Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

Human Nature

|

May 4 2020, 11:28 AM May 4 2020, 11:28 AM

|

|

QUOTE(bbgoat @ May 4 2020, 10:50 AM) Received from OCBC RM Good Morning ☀️ *FD Promo Rate effective 4/5/2020 :* *6 Months FD* 🔸 3.10% p.a. 🔸 Minimum Placement RM10K *12 Months FD* 🔹 3.25% p.a - *FULL FRESH FUNDS* 🔹 3.20% p.a - *EXISTING FUNDS/ TOP UP* 🔹 Minimum Placement RM10K The above rates are available for both Conventional & Islamic FD. All promotion are subject to availability, will update if there is any changes on the rates. They don't want to wait for BNM to announce OPR  C'mon, Ambank.. retain the 3.50% too |

|

|

|

|

|

Human Nature

|

May 4 2020, 11:48 AM May 4 2020, 11:48 AM

|

|

QUOTE(GrumpyNooby @ May 4 2020, 11:29 AM) Back fron UOB: 3% pa for 36-months with yearly paid interest. I double confirmed with the staff with the tenure. This one is tricky and hard to read. Could this be a signal that OPR will continue to be very low in 2-3 years or gasp, more. |

|

|

|

|

|

Human Nature

|

May 5 2020, 03:16 PM May 5 2020, 03:16 PM

|

|

Somewhat expected, doesn't look like BNM has any other strategy

|

|

|

|

|

|

Human Nature

|

May 5 2020, 06:09 PM May 5 2020, 06:09 PM

|

|

'New norm'

No big FD maturing this month. Next month will start to feel heart pain when need to renew

|

|

|

|

|

|

Human Nature

|

May 6 2020, 10:29 PM May 6 2020, 10:29 PM

|

|

QUOTE(faradie @ May 6 2020, 09:19 PM) Since 7 July 2019 BNM has reduced the OPR by 1.25%. The effect of this will 1. Devalue our weak Ringgit further making imports more expensive and risking higher inflation 2. Punish pensioners further who have seen FD rates fall from 4% to probably 2.5%. Notice the FD rates fall more than the OPR Economists world wide will tell you that lowering interest rates can never lift an economy from recession/depression. What is needed is a change in mental attitude from doom and gloom to brightness and this will come when a vaccine for covid 19 is found. Meanwhile BN pls stop following the herd in lowering int rates. Reducing corruption and increasing accountability are goals that would lift our economy more than these ineffective measures I agree with you. Still following the ancient way of managing economy. |

|

|

|

|

|

Human Nature

|

May 6 2020, 10:50 PM May 6 2020, 10:50 PM

|

|

QUOTE(!@#$%^ @ May 6 2020, 10:43 PM) what's the modern way that is applicable? any examples of countries to follow? That is for them to devise a new strategy  |

|

|

|

|

|

Human Nature

|

May 7 2020, 04:50 PM May 7 2020, 04:50 PM

|

|

Apart from BR, any other option for an 'okay' long term FD rate, say for 2-3 years? 1% is unthinkable  |

|

|

|

|

|

Human Nature

|

May 14 2020, 04:44 PM May 14 2020, 04:44 PM

|

|

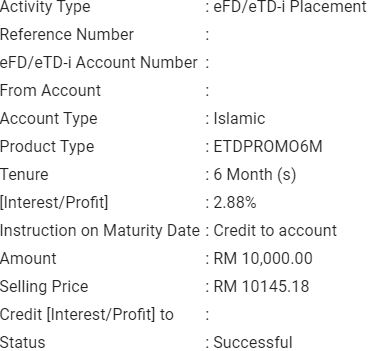

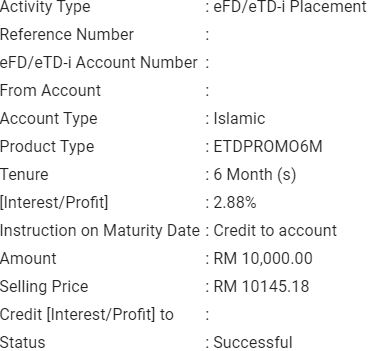

QUOTE(GrumpyNooby @ May 14 2020, 04:32 PM) I just placed RM 10k. No problem.  This is what you call dedication. Placed an FD just help troubleshoot a problem. All banks CS, please learn. |

|

|

|

|

|

Human Nature

|

May 16 2020, 08:18 PM May 16 2020, 08:18 PM

|

|

QUOTE(babyscouts @ May 16 2020, 07:57 PM) Good evening May I know which bank still provide fd slip Tq in advance BR, UOB, OCBC over the counter too |

|

|

|

|

|

Human Nature

|

May 16 2020, 08:47 PM May 16 2020, 08:47 PM

|

|

QUOTE(GrumpyNooby @ May 16 2020, 08:19 PM) The UOB OTC that I made is just an acknowledgement slip. It is not proper FD certificate like Public Bank. How's about your experience? Yeah, just the slip  |

|

|

|

|

|

Human Nature

|

May 16 2020, 09:02 PM May 16 2020, 09:02 PM

|

|

QUOTE(GrumpyNooby @ May 16 2020, 08:50 PM) Certain place that accepts FD as secured or guaranteed deposit/money cannot accept acknowledgement slip right?  Hmm, no experience on this. As long as have something printed I am okay. Later will print out all the online FDs that I have placed during MCO, more so when the CASA is not joint account. At least if something happen to me, my family will know got money somewhere in the virtual world  |

|

|

|

|

|

Human Nature

|

May 19 2020, 07:01 PM May 19 2020, 07:01 PM

|

|

I would like to confirm on one thing regarding the concluded 3.5% FD promotion with Ambank, 6m and 12m (online/otc).

When you make placement, do you already have RM10,000 min in your CASA?

Example,

If you bring in a fresh fund of RM30,000 and you have ZERO amount in CASA, were you able to place the whole RM30,000 or you need to leave RM10,000 in CASA?

The critical point here is, whether you already have RM10,000 min beforehand in CASA or not.

Thanks

This post has been edited by Human Nature: May 19 2020, 07:24 PM

|

|

|

|

|

|

Human Nature

|

May 19 2020, 09:06 PM May 19 2020, 09:06 PM

|

|

QUOTE(cclim2011 @ May 19 2020, 08:37 PM) no. few tens or hundreds in casa before transfer in fund from other banks. mostly from ocbc 360, sometime 15k, sometime 30k. can put all funds in fd 3.5%. Okay thanks. I complaint about the requirement to leave RM10k in CASA and today customer service told me that actually need to have RM10K in CASA beforehand to be eligible  This post has been edited by Human Nature: May 19 2020, 09:08 PM This post has been edited by Human Nature: May 19 2020, 09:08 PM |

|

|

|

|

|

Human Nature

|

May 19 2020, 09:34 PM May 19 2020, 09:34 PM

|

|

QUOTE(cclim2011 @ May 19 2020, 09:22 PM) meaning will not get 3.5% if no 10k in casa when placement made? Means if no 10k in CASA initially, not eligible for that promo. So need to leave 10k in CASA. We all know that is a lie. |

|

|

|

|

|

Human Nature

|

May 19 2020, 11:02 PM May 19 2020, 11:02 PM

|

|

QUOTE(cclim2011 @ May 19 2020, 10:25 PM) erm not too sure if later after 6m or 12m they didnt want to give the extra 1%? i didnt read the term and condition when placing the fd. Dont worry, nothing about that  |

|

|

|

|

|

Human Nature

|

May 19 2020, 11:43 PM May 19 2020, 11:43 PM

|

|

QUOTE(siawyent @ May 19 2020, 11:29 PM) I thought the 3.5% Ambank offer has expired? still have? Had expired. I am just following up on a complaint to the bank |

|

|

|

|

|

Human Nature

|

May 20 2020, 01:14 PM May 20 2020, 01:14 PM

|

|

Which of you wrote this?  https://www.thestar.com.my/opinion/letters/...-need-rate-hike https://www.thestar.com.my/opinion/letters/...-need-rate-hike» Click to show Spoiler - click again to hide... « THE current turbulent climate necessitates Prime Minister Tan Sri Muhyiddin Yassin to urgently demand an increase in fixed deposit interest rate for elderly savers with deposits of RM500,000 and below. Without this, our elderly middle class will shrink into poverty as insurance premiums skyrocket.

Escalating inflation has rendered RM500,000 savings small today! A budget of RM2,500 monthly or RM30,000 annually is merely adequate for an elderly person to cover costs of food, house, utility, maintenance, healthcare, communication, transport and some domestic help. They need about 6% return on a principle of RM500,000 to yield RM30,000 annually.

Retiring at 60 means we can expect to live another 20 years or more. Many elders live on the annual bank interest alone, yet our country’s depositor interest rate for senior small savers has been allowed to descend from a weak 3% to 2%, and is projected to spiral down to negative next year. Meanwhile, inflation has swelled to over 2% this year.

The burden of low deposit interest rate falls most heavily on Malaysia’s middle-class elderly who have neither the opportunity nor sophistication to make funds grow without incurring high risks. Their savings of RM500,000 or less are considered too meagre to be accepted into the higher yielding bank deposit accounts. Currently, our banking system pays higher earnings to large savers to retain their patronage, like regressive tax that enriches the already wealthy in our society.

We need greater humanistic capitalism that promotes fair saving interest rates for citizens aged 60 and above. No elder wishes to be a drain on the resources of their children when unemployment is high amid more job cuts due to global recession and the Covid-19 pandemic. The truth is many elderly citizens are still financially supporting their jobless adult children.

Low interest rates also affect insurance companies that rely on greater interest return on their premiums to support coverage liabilities. Insurance companies compensate for this diminishing margin by charging our vulnerable elders much higher premiums for coverage at a time when they need healthcare the most.

Bank Negara Malaysia holds responsibility for the safety and soundness of the quality of life of our society and needs to re-evaluate the rising risk of lowering savings interest rates for far too long. Slashing the overnight policy rate twice this year to 2.5% has made it the lowest since 2010. Bank Negara’s Monetary Policy Committee can motion to issue savings certificates indexed against inflation for senior savers. It is definitely possible for senior citizens to invest in Treasury Bills where our government guarantees the principle with a fixed higher return, so there is no risk unless our government goes down.

In an orderly fashion that will not cause painful disruptions to existing maturing loans in the savings and loans industry, controlled conditions for higher-yield savings (HYS) can be put in place:

1) HYS is solely reserved for senior citizens aged 60 and above;

2) HYS is for long-term certificates of minimum one-year tenure; and

3) HYS is eligible for maximum savings of RM500,000.

It’s time our Prime Minister pushes for higher yield interest for Malaysia’s elderly small savers as part of our nation’s social safety net.

NIKOLE MIKHAEL ABDULLAH

Founder, terangi.org

(Society that advocates for the well-being and productivity of seniors aged 50 and above) This post has been edited by Human Nature: May 20 2020, 01:15 PM |

|

|

|

|

|

Human Nature

|

May 26 2020, 07:56 PM May 26 2020, 07:56 PM

|

|

For maturing FD in UOB, placed OTC, can we withdraw it online? If yes, can it be withdrawn on the same day as maturity date, without penalty?

|

|

|

|

|

|

Human Nature

|

May 26 2020, 10:15 PM May 26 2020, 10:15 PM

|

|

Thanks for all the replies. Just realized that still need to go UOB this week to withdraw cash OTC to avoid CASA being dormant.

June will be a heartache month as few FD maturing. Will divert a bulk of them into BR as their 2.75% 12m is the best bet for now.

|

|

|

|

|

|

Human Nature

|

May 27 2020, 12:20 PM May 27 2020, 12:20 PM

|

|

QUOTE(peach_on_tea @ May 27 2020, 10:30 AM) Their BR now isn’t revised to 2% for 12m now? 2.75% https://www.irakyat.com.my/index.php/person...posit-i-accountQUOTE(babysotong @ May 27 2020, 11:04 AM) Actually, no need to go to the branch. Withdrawal online when mature or set instruction to credit Casa upon maturity. Then, transfer out using IBG or DuitNow. Savings account will not considered as dormant as long as there is a credit to the account - you will achieve this when FD amount is transferred to your Casa. If want to be sure, just transfer rm1 from other bank account to this UOB Casa. This will avoid u to travel all the way to the branch during MCO or CMCO period. I don't think so ler. There needs to be an OTC transaction. Refer here for Maybank https://www.maybank2u.com.my/WebBank/DormantAccount-FAQ.pdf4. How do I prevent my account from turning dormant? The simplest way is to ensure that there are some transactions being made in your account i.e to withdraw or deposit some money over the counter, even if it is a small amount. |

|

|

|

|

May 4 2020, 11:28 AM

May 4 2020, 11:28 AM

Quote

Quote

0.0514sec

0.0514sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled