QUOTE(azbro @ Nov 2 2016, 09:22 AM)

Funny this thread

1) When you give IC to check you didn't cross it?

2) Ppl saying that they got to know that they are CTOSed blacklisted when they tried to apply loan

3) But advice not to register to CTOS because they will know your data, of course they know your data, if not how company knows from CTOS you are blacklisted?

4) Now you really dunno if you are OK or not because you never join CTOS but get blacklisted from it, but blame CTOS

Now become checkmate for the person.

Wanna register CTOS, /k advice not to, but how to check if blacklist or not? Because other ppl know we are blacklist without even us knowing.

So, OK, cleared one blacklist, but is it still blacklist? or got other issue somewhere else? Probably another blacklist?

So better than blame CTOS for providing and getting your latest up to date info, better blame the financial, Telco, employer whatever for using CTOS to check you without even you knowing you have that kind of information available to them

bro, have you take your morning coffee yet?1) When you give IC to check you didn't cross it?

2) Ppl saying that they got to know that they are CTOSed blacklisted when they tried to apply loan

3) But advice not to register to CTOS because they will know your data, of course they know your data, if not how company knows from CTOS you are blacklisted?

4) Now you really dunno if you are OK or not because you never join CTOS but get blacklisted from it, but blame CTOS

Now become checkmate for the person.

Wanna register CTOS, /k advice not to, but how to check if blacklist or not? Because other ppl know we are blacklist without even us knowing.

So, OK, cleared one blacklist, but is it still blacklist? or got other issue somewhere else? Probably another blacklist?

So better than blame CTOS for providing and getting your latest up to date info, better blame the financial, Telco, employer whatever for using CTOS to check you without even you knowing you have that kind of information available to them

in order for you to register with CTOS, you need to send them copy of mykad front and back

https://www.google.com/url?sa=t&rct=j&q=&es...a8QFUS0NIeNiAXA

if you go register at their office they will ask for your IC and scan it. NO CROSS BRO.

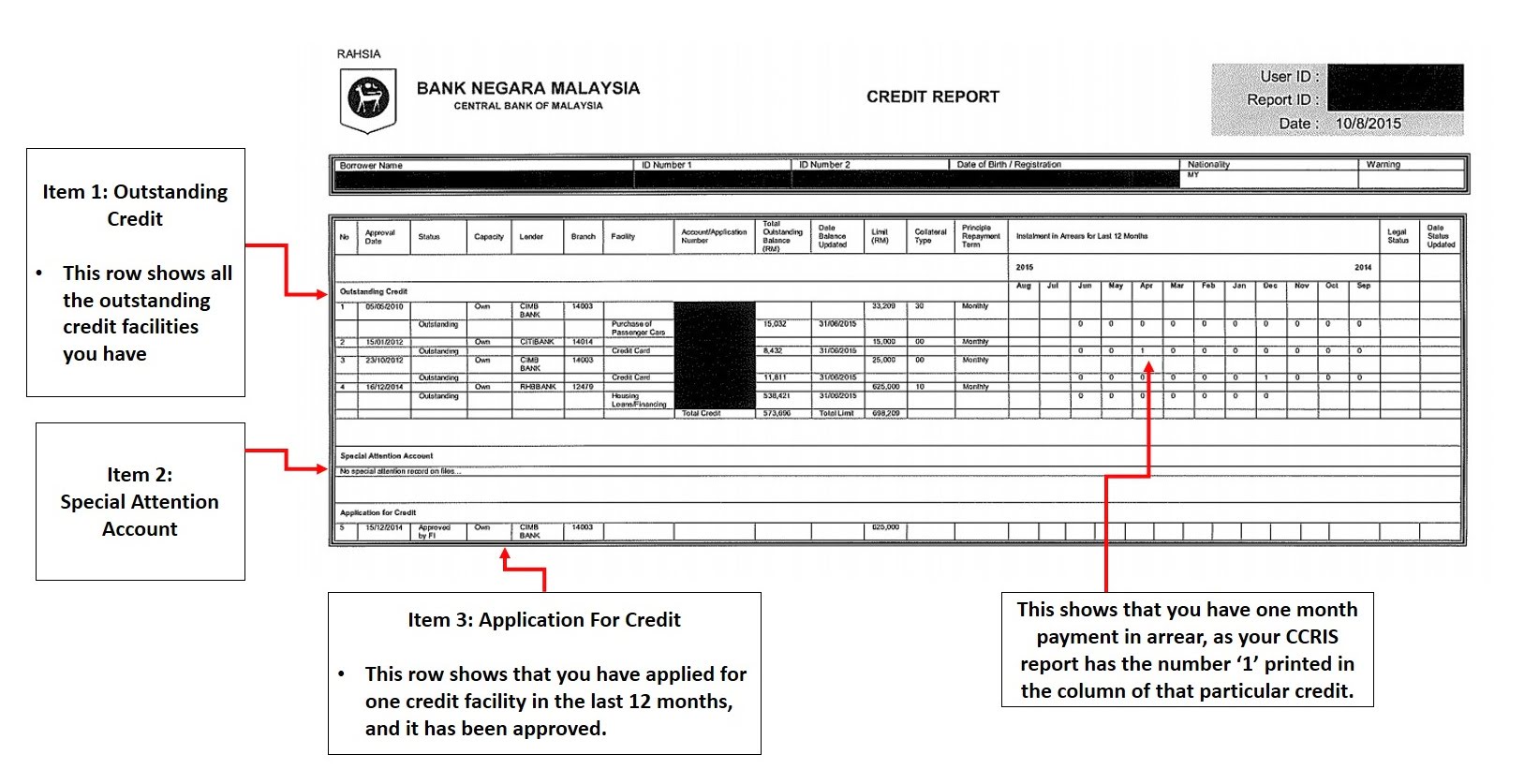

of course you can check your credit standings with CCRIS Bank Negara.

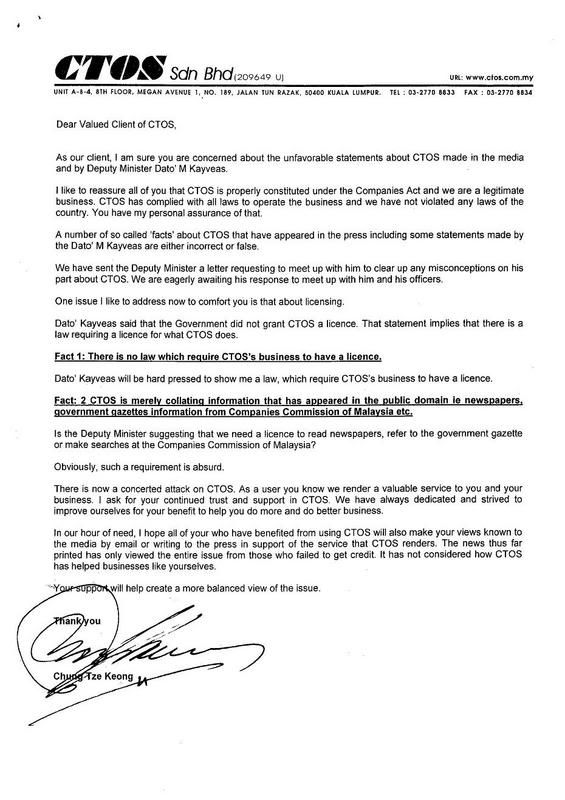

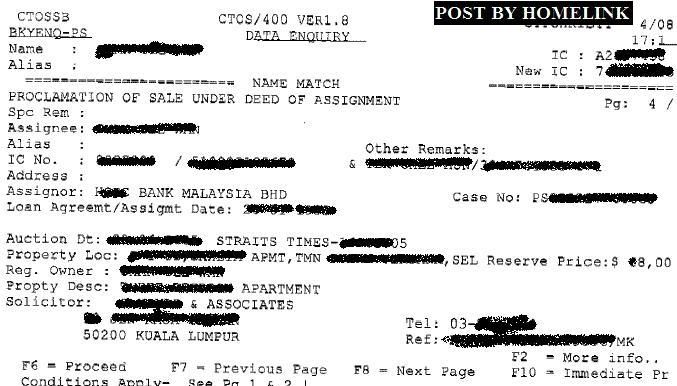

the issue here right now, who give permission for 3rd party company like CTOS Data Systems Sdn Bhd to collect our sensitive details?

do you know what they can do with your details?

Nov 2 2016, 09:29 AM

Nov 2 2016, 09:29 AM

Quote

Quote

0.0213sec

0.0213sec

0.77

0.77

5 queries

5 queries

GZIP Disabled

GZIP Disabled