Outline ·

[ Standard ] ·

Linear+

Multiple Signs of Malaysia Property Bubble V20

|

Syie9^_^

|

Jan 9 2020, 11:43 PM Jan 9 2020, 11:43 PM

|

|

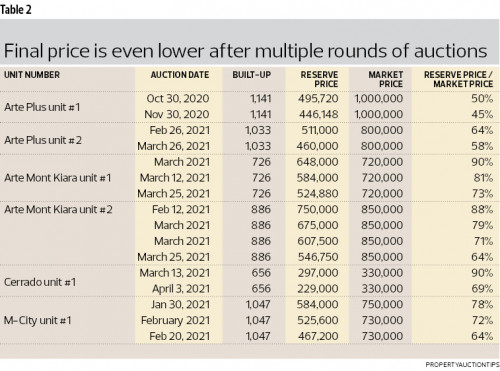

QUOTE(AskarPerang @ Jan 10 2020, 12:48 AM) Pigeon hole unit. KL address. Owner bought at 450k via subsale market.  Now further price drop. Details as below: C-18-7, Type F, Hedgeford 10 Reserve price 🔥🔥RM 263,000🔥🔥 Freehold 562sqft, 1 car park slot Corner/End lot unit Auction: 30-Jan-2020 (Thu) *Occupied unit (tenant staying) » Click to show Spoiler - click again to hide... « next door 280K   half the ori price  |

|

|

|

|

|

Syie9^_^

|

Jan 20 2020, 11:52 PM Jan 20 2020, 11:52 PM

|

|

QUOTE(AskarPerang @ Jan 21 2020, 01:17 AM) Another 3 bedroom unit drop to below 300k. You can get a 3 bedroom unit at studio pricing from the lelong market. J-06-08, 6th Floor, Tower J, Mutiara Ville Reserve price: 🔥🔥RM 263,000🔥🔥 Freehold 935 sqft (Type A), 2 car park slots Auction : 19-Feb-2020 (Wed) *Non bumi lot » Click to show Spoiler - click again to hide... « Damn Cheap for Cyberjaya  |

|

|

|

|

|

Syie9^_^

|

Jan 20 2020, 11:54 PM Jan 20 2020, 11:54 PM

|

|

QUOTE(icemanfx @ Jan 18 2020, 03:56 PM) Reducing the property prices is the only way to clear the overhang units in the country, urged CBRE | WTW managing director Foo Gee Jen. https://www.edgeprop.my/content/1634222/red...-urged-cbre-wtwand impose how many property a person able to hold. need to burn these BBBUUU gang. Mean if one hold more than 2 property; impose RPGT+ Ownership tax+ Capital Gain. This will help to free up property glut and avoid price manipulation. This post has been edited by Syie9^_^: Jan 20 2020, 11:55 PM |

|

|

|

|

|

Syie9^_^

|

Feb 2 2020, 11:23 AM Feb 2 2020, 11:23 AM

|

|

QUOTE(alexkos @ Feb 1 2020, 10:31 AM) Ayam math not Gooding. So the market price is 450k or 263k? No bidder again at 263k. sweat.gif Remember owner bought the unit at 450k if it goes 250K-260K below you better jump in. nothing beats those anymore  BUYER MARKET!! |

|

|

|

|

|

Syie9^_^

|

Feb 15 2020, 11:09 AM Feb 15 2020, 11:09 AM

|

|

QUOTE(icemanfx @ Feb 15 2020, 12:26 PM) I have been a co-founder of IJM Corporation Bhd and a few other listed companies involved in property development, I have never seen so many unsold properties in my life. No one knows when this property glut problem can be resolved. Property prices will continue to drop for many more years to come. Now many property developers are already in liquidation or in bankruptcies because the banks are recalling back the loans. Moreover, the banks have increased the buyers’ down payment from 10% to 30 %. As a result, property developers cannot sell their products. https://klse.i3investor.com/blogs/koonyewyi...oon_Yew_Yin.jspmargin calls have begin!   |

|

|

|

|

|

Syie9^_^

|

Mar 9 2020, 11:16 PM Mar 9 2020, 11:16 PM

|

|

QUOTE(icemanfx @ Mar 10 2020, 12:42 AM) Possible 60k by year end. if no picker. |

|

|

|

|

|

Syie9^_^

|

Mar 9 2020, 11:28 PM Mar 9 2020, 11:28 PM

|

|

QUOTE(AskarPerang @ Mar 10 2020, 12:53 AM) Cyberjaya studio below 200k will attract interest from buyer. Unless from those older project like Domain. That one maybe need below 150k. the rot in market just at early stage and there is alot to compute in. so now i just put the fv of it. happen or not lets see 31.12.2020. Not this deal alone those who bought at top price basically pooof~ of bv; etc etc. This post has been edited by Syie9^_^: Mar 9 2020, 11:28 PM |

|

|

|

|

|

Syie9^_^

|

May 12 2020, 06:19 PM May 12 2020, 06:19 PM

|

|

QUOTE(Red_rustyjelly @ May 12 2020, 11:44 AM) Gone, now she is officially bankrupt. Although managed to drag until this year. with the amount of effort she put in. How much damaged? |

|

|

|

|

|

Syie9^_^

|

Jun 18 2020, 04:14 PM Jun 18 2020, 04:14 PM

|

|

QUOTE(icemanfx @ Jun 18 2020, 11:35 AM) Sleepless nights – that would best describe the mental state of Alex, a property investor, these past few months. He had been optimistic about three years ago when he bought several properties on the advice of a “property guru”. Property prices will go up, you can enjoy bulk discounts and benefit from the rebates now, he was told. He was assured of great options for short or long-term rent to cover the mortgage, plus a lot of cash in hand. The good days have come to an end and the promises have turned into a nightmare. With the current economic situation, what will it mean for Alex and his family if he is unable to service his mortgages when the six-month moratorium ends in September? He is but one of many individuals going through such a situation. https://www.theedgemarkets.com/article/cove...-under-pressure

“They claim there will be an amazing capital return when the purchasers sell the property [that they recommend] when it is completed or there will be a fantastic rental return that is way above the monthly mortgage. Also, many developers have offered all sorts of freebies, including DIBS (developer interest bearing scheme), free furniture and fittings, and cash back,” he says.

“In fact, cash back is a prevalent trend now, where, in some cases, a purchaser can get back more than RM100,000 in cash when buying a property.”

“Most of all, these so-called property gurus have no credibility and they have done it in a way that is nothing more than a skim cepat kaya or Ponzi scheme,” he adds.

This post has been edited by Syie9^_^: Jun 18 2020, 04:16 PM This post has been edited by Syie9^_^: Jun 18 2020, 04:16 PM |

|

|

|

|

|

Syie9^_^

|

Jun 19 2020, 11:03 AM Jun 19 2020, 11:03 AM

|

|

QUOTE(MAGAMan-X @ Jun 19 2020, 12:06 PM) Price goes up, value stays the same. In other words, you're overpaying, at some point, there will be a correction. Ie still speculation. And the property gurus will say: your bank valuation will be higher  do you want to buy another one?   |

|

|

|

|

|

Syie9^_^

|

Jun 19 2020, 11:10 AM Jun 19 2020, 11:10 AM

|

|

QUOTE(MAGAMan-X @ Jun 19 2020, 12:38 PM) Other people's money how they want to spend it is up to them, when banks loan more, I buy more bank shares only  After all, managing my portfolio from my computer is much easier than dealing with tenants and agents and lawyers.  totally agree with you! dont forget this in 6 months time  This post has been edited by Syie9^_^: Jun 19 2020, 11:10 AM This post has been edited by Syie9^_^: Jun 19 2020, 11:10 AM |

|

|

|

|

|

Syie9^_^

|

Dec 31 2020, 04:24 PM Dec 31 2020, 04:24 PM

|

|

QUOTE(icemanfx @ Dec 30 2020, 03:19 AM) Believe many poorperly flippers took excess cash from loan moratorium and bought gloves share, and many are below water. glove? if they were smart they got in bitcoin, today take profit.  Still better than Gloves.  |

|

|

|

|

|

Syie9^_^

|

Apr 6 2021, 10:01 AM Apr 6 2021, 10:01 AM

|

|

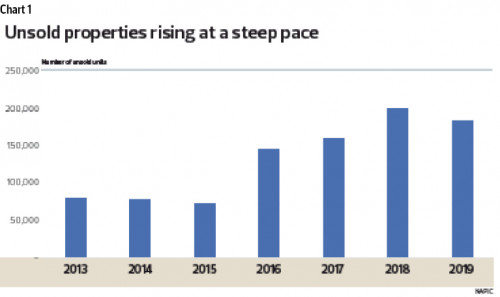

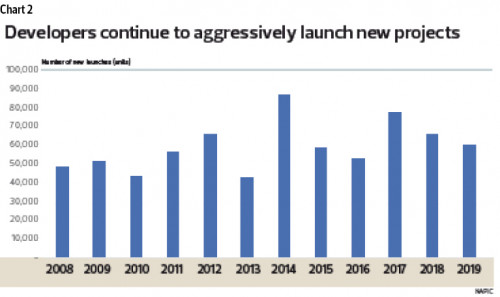

QUOTE(icemanfx @ Apr 1 2021, 09:46 AM) Bank Negara Malaysia (BNM) warns that unsold properties in the country have remained at an elevated level as at end-2020. These are mainly the serviced apartments, small office home office (SOHO) units, and houses priced above RM500,000 in less popular locations. .... BNM also observed that there were adjustments to incoming supply of office and retail space as some developers deferred the completion date of their projects. However, it said the planned incoming supply of office and retail space in the Klang Valley over at least the next three years remains large, equivalent to 23% and 58% of the existing stock, respectively. https://www.theedgemarkets.com/article/numb...l-very-high-bnmDefer date will not reduce supply either. It is inevitable for price fall even it comes to availability. |

|

|

|

|

|

Syie9^_^

|

Apr 6 2021, 10:02 AM Apr 6 2021, 10:02 AM

|

|

QUOTE(aspartame @ Apr 6 2021, 11:07 AM) The government not aware or not willing to plug the “zero entry” sales tactic loophole with cash rebates to lure unsuspecting naive young buyers causing them to be victims of greedy developers ...this is a big problem ... government should ban cash rebates in any form and stipulate minimum deposit for a property at 10% or 20% just like in subsales ...as long as policy not corrected... transfer of wealth from young owners to developers is happening On the other hand, one can also let the situation play out itself.. when enough ppl get burnt, then they will stop on their own... everyone is responsible for their own financial health anyway...laissez faire Should have done NZ way, LVR capped 40% before one can apply for house loan |

|

|

|

|

|

Syie9^_^

|

Apr 6 2021, 10:42 AM Apr 6 2021, 10:42 AM

|

|

QUOTE(aspartame @ Apr 6 2021, 11:42 AM) Follow Singapore good enough. Max loan 90%. Singapore position. Not feasible for Malaysia situation. Singapore is controlled by their URA. And their land ownership is 95% govt to 5% private. While Malaysia is rever, 5% govt, roughly 75% private. in urban area. Hence to change the game, it never favours the govt. On loan issue, they should cap it at lower to deter fallout if asset price "correction" |

|

|

|

|

|

Syie9^_^

|

Apr 6 2021, 07:52 PM Apr 6 2021, 07:52 PM

|

|

QUOTE(prody @ Apr 6 2021, 07:01 PM) Landlords renting out office space are really in big trouble with the new WFH culture growing in popularity. Really? never see them cry on street also  |

|

|

|

|

|

Syie9^_^

|

Apr 6 2021, 10:11 PM Apr 6 2021, 10:11 PM

|

|

QUOTE(prody @ Apr 6 2021, 09:35 PM) It's a logical conclusion. Office space was already oversupplied before covid. Now more companies shifting to work from home, means office space even more oversupplied. Some landlords will obviously suffer. will they burn their office down?  |

|

|

|

|

|

Syie9^_^

|

Apr 8 2021, 01:14 PM Apr 8 2021, 01:14 PM

|

|

|

|

|

|

|

|

Syie9^_^

|

Apr 8 2021, 01:32 PM Apr 8 2021, 01:32 PM

|

|

QUOTE(blek @ Apr 8 2021, 02:50 PM) Does the rent included management fee? i dont know |

|

|

|

|

|

Syie9^_^

|

Apr 13 2021, 03:37 PM Apr 13 2021, 03:37 PM

|

|

QUOTE(icemanfx @ Apr 13 2021, 04:57 PM) Where is 2020. Need a long candle chart.  |

|

|

|

|

Jan 9 2020, 11:43 PM

Jan 9 2020, 11:43 PM

Quote

Quote

0.1640sec

0.1640sec

1.11

1.11

7 queries

7 queries

GZIP Disabled

GZIP Disabled