Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jan 9 2019, 08:44 PM Jan 9 2019, 08:44 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

29 posts Joined: May 2012 |

Brought a banker's cheque to Bank Islam today, but the staff told me they can produce the FD cert for me only after the cheque is cleared

|

|

|

|

|

|

Jan 26 2019, 03:33 PM Jan 26 2019, 03:33 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

29 posts Joined: May 2012 |

QUOTE(bbgoat @ Jan 25 2019, 08:42 PM) Today again took out from HL matured FD. Wow, what branch was that? Good service there.Took a BC from HL bank. Went to B Islam for 24 mth step up with effective rate of 4.65%. Only now found out that BI branch allow cheque and effective rate on the same day, instead of after cheque clearance. Last time asked, they say can only receive FD cert after cheque clearance and effective date after cheque clearance. Would have saved some trouble and saved few ringgit if used cheque instead of RENTAS in the fund for previous 2 FD placed in BI. I went to Bank Islam to place FD twice. First time using banker's cheque and they can only produce the FD cert after the cheque is cleared. So the second time I used RENTAS to transfer money into CA, and when I reached Bank Islam about an hour later, the officer told me the money is not fresh fund anymore Wonder do I need to argue with them that cheque is allowed to get FD with effective date on the same day at other branches if I still want to place FD there. This post has been edited by lawr0202: Jan 26 2019, 03:33 PM |

|

|

Jul 11 2019, 01:23 PM Jul 11 2019, 01:23 PM

Return to original view | Post

#3

|

Junior Member

29 posts Joined: May 2012 |

Bank Rakyat

3.98 for 7 months 4.28 for 11 months 15 Jul–15 Oct |

|

|

Jul 11 2019, 03:08 PM Jul 11 2019, 03:08 PM

Return to original view | Post

#4

|

Junior Member

29 posts Joined: May 2012 |

QUOTE(879098 @ Jul 11 2019, 02:54 PM) Any more information about this? Just went there thinking to nego rate for 2 years and the officer told me about this. So i just banked in banker’s cheque to savings and they will do the FD for me on 15. Not so sure if CASA is a requirement since I already have one.Cannot find in their website... Can share? To open FD, do they need CASA too? |

|

|

Nov 29 2020, 02:37 PM Nov 29 2020, 02:37 PM

Return to original view | Post

#5

|

Junior Member

29 posts Joined: May 2012 |

The CIMB branch manager told me 2.45% for 12 months is TIA

|

|

|

Oct 19 2022, 09:49 PM Oct 19 2022, 09:49 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

29 posts Joined: May 2012 |

Bank Islam revised rate for TDT Extra 6mth 4% 12mth 4.2% 18mth 4.4% BoomChaCha liked this post

|

|

|

|

|

|

Oct 19 2022, 10:27 PM Oct 19 2022, 10:27 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

29 posts Joined: May 2012 |

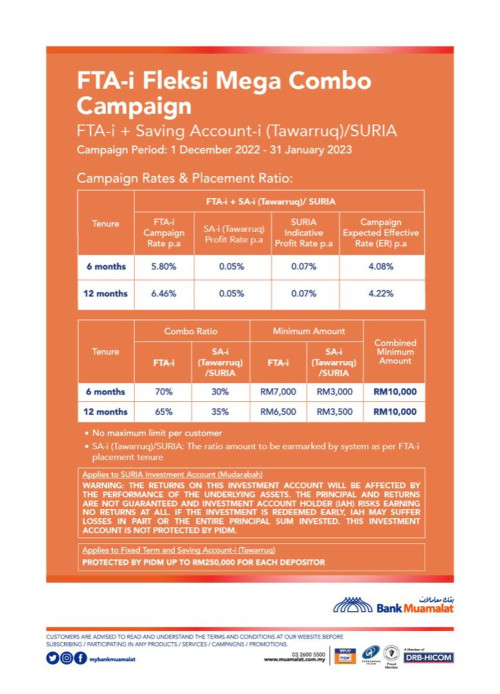

QUOTE(guy3288 @ Oct 19 2022, 10:09 PM) ini betul kah?? too good to be true This one is pure FDi am quite sure is some 70:30 thingy, the rates are referring to FD part only. Effective rates would be much lower. Please give full details rather than simply copy a part and not telling the other. The 70:30 one is MaxCash, revised rate is 5.7% if I rmb correctly, didn't ask in details for this |

|

|

Nov 23 2022, 02:20 PM Nov 23 2022, 02:20 PM

Return to original view | Post

#8

|

Junior Member

29 posts Joined: May 2012 |

Hi, anyone know how to uplift Muamalat online FD? Placed a few last year and matured today, but cannot find a way to do it online… Is there a way or need to go to branch

|

|

|

Dec 1 2022, 06:31 PM Dec 1 2022, 06:31 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

29 posts Joined: May 2012 |

|

|

|

Mar 11 2023, 05:08 AM Mar 11 2023, 05:08 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

29 posts Joined: May 2012 |

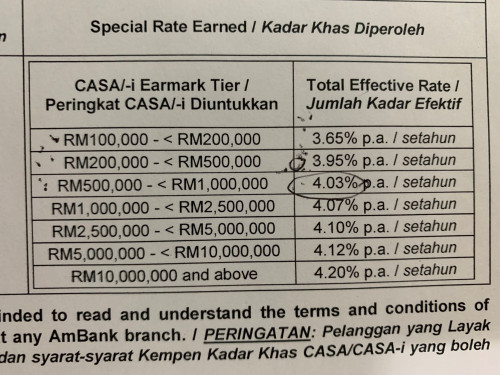

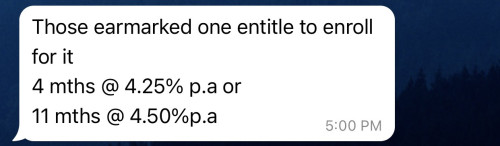

QUOTE(BoomChaCha @ Mar 10 2023, 10:29 PM) I want to say Thank You Very Much to Joeblow to introduce this FD product to us.. Am Bank 4.5% FD needs to place before 31 March 2023 (1) Min FD placement RM 50K (2) Parking RM 10K, can withdraw after FD placement (3) Need to put fund in CASA first before 31 March 2023. Will convert to 4.5% FD on 3rd of March. Can start to put in fund now. (4) Interest earned in CASA before 3 April 2023. Am Bank will adjust the rate according to fund amount (a) FD amount less than RM 200K ----> ?? (b) FD amount RM 200K or more ----> 3.95% © FD amount RM 500K or more ----> 4.03% (d) FD amount RM 1 Million or more ----> 4.07% (5) Need to visit Am Bank branch again on 3rd April to sign form. (6) Start to earn 4.5% FD interest from 3 April until 3 Feb 2024, total 11 months FD term (7) Joint FD account is allowed. Can use existing FD account. (8) No monthly interest Example: if put in RM 220K today until Feb 2024, effective rate is approximately 4.45%. Hope this helps  This is the interest rate for the earmarked amount in CASA and the first tier minimum amount has changed to 50k Actually this thing is quite complicated, you need to look at the total amount in your CASA on 31 January 2023, and on 31 March 2023, the amount (not including the earmarked) cannot be lower than that to be eligible for the FD BoomChaCha and CommodoreAmiga liked this post

|

|

|

Mar 11 2023, 01:02 PM Mar 11 2023, 01:02 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

29 posts Joined: May 2012 |

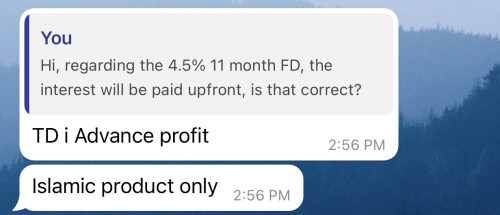

QUOTE(CommodoreAmiga @ Mar 11 2023, 08:32 AM) Max also 4.2% with CASA crap. Why not just go for pure FD 4.3%? What's the point of this?? 🤦 Next week will go do another 4.3%. Meanwhile, today I take back my RM10k which was needed to put there 1 day for the promotion. Again... pointless weird exercise... Well, overall you still get more interestAnd another interesting point, according to the branch manager the 11 month FD interest will be given upfront |

|

|

Mar 11 2023, 04:06 PM Mar 11 2023, 04:06 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

29 posts Joined: May 2012 |

QUOTE(CommodoreAmiga @ Mar 11 2023, 02:03 PM) How to get more interest rates? All the E.R are lower than 4.3% in the ad posted above. Unless I am missing something here. The amount you put into CASA will be earmarked and earn the shown rate until 2 April 2023 and after that on 3 April 2023 the same amount will be taken out and put into the 4.5% interest 11 month FD BoomChaCha and CommodoreAmiga liked this post

|

|

|

Mar 17 2023, 03:35 PM Mar 17 2023, 03:35 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

29 posts Joined: May 2012 |

QUOTE(BoomChaCha @ Mar 16 2023, 05:27 PM) Update: I just placed this FD, update some info here: (1) Parking is RM 10K in CASA, parking RM 10K's interest rate is only normal rate based on which CASA we put in. I put in True Saver, I anticipate my RM 10K parking can get 1.9% p.a. from True Saver. Parking RM 10K can only withdraw when we go to sign up the form in between 3 April to 7 April in order to switch the fund from saving to FD at 4.5%. If we go to sign up the form on 3 April, 4.5% FD will effective on 3 April; if we go to sign up the form on 4 April, 4.5% FD will effective on 4 April and etc. (2) AM Bank did not give me any black & white hard copy about this 4.5% FD info after I put in fund for this 4.5% FD plan. (3) I can notice from online banking that my fund + RM 10K parking are in my Treu saver now. (4) According to this 4.5% FD plan, my fund in True Saver (excluding RM 10K parking) is earning special saving rate (like below chart) from today until to the day I sign-up the form [attachmentid=11439745] (5) When I go to sign up the form in between 3 April to 7 April (of course the early the better), my FD fund will switch to 4.5% FD, and on the same day I can withdraw my parking RM 10K. My personal opinion, there are 3 disadvantages of this 4.5% plan: (1) RM 10K parking for earmark cannot earn special interest rate. (2) RM 10K parking can only withdraw when we sign-up form in between 3 April to 7 April. (3) No monthly interest Advantages of this 4.5% plan : (1) 4.5% vs 4.3% (2) 11 months In conclusion, if you have FD that will mature near to month end of March, then no need to hesitate to take this 4.5% rather than 4.3% from same Am Bank In overall, the return of 4.5% plan is only slightly better than 4.3% in my opinion.   According to the branch manager, if the FD put in this TD-i Advance Profit, then can get profit paid upfront BoomChaCha liked this post

|

|

|

|

|

|

Mar 17 2023, 11:35 PM Mar 17 2023, 11:35 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

29 posts Joined: May 2012 |

QUOTE(BoomChaCha @ Mar 17 2023, 09:40 PM) I heard before 31 March. It's the total balance of all your CASA on 31/1/23. You'll need to have the same or more than that amount (excluding the earmarked) on 31/3/23 to be eligible for the FD promotionIf place on 31 March? I do not know... Taiko Boss, Why your parking is only RM 1746.50 so little? My branch asked me to park RM 10K in saving. What is your RM 350..? Oh.. Note: the CASA 3.95% interest will only be paid end of April 23 --> Oh...I see Maybe your balance on 31/1/23 is 10k? |

|

|

Jun 10 2024, 11:01 AM Jun 10 2024, 11:01 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

29 posts Joined: May 2012 |

kplaw and Human Nature liked this post

|

|

|

Aug 14 2025, 10:42 AM Aug 14 2025, 10:42 AM

Return to original view | IPv6 | Post

#16

|

Junior Member

29 posts Joined: May 2012 |

|

| Change to: |  0.0648sec 0.0648sec

0.62 0.62

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 09:57 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote