QUOTE(coolguy99 @ Aug 30 2020, 05:12 PM)

eh sorry, not RHB hahaha.. typo typo, this one:https://www.fundsupermart.com.my/fsmone/fun...tals-Securities

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 30 2020, 05:27 PM Aug 30 2020, 05:27 PM

Return to original view | Post

#141

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(coolguy99 @ Aug 30 2020, 05:12 PM) eh sorry, not RHB hahaha.. typo typo, this one:https://www.fundsupermart.com.my/fsmone/fun...tals-Securities |

|

|

|

|

|

Sep 16 2020, 10:28 AM Sep 16 2020, 10:28 AM

Return to original view | IPv6 | Post

#142

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(adele123 @ Sep 11 2020, 09:45 AM) just curious, what got you to make the decision? because covid? actually i do feel it's not the fund's fault. i had >8% IRR back in 2017. but the market that KGF invest in, it's just not so great also. so now 4% only... SGIH |

|

|

Oct 13 2020, 11:25 PM Oct 13 2020, 11:25 PM

Return to original view | Post

#143

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Oct 14 2020, 01:04 PM Oct 14 2020, 01:04 PM

Return to original view | IPv6 | Post

#144

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Jan 19 2021, 10:40 PM Jan 19 2021, 10:40 PM

Return to original view | Post

#145

|

Senior Member

3,968 posts Joined: Nov 2007 |

Gogo china and apac long time didnt login to check the fund performance. what a pleasant surprise to see this 2 : Greater china at +41% dynamic income fund at +38% brokenbomb, whirlwind, and 1 other liked this post

|

|

|

Jan 19 2021, 11:49 PM Jan 19 2021, 11:49 PM

Return to original view | Post

#146

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

|

|

|

Jan 20 2021, 01:27 PM Jan 20 2021, 01:27 PM

Return to original view | IPv6 | Post

#147

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Feb 3 2021, 05:51 PM Feb 3 2021, 05:51 PM

Return to original view | Post

#148

|

Senior Member

3,968 posts Joined: Nov 2007 |

overall (+21.07%) at the moment. Long may it continue

|

|

|

Feb 3 2021, 05:52 PM Feb 3 2021, 05:52 PM

Return to original view | Post

#149

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Feb 4 2021, 02:00 AM Feb 4 2021, 02:00 AM

Return to original view | Post

#150

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(coolguy99 @ Feb 3 2021, 08:53 PM) heavy in china is good. this year im 50% in china..10.56% china 37.05% greater china 17.26% Asia ex Japan kabal82 liked this post

|

|

|

Feb 10 2021, 11:30 PM Feb 10 2021, 11:30 PM

Return to original view | Post

#151

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Apr 2 2021, 01:02 AM Apr 2 2021, 01:02 AM

Return to original view | Post

#152

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Apr 18 2021, 06:12 PM Apr 18 2021, 06:12 PM

Return to original view | Post

#153

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(xuzen @ Apr 17 2021, 10:54 AM) Hari ini top up Interpac Dana Safi = RM 1,000.00 + United Global Tech ( MYR ) = RM 2,000.00 +1 for china. Huat ahhEarly of the month already top up RM 5,000.00 into AmChina-A. ( NB: Min top up for AmChina-A is RM 5K ) KAF Tactical just maintain. I am bullish on Mehsia ( mid cap ) + China. US exposure is so-so. Top up just to achieve % target in portfolio. Xu'. Ong Mali Huat Mali Heng Mali my allocation this year is ■Asia ex Japan 18.16% ■Singapore 1.76% ■China 9.37% ■Malaysia Focus 9.22% ■Malaysia 17.75% ■Greater China 35.79% ■Global 7.95% |

|

|

|

|

|

May 7 2021, 11:45 PM May 7 2021, 11:45 PM

Return to original view | Post

#154

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(majorarmstrong @ May 4 2021, 03:22 PM) anyone start to pick up China? me me. focusing china too. china + greater china , total up 46%just added an additional 5% of my portfolio to china just added Reits another 2% to my overall portfolio cash out 50% of on tech United Global Tech not sure why my friend ask me to cash out, but i listen saja la cash out end of April. Tech - 15% China - 22% Asia Pacific Ex Japan - 18% Reits - 18% Malaysia - 12% Cash - 15% <--- gonna slowly masuk china (not asia pacific) and reits ■Asia ex Japan 17.82% ■Singapore 1.70% ■China 11.23% ■Malaysia Focus 9.00% ■Malaysia 17.40% ■Greater China 35.50% ■Global 7.35% |

|

|

May 9 2021, 01:36 AM May 9 2021, 01:36 AM

Return to original view | IPv6 | Post

#155

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Jun 2 2021, 05:56 PM Jun 2 2021, 05:56 PM

Return to original view | IPv6 | Post

#156

|

Senior Member

3,968 posts Joined: Nov 2007 |

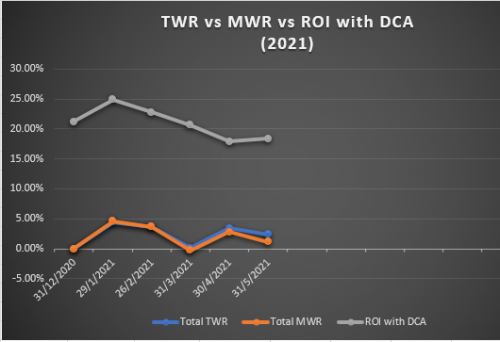

QUOTE(WhitE LighteR @ Jun 2 2021, 11:51 AM)  My port for May gave up some of the gains made in April. YTD TWR : 2.43 % MoM Change TWR : -0.97 % YTD MWR : 1.12 % MoM Change MWR : -1.70 % Underperforming market. In May, China A-Shares & Greater China continues to be weak with little to no improvement. There is small sign of recovery but not sure can sustain further or not with so much speculation of taper coming from China & US. Malaysia trending down in May, while US Tech recovered a little. Precious Metals and Resources perform the best out of all the other funds in May, rallying about 6-7% in May alone. Less that 10% allocation in my portfolio only, so doesnt have much impact on overall performance. No big top up this month until I can see further momentum. Seems to be 50/50 now as some funds are so close to the 200sma, some even fall below it. Small top up in Precious Metals and AH Innovation fund. Small profit taking in underperforming funds. Because almost half of my portfolio is in China A-Shares & Greater China, I dont expect any substantial improvement to portfolio performance until there improvement in those markets. |

|

|

Jul 9 2021, 06:25 PM Jul 9 2021, 06:25 PM

Return to original view | IPv6 | Post

#157

|

Senior Member

3,968 posts Joined: Nov 2007 |

only holding 8% malaysia focused funds.. i dont think the returns will be comparable to other regions, might as well move to other asia countries

|

|

|

Aug 3 2021, 02:00 AM Aug 3 2021, 02:00 AM

Return to original view | IPv6 | Post

#158

|

Senior Member

3,968 posts Joined: Nov 2007 |

|

|

|

Aug 26 2021, 12:45 AM Aug 26 2021, 12:45 AM

Return to original view | IPv6 | Post

#159

|

Senior Member

3,968 posts Joined: Nov 2007 |

finally some good news from china :S heartache for so long

anyone into Principal Global Millennial Equity Fund - MYR? |

|

|

Aug 26 2021, 01:28 PM Aug 26 2021, 01:28 PM

Return to original view | Post

#160

|

Senior Member

3,968 posts Joined: Nov 2007 |

QUOTE(jonoave @ Aug 26 2021, 04:30 AM) Yes, i put in some money for fun at first. I think I was the first one who mentioned it here when I saw i found it cos I thought the name was cool . Decent only meh? The return looks high hahaha i bought in abit , for the US exposure. Now very heavy on chinaSo far not too bad, decent returns. Not as high as Global Titans which I started DCA a long time ago, currently up 19%. |

| Change to: |  0.3967sec 0.3967sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 03:05 AM |