A few precautions:

1. Your Bank phone don't go surf dodgy sites or use Facebook (my sister's phone just got hacked because she download some stuff from FB...supposely it's a menu, but actually a malware. They don't ask you to download app anymore. JUST DON'T USE FB TIKTOK or whatever crap socmed).

2. Do not use same id and password for bank accounts, all use different id and passwords.

3. Don't download any apps more than what's required. Don't play shit mobile games on it. Don't watch porn on it.

4. Install good paid internet security like BitDefender on your phone.

5. Have a dedicated dumb Nokia phone for your OTP SMS from banks. So even malware hack your main phone, they can't get the SMS as it's sent elsewhere.

6. Your main phone make sure has security software update and support. When the software support EOL, then change new phone with at least 4 years of security updates or more(which is what i did recently).

Of course it's not 100% foolproof, nothing is, but surely it makes everything just more secured and more difficult for bad actor.

I don't really bother about limits nowadays.

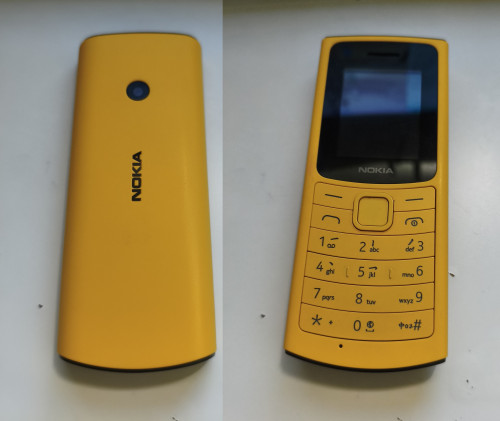

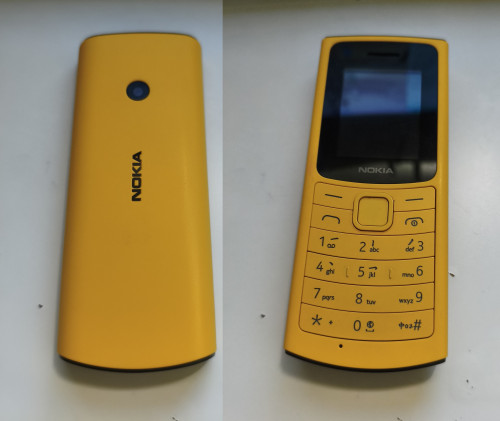

My Nokia 110....

Not really. I have just changed phone.

Maybank, RHB, Islamic Bank all need ATM to activate new device. HLB is crazy, although don't need ATM to activate, send SMS multiple times, then send email with PDF, then use code in PDF, then send SMS again.

CIMB is very unsecured, can straight login to new phone to remove your registered device. WTF.

i am more curious because nowadays most bank do not send out OTP anymore.. how you use the nokia phone for bank transaction..

Jun 28 2022, 11:53 AM

Jun 28 2022, 11:53 AM

Quote

Quote

0.0589sec

0.0589sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled