feel so weird. Suddenly all this low profile funds jump so much. |

|

|

|

|

|

WhitE LighteR

|

Feb 28 2022, 09:59 AM Feb 28 2022, 09:59 AM

|

|

For those wondering regarding Interpac Dana Safi recent performance. FSM inform that the fund manager went all into cash coz of the recent downturn. Same story for the other fund that stagnant under Interpac.

|

|

|

|

|

|

WhitE LighteR

|

Mar 3 2022, 03:25 PM Mar 3 2022, 03:25 PM

|

|

QUOTE(Kpjh @ Mar 2 2022, 06:35 PM) Did fsm inform via email? i sent them email. they call me to explain. quite good service i think. i didnt had a long chat. i was busy attending a funeral at the time.  This post has been edited by WhitE LighteR: Mar 3 2022, 03:25 PM This post has been edited by WhitE LighteR: Mar 3 2022, 03:25 PM |

|

|

|

|

|

WhitE LighteR

|

Mar 9 2022, 09:07 AM Mar 9 2022, 09:07 AM

|

|

QUOTE(Le Don @ Mar 8 2022, 05:51 PM) Manulife global resources fund this fund is good. but its an underperformer during good times. if u not in it already, going in now might not be such a good idea. my 2 cent just like others, my normal equity funds all taking looses now. i manage to escape a few into cash by taking profit, but the others jst have to bare with it until market goes back up. as long as i dont sell, i wont realized the losses. the only one making money now for me is Precious Metal fund, and i got 2 etf for hedging, UVXY and XME This post has been edited by WhitE LighteR: Mar 9 2022, 09:10 AM |

|

|

|

|

|

WhitE LighteR

|

Mar 9 2022, 06:44 PM Mar 9 2022, 06:44 PM

|

|

QUOTE(sgh @ Mar 9 2022, 11:39 AM) https://www.channelnewsasia.com/world/nod-r...bership-2549551Hope peace prevail soon and all back to normal and stock market recover! NATO also just tease them for so long about membership. Not dare to grant them for so long untill ppl kena attack. Why wan to seek membership for anymore. Too late. Better to placate Russian for now and end the war. Become neutral country also not bad as long as they can avoid loosing anymore terrories to separatist |

|

|

|

|

|

WhitE LighteR

|

Mar 10 2022, 10:09 AM Mar 10 2022, 10:09 AM

|

|

QUOTE(sgh @ Mar 9 2022, 07:09 PM) US always the country that instigate. Why did the great Soviet Union disintegrate in 1991? If not USSR still one super big country. Now it breakup into so many and US slowly psycho them to go against Russia and now Russia really action US surprised don't dare provoke scared WW3. Who suffer? Those former USSR breakup countries loh. I am actually quite surprised Putin really wage war my gosh don't play play with him even more garang than China sia  Just my personal opinion. I dont think USSR could have ever made it. The system is not sustainable. Without some kind of way to actively generate income, a socialist country has no way to equally give everyone everything. So the cold war is jst the death of a weaker ideology imho. |

|

|

|

|

|

WhitE LighteR

|

Mar 10 2022, 10:44 AM Mar 10 2022, 10:44 AM

|

|

QUOTE(sgh @ Mar 10 2022, 10:37 AM) You know your thinking applies way back many years ago on China too. But look how China has flourished along the years so much so that their stock market sneeze it actually affect Asia markets in many ways. They maybe holding their same old idealogy but economic and business wise to me more like capitalism (opening up for trade etc). Unfortunately USSR does not have the time horizon to prove themselves like China did since they kena split up around 1991 by instigator countries (ok I get it conspiracy theories) behind. china and ussr is not the same. china does a hybrid socialism. it practice the regular socialism plus commerce at same time. thus avoiding the mistake ussr made long time ago. jst like in some other european country that slowly going towards social democratic system. this days hybrid system seems to work best. but russia now is slowly regressing back to totalitarianism which is a shame. This post has been edited by WhitE LighteR: Mar 10 2022, 10:46 AM |

|

|

|

|

|

WhitE LighteR

|

Mar 10 2022, 08:17 PM Mar 10 2022, 08:17 PM

|

|

QUOTE(Red_rustyjelly @ Mar 10 2022, 01:39 PM) just buy gold fund la  its at 2k usd now. its major resistance. u sure can buy now? |

|

|

|

|

Oct 15 2021, 01:42 PM

Oct 15 2021, 01:42 PM

Quote

Quote

0.0668sec

0.0668sec

0.96

0.96

7 queries

7 queries

GZIP Disabled

GZIP Disabled