QUOTE(clolol @ Apr 14 2019, 07:15 PM)

From what I can tell, property market is very soft at the moment.

There seems to still be demand for properties priced RM500k and below, however, not many are eligible for loans. For property above RM1mio, prices are falling. I believe one way the government is trying to solve the overhang problem is by 1)stopping the development of residential properties priced at RM1mio and above, 2) HOC, 3) BNM announced they may decrease OPR in the next meeting if growth continues to slowdown... not too sure if it'll be wise as there may be more capital outflow...

Seems like you've lived through the Asian Economic Recession in 1997... so I'd like to ask- as I am a newbie and took up a loan to get one of those affordable housing during this HOC period-

1) Will I be screwed if property bubble burst say... this year or next? Will the property prices still be affected if it's those under the affordable housing scheme (i.e. RM300k, maxed RM400k...) Do you think there'll be tonnes of default even on affordable housing? Why would banks and the government allow that, did we not learn from history?

2) Recession- as I know there are many many many citizens in this country who has a home loan and other debts, should interest rates go crazily high like in the 1997... are you saying that's when we will all "see blood"? As I heard from my folks, they were "okay" and their debt commitments were just slightly higher... hmm...

3) How should we cushion for market difficulties? FD? Cash in CA/SA? Holding onto a stable job?

Back in 97, our bubble wasn't of property, but assets like stock, even though I am young at the time we don't have trouble of negative equity at the time, but what happens is that there are tonnes of abandoned projects, some still stand in ruins today, personally known a family that have disposable cash and bought and refurbished what is now called "Fawina Court" in Ampang after it stand vacant for years and made a tonne of cash from it, and they aren't even experience property developer.

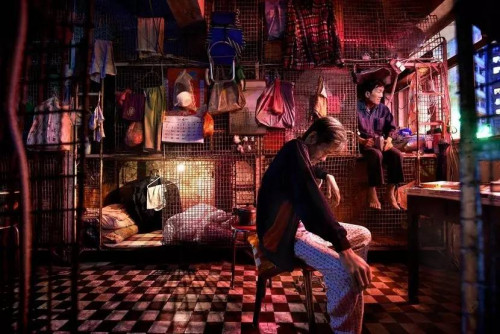

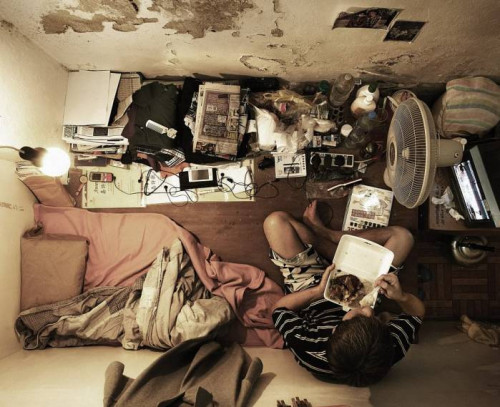

But it happens in Hong Kong, Kenny Bee is a classic example, his wife Teresa Cheung secured multiple property loan, thinking that it can only goes up and they have the income to finance the loans.

1. If your property value fells less than the remaining balance of your loan, say there is 1 million remaining on your loan and the property is now only worth 800k on the market, the property is "underwater" as they say.

They will ask you to refinance the loan say in our example, 200k - in cash, if not they will repossess your property if you couldn't renegotiate the term of loans with them and you will lost your house and go bankrupt.

This is what happens to the multi-millionaire Kenny Bee, it was the new buzz word of the late 90's and back then we didn't think this is possible even if one pay their loans on time.

I think the auction now can tell you if there is a lot of affordable housing in default.

As to why banks and government allows that, there are some banks that are involved with the developer themselves, some like Hong Leong are even developer themselves.

MBF did the same thing in the 90's, they have the most branch out of all banks, and went down under as the market collapse.

Some government linked companies, investment and cronies in each and their own ways involved in real estate business, and it stands about 4.2% of our GDP.

We don't have a honorable figure like Paul Volcker of Federal Reserve or as qualified and as good, and all have to say good things for the government. (ie. Zeti for Najib, and previous directors of BNM in Mahathir era)

2. Household debt wasn't high in the 90's, buying car with cash instead of loan with help of family is not uncommon, and downpayment of 30-40% for property is even common, and people aren't highly leveraged, our stock market on the other hand is a different story when many players overleveraged on their margins, most of all the bubble wasn't on real estate.

3. Cash is always important, but when I got out of college around the great recession 07-08 we played gold. Bought some gold bars at around $650 price level, it shoot up till $1800, and I sold around $1600 as I need money to buy stock, it is a good decision, but got cut kaw kaw as it was easy to buy gold in Malaysia, but impossible to sell, all shops will cut you kaw kaw and the market is monopolized by goldsmith, finally there is a goldbar dealer who could take my gold at Kuchai.

If I could do it today I will put some money on gold investment account like Maybank instead of holding real gold as a hedge against currency drop and inflation, I think I might buy some if it is at 1200-1250 level these days.

This post has been edited by Angelic Layer: Apr 15 2019, 01:41 PM

Jan 11 2019, 02:55 PM

Jan 11 2019, 02:55 PM

Quote

Quote

0.1406sec

0.1406sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled