QUOTE(kochin @ Jun 27 2023, 09:31 AM)

Any special FD promotion for that day? Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jun 27 2023, 10:43 AM Jun 27 2023, 10:43 AM

Return to original view | Post

#1

|

Junior Member

170 posts Joined: Jun 2023 |

|

|

|

|

|

|

Aug 30 2023, 01:52 PM Aug 30 2023, 01:52 PM

Return to original view | Post

#2

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(ericlaiys @ Aug 30 2023, 01:18 PM) 3.85% is after 85:15. |

|

|

Oct 27 2023, 08:10 AM Oct 27 2023, 08:10 AM

Return to original view | Post

#3

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(verbatin @ Oct 26 2023, 10:43 PM) RM 700 is the interest i will lose if i don't want it to renew it. of course i don't want to renew as 2.35% is lousy. but i will lost the 700 interest if i cancel it Majority adopt auto renew.my question is if auto renew is the norm in Malaysia? if i dont tell them, the default is auto renew. Autorenew - get board rate, which normally lousy rate. No auto renew - deposit in saving ac, many have no interest rate or very low rate, something like 0.x% only. You don't get any favour either side, and already at losing side when didn't perform anything when the FD matured. The key is to do perform withdraw when fd mature and to park the money into higher rate deposit ac or FD. CommodoreAmiga liked this post

|

|

|

Oct 27 2023, 10:27 AM Oct 27 2023, 10:27 AM

Return to original view | Post

#4

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(Junichiro Tanizaki @ Oct 27 2023, 09:51 AM) When doing efd, there is no option not to auto renew. Banks are smart. If yr efd matures on a public holiday, they do not need to pay extra interest cos' it is already auto-renewed. What I read about losing Rm700 - you won't be entitled to any interest for a premature withdrawal. Like someone wrote above - an opportunity cost. efd operates 365, holiday or not is not an issue, efd can be placed and withdrawn on holiday also. |

|

|

Feb 1 2024, 09:28 AM Feb 1 2024, 09:28 AM

Return to original view | Post

#5

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(ruudygh @ Feb 1 2024, 02:47 AM) I dont understand... why are the FD rate for over the counter higher than online? OTC- Can introduce or persuade you to buy unit trust and insurance product. Why are banks encourage us to go to Bank when it can easily be done online? Is it their counter staffs have nothing to do? Or is it they want many people to squeeze inside the bank to make the bank looks very busy and lively? Online - placed, log out. |

|

|

Feb 17 2024, 06:09 PM Feb 17 2024, 06:09 PM

Return to original view | Post

#6

|

Junior Member

170 posts Joined: Jun 2023 |

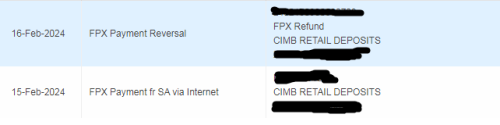

QUOTE(Ichitech @ Feb 16 2024, 11:14 PM) Luckily.. TQ so much guys Money won't gone in thin air.Feeling better.. although amount is small, but still feel uneasy lah when money just gone from the air  Once I withdrew cash from ATM, money deducted, but no cash coming out. That time also feel anxious, the bank officer said, don't need to worry, once they open the machine and count the cash, they will know the excess cash, and they have log file to identify. I just need to make a report, how much, which machine and time. Eventually, the money was credited back 2 days afterwards. For FPX Debiting bank -> paynet (FPX) -> Receiving bank or eFD. In your case, you have successful debiting, and go thru paynet, but since you closed the window of receiving bank, the likelyhood the money is stuck at FPX gateway and can't go into receiving bank to complete the transaction. Every transaction has its log, the only matter is where the unsuccessful transaction is stuck at. Every FPX has its own transaction ID number. Money will be refunded back to origin debiting account if transaction fail to complete. Giro also the same. ericlaiys liked this post

|

|

|

|

|

|

Mar 2 2024, 05:39 PM Mar 2 2024, 05:39 PM

Return to original view | Post

#7

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(ManutdGiggs @ Mar 1 2024, 01:38 PM) There are banks that offering higher rate (not sure how high) if clients are buying other products Only if you are interested in those other products.The question is do u think it worths doing so just to get slightly higher FD rate? Furthermore how much higher depends on what kinda products we are buying and subject to HQ approval. What if HQ rejected or slightly higher rate after we committed in other products? Haiz May not worthwhile if merely chase for 0.x% more by investing into other products. Some bancassurance are very long term commitment, while unit trust has sales charge, and capital is not guaranteed, it may profit also can loss. |

|

|

Jul 22 2024, 09:41 AM Jul 22 2024, 09:41 AM

Return to original view | Post

#8

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(cybpsych @ Jul 21 2024, 05:06 PM) all the security features enforced on digital front due to lack of physical verification taken place. this is fine. Online E-fd does send notification to apps and email for transaction made for FD placement, uplift or Duitnow, which is a good feature.however, it's the human element that's the weekest link. from counter staff to back-office staff to supervisor to branch manager... all human element with authorized access. usually banks doesn't do cross-platform security measures like simple notification. eg fd uplifted (ANY method), notify via email and sms. better still, bank call customer to notify and verify such action taken place, something like cc spending with unusual high amount or overseas spending. of course, there could be many cases happened to many banks, just swept under carpet or resolved silently with customer's NDA to protect bank reputation. for general customers, just be prudent and always check your bannking/financial accounts frequently. missing $$ is one matter, suddenly having extra $$ is also to be worried too. |

|

|

Feb 2 2025, 01:55 PM Feb 2 2025, 01:55 PM

Return to original view | Post

#9

|

Junior Member

170 posts Joined: Jun 2023 |

QUOTE(Human Nature @ Feb 2 2025, 12:21 PM) Placed some FD via FPX for the 3.88% rate today 2 Feb 2025 but mature date is on 3 Feb 2026, a Tuesday. Weird that it added 1 extra day for non-weekend mature date. 1 Feb is Federal Territory holiday which is on Sunday, replacement holiday on Monday 2 Feb, 3 Fed is the first working day. Some banks tune the FD maturity that always on working days but this is normally for OTC FD. Human Nature liked this post

|

| Change to: |  0.0661sec 0.0661sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 06:05 PM |