QUOTE(peri peri @ Apr 13 2018, 10:23 AM)

sikit sikit lama lama jadi bukit juga

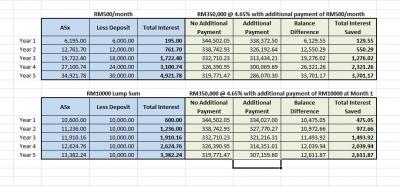

park your money wisely.

for eg, my friend rather park his money in EPF which gives the higher dividend, how?

he requests his employer to contribute 19%

EPF can withdraw the additional contribution anytime? The attractiveness of ASx is that you don't have to wait until 50/55 to access your money in case of emergency.

QUOTE(peri peri @ Apr 13 2018, 10:25 AM)

omg, rm500k is everyone dream.

better diversify in many other channels

eg, flexi home, FD, share market, forex, gold, REIT, property, unit trusts

dont pull all eggs in one bucket.

Diversification is good but depending on risk appetite. Forex, gold, UT is all exposed to higher risk and requires more research. ASx is sort of a safe deposit for many. Not sure if it will forever be able to payout 6% dividend annually but at least for now it's a good place to keep any extra money.

If PNB close shop, the whole Malaysian economy and stocks will also be affected greatly.

Apr 9 2018, 06:05 PM

Apr 9 2018, 06:05 PM

Quote

Quote

0.2161sec

0.2161sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled