Outline ·

[ Standard ] ·

Linear+

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

|

HouLeiiShytt

|

Aug 31 2021, 02:48 PM Aug 31 2021, 02:48 PM

|

New Member

|

Hi guys, new to Lowyat here. Currently a fresh graduate with monthly income of RM3.5K. Looking to apply for my first credit card to start building up my credit history.

1. Annual Income: RM42K (RM3.5K / month)

2. Free Lifetime Annual Fee: Good to have but not a must if the benefits out-weight the fees.

3. Card required for: Mainly Cash Back/Rebate, Online/offline shopping, Petrol (needed after pandemic, currently WFH), Overseas Transactions (once in a while)

4. Existing credit cards (if any): Nil.

5. Interested in CC from: Maybank, CIMB, Public Bank (other bank recommendations are welcomed)

6. Others: Priority on cash back. Currently looking at Maybank 2 Gold card & Public Bank Quantum cards.

|

|

|

|

|

|

HouLeiiShytt

|

Aug 31 2021, 06:38 PM Aug 31 2021, 06:38 PM

|

New Member

|

QUOTE(Human Nature @ Aug 31 2021, 02:50 PM) Get PBB Quantum. Depending on your petrol brand, you can use it to but voucher or top up ewallet to pay for petrol Oh, Quantum can top up e-wallet? But only with Master card got cash back right if e-wallet |

|

|

|

|

|

HouLeiiShytt

|

Sep 10 2022, 04:11 PM Sep 10 2022, 04:11 PM

|

New Member

|

1. Annual Income: ~RM58K.

2. Free Lifetime Annual Fee: A Must.

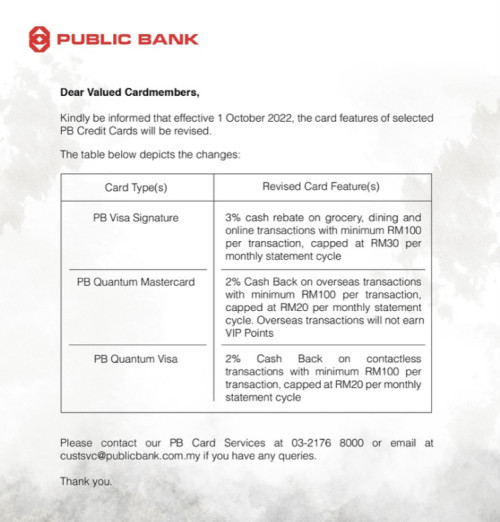

3. Card required for: Insurance, Telco, Online Shopping, Petrol, Food, Offline Shopping. - From highest priority (left) to lowest priority (right)

4. Existing credit cards (if any): PBB Quantum Cards (cash back T&C changing soon so it's not as good for me starting 1 OCT).

5. Interested in CC from: PBB, MBB, CIMB / any other bank if benefits are justifiable.

6. Others: Monthly fixed spending - ~RM300 - ~RM800, Prioritise cash back than any other benefits, reward points is a plus.

|

|

|

|

|

|

HouLeiiShytt

|

Oct 31 2024, 12:34 PM Oct 31 2024, 12:34 PM

|

New Member

|

1. Annual Income: RM120K

2. Free Lifetime Annual Fee: Preferable. Don't mind if cash back can cover the fee.

3. Card required for: Online purchases, Petrol (Setel), Bills (Unifi, CelcomDigi), Restaurants

4. Existing credit cards (if any): PIBB Visa Plat, MBB FCB, CIMB eCC

5. Interested in CC from: Any

6. Others: Prefer cash back over anything. Prefer card with no minimum spending.

Thank you in advance!

|

|

|

|

|

|

HouLeiiShytt

|

May 7 2025, 10:51 AM May 7 2025, 10:51 AM

|

New Member

|

Hi Sifus, requesting for credit card recommendation, preferably Air Miles, currently looking at Alliance VI and HLB VI

1. Annual Income: RM120K and above

2. Free Lifetime Annual Fee: Good to have. If not, best to have waivable conditions.

3. Card required for: From high to low - Insurance, Utilities (Telco, Unifi), Physical F&B, Petrol thru Setel, e-commerce, Overseas spending

4. Existing credit cards (if any): MBB FC Barcelona Visa Signature, PIBB Visa Platinum, CIMB eCredit Card

5. Interested in CC from: Any

6. Others: Prefer Air Miles, Cash back also acceptable

|

|

|

|

|

|

HouLeiiShytt

|

May 7 2025, 11:29 AM May 7 2025, 11:29 AM

|

New Member

|

QUOTE(coolguy99 @ May 7 2025, 10:54 AM) For Insurance Payment, you can look at Affin Duo. This is one of the very very few cards that still gives cashback for insurance payments today. Get the MBB 2 Card Amex for weekend cash back and make your utility payments through Lazada. For overseas spending you can consider Ambank Enrich Visa, if you are worried about the annual fee, suggest you go for the Platinum card instead of Infinite. Aren't MBB 2 Card Amex have updated their weekend cash back, preventing us from using it for utilities Quoted from MBB website: Effective 1st June 2019, 5% Cash Back for all purchases (except for government bodies and utilities) on weekends (capped at RM50 per month) or paying through Lazada bypasses that? |

|

|

|

|

|

HouLeiiShytt

|

Jun 5 2025, 07:24 PM Jun 5 2025, 07:24 PM

|

New Member

|

Hi sifus, anyone here know if paying off Shopee Pay Later is considered as Online Spending?

|

|

|

|

|

Aug 31 2021, 02:48 PM

Aug 31 2021, 02:48 PM

Quote

Quote

0.0264sec

0.0264sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled