Outline ·

[ Standard ] ·

Linear+

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

|

GrumpyNooby

|

Apr 25 2020, 09:03 PM Apr 25 2020, 09:03 PM

|

|

QUOTE(jiaen0509 @ Apr 25 2020, 08:36 PM) Currently I am holding; Maybank - M2Plat, FCB Public Bank - Quantum Master and Visa Standard and Chartered Bank - JustOne and LCB Mostly Cashback credit card. Now I am looking for another bank credit card. Any recommendations? I look for the benefit card. Maybe have CB/Promotions? Need recommendations. PB Visa Signature, Aeon BIG Visa, AmBank True Visa, Alliance Younique, UOB YOLO Visa, UOB ONE Visa, HSBC Amanah Mpower Visa Platinum, RHB Visa Signature, Citibank Cash Back, HL Wise This post has been edited by GrumpyNooby: Apr 25 2020, 09:07 PM |

|

|

|

|

|

GrumpyNooby

|

May 16 2020, 08:54 AM May 16 2020, 08:54 AM

|

|

QUOTE(cocopuffs @ May 16 2020, 08:53 AM) Hi Senpai, Besides Mbb 2 cards & visa signature, which other cc are recommended for petrol? Without annual fee & Min spending conditions. Thanks  Up to 10% cash back at BHPetrol station 10% cash back on weekends 2% cash back on weekdays Cash back is valid for fuel purchase made at BHPetrol station and capped at RM50 per month. AFFIN Rewards Earn 1 AFFIN Rewards Point for every RM1 retail transaction spent at other retailers. Please click here for full Terms and Conditions. T&C link: https://www.affinonline.com/AFFINONLINE/med...ashBack_ENG.pdf |

|

|

|

|

|

GrumpyNooby

|

May 25 2020, 10:08 AM May 25 2020, 10:08 AM

|

|

QUOTE(datolee32 @ May 25 2020, 10:05 AM) A lot of bank no longer count JOMPAY for cash back entitlement, but you can try credit card under AEON, there is 2% cash back via online bill payment. 2% cash back for Aeon online payment includes JomPay too? |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 12:24 PM May 27 2020, 12:24 PM

|

|

QUOTE(echoesian @ May 27 2020, 12:17 PM) What is the best card to use for paying Insurance premiums? Maybank Barcelona VS |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 12:29 PM May 27 2020, 12:29 PM

|

|

QUOTE(echoesian @ May 27 2020, 12:28 PM) Why MBB Barcelona where as SC JustOne Platinum can offer cashback 15%? JOP got pre-condition to meet. Barcelona VS no pre-condition to meet. |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 05:47 PM May 27 2020, 05:47 PM

|

|

QUOTE(echoesian @ May 27 2020, 05:39 PM) If using for retail, actually MBB Barcelona and MBB 2 MasterCard is the same right? But MBB 2 MasterCard has no cash back. You sure? This post has been edited by GrumpyNooby: May 27 2020, 05:50 PM |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 07:44 AM May 28 2020, 07:44 AM

|

|

QUOTE(Acoen @ May 28 2020, 07:32 AM) Currently using MBB 2 cards with 5% cashback in weekend spending only. Can recommend other CC with better cashback? Complement that with Maybank Barcelona VS This post has been edited by GrumpyNooby: May 28 2020, 07:47 AM |

|

|

|

|

|

GrumpyNooby

|

May 29 2020, 11:56 AM May 29 2020, 11:56 AM

|

|

QUOTE(echoesian @ May 29 2020, 11:54 AM) Is it confirm MBB Barcelona can get 2% rebate for Insurance Premium? It is not in the exclusion list right?  |

|

|

|

|

|

GrumpyNooby

|

Jun 4 2020, 09:40 PM Jun 4 2020, 09:40 PM

|

|

QUOTE(Michael_Light @ Jun 4 2020, 09:39 PM) Pbb quantum master - free annual free, 5% cashback on online & dining cap at RM30.Uob Yolo - 5% cashback on dining, online & contactless, cap at Rm30. Correction: Pbb quantum master - free annual free, 5% cashback on online only cap at RM30. This post has been edited by GrumpyNooby: Jun 4 2020, 09:43 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 25 2020, 08:37 PM Jun 25 2020, 08:37 PM

|

|

QUOTE(datolee32 @ Jun 25 2020, 08:35 PM) If I didn't get wrong, you can pay TNB bill online using Public Quantum Master, 5% cash back for online transaction. If the monthly TNB bill amount is > RM 600, that card is useless. |

|

|

|

|

|

GrumpyNooby

|

Jun 25 2020, 08:45 PM Jun 25 2020, 08:45 PM

|

|

QUOTE(datolee32 @ Jun 25 2020, 08:42 PM) Can pay RM 600 first for the card, then the balance use other credit card/e-wallet to pay  What is the next credit card proposed to use that will earn cash back for TNB bills? |

|

|

|

|

|

GrumpyNooby

|

Jul 5 2020, 08:41 PM Jul 5 2020, 08:41 PM

|

|

QUOTE(Kitty_catts @ Jul 5 2020, 08:33 PM) Any credit card that offers cashback regardless of amount used every month? Most of the card that I found require usage more than 2k per month. Currently i only spend about 900 - 1.6k per month. Best i can find is the CIMB mastercard. Any others? Maybank2kard AMEX Maybank Barcelona Visa Signature |

|

|

|

|

|

GrumpyNooby

|

Jul 16 2020, 09:31 AM Jul 16 2020, 09:31 AM

|

|

QUOTE(lis_elle @ Jul 16 2020, 09:28 AM) Thanks for this thread I got PB Quantum cards but I realize I maxed out the cashback especially for e-wallet (5%, RM30 capped). Any other recommended cards so that I can really utilize the e-wallet/online transactions? PB Visa Signature SC Liverpool SC JustOne Platinum This post has been edited by GrumpyNooby: Jul 16 2020, 09:32 AM |

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 07:34 AM Jul 21 2020, 07:34 AM

|

|

QUOTE(virgoguy @ Jul 21 2020, 12:41 AM) Affin VS got annual fee right? Annual Fee Waiver Enjoy annual fee waiver for the first year, and minimum requirement for subsequent years - minimum retail spend of RM6,000 per annum or RM500 per month https://www.affinonline.com/tap_for_cash_back |

|

|

|

|

|

GrumpyNooby

|

Jul 26 2020, 08:07 AM Jul 26 2020, 08:07 AM

|

|

QUOTE(datolee32 @ Jul 25 2020, 11:30 PM) If petrol, grocery, dining, can try Citibank cash back credit card, RM 10 for each category but your statement amount must be > RM 500. For PTPTN cash back, you can use boost to pay, can use those with online transaction cash back credit card to top up boost. Public Quantum Master is good enough to reload into e-wallet, 5% cash back. For flight benefit, you mean air miles? If yes, you can try Maybank 2 Cards. Point collection? I think the best point to collect is Treat point (Maybank 2 Cards)Treat Points evergreen?  |

|

|

|

|

|

GrumpyNooby

|

Jul 28 2020, 05:27 PM Jul 28 2020, 05:27 PM

|

|

QUOTE(Seth Ho @ Jul 28 2020, 05:14 PM) If every credit card cit their benefit than yes. But 1% is really really low   if 2% but cut away may and august special still good 5 more months to go before new interchange fee to take place on 1/1/2021 |

|

|

|

|

|

GrumpyNooby

|

Jul 28 2020, 05:37 PM Jul 28 2020, 05:37 PM

|

|

QUOTE(!@#$%^ @ Jul 28 2020, 05:35 PM) enjoy, until the time comes. then we see what to do. Remaining 5 months only; not 5 years. Time flies fast ... |

|

|

|

|

|

GrumpyNooby

|

Jul 29 2020, 08:42 AM Jul 29 2020, 08:42 AM

|

|

Do you know...Credit cards are the people's top payment choicehttps://www.thestar.com.my/news/nation/2020...-payment-choice

|

|

|

|

|

|

GrumpyNooby

|

Jul 30 2020, 07:26 AM Jul 30 2020, 07:26 AM

|

|

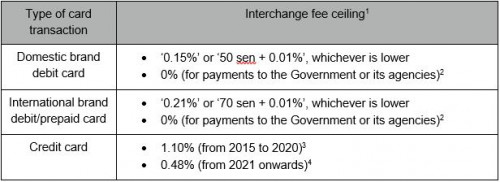

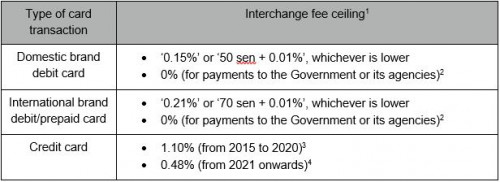

QUOTE(leo_kiatez @ Jul 30 2020, 12:05 AM) Didn't know that! What is interchange fee & how much it cost? Under the Framework, ceilings are imposed on interchange fees payable by the acquiring banks to the payment card issuing banks. As the interchange fees are reflected in the merchant discount rates (MDRs) paid by merchants, the ceilings would address the risk of escalation in the MDRs due to indiscriminate increases in interchange fees. As a general principle, the interchange fee ceilings for debit card based on its eligible cost components are much lower than that of credit card. https://www.bnm.gov.my/index.php?ch=en_pres...ac=2618&lang=enGradual reduction from 1.1% pa to 0.48% (in 2021):  FAQ link: https://www.bnm.gov.my/documents/2014/pcrf/FAQs_PCRF_en.doc |

|

|

|

|

|

GrumpyNooby

|

Aug 6 2020, 09:46 PM Aug 6 2020, 09:46 PM

|

|

QUOTE(datolee32 @ Aug 6 2020, 09:19 PM) Public quantum 2 cards is good for your expenses, or you can try StanChart JOP (call to waive AF). Public Quantum cards don't give any benefit for petrols. |

|

|

|

|

Apr 25 2020, 09:03 PM

Apr 25 2020, 09:03 PM

Quote

Quote

0.0265sec

0.0265sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled