QUOTE(sjz @ Jan 21 2021, 12:24 PM)

The mechanism is rather similar to SC JOP.You need to hit min spending amount to trigger the higher tier cash back rate.

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

|

Jan 21 2021, 12:25 PM Jan 21 2021, 12:25 PM

Return to original view | Post

#621

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jan 21 2021, 12:29 PM Jan 21 2021, 12:29 PM

Return to original view | Post

#622

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 21 2021, 12:38 PM Jan 21 2021, 12:38 PM

Return to original view | Post

#623

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gonzapod @ Jan 21 2021, 12:36 PM) hi all, i plan to change LFC card to JOP. any idea what is the best way to apply to be entitled for some sign-up offer? seems a lot of website dont really offer existing standard charterted card holders. I believe you have the answer.Even the banks won't give anything to existing cardholders. |

|

|

Jan 21 2021, 01:24 PM Jan 21 2021, 01:24 PM

Return to original view | Post

#624

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 21 2021, 01:43 PM Jan 21 2021, 01:43 PM

Return to original view | Post

#625

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 23 2021, 02:46 PM Jan 23 2021, 02:46 PM

Return to original view | IPv6 | Post

#626

|

All Stars

12,387 posts Joined: Feb 2020 |

Revision to the Consolidated Credit Card Terms (“Terms”) effective 25 January 2021

Kindly be informed of the following additions to the Consolidated Credit Card Terms effective 25th January 2021 There is an addition of a new clause in the Terms as seen below. 24: Excess Funds Transfer Service 24.1 The excess funds transfer service is a service where we may transfer excess funds in any of your credit card account or PLC account to pay off to your other credit card account or related PLC account. 24.2 You need not apply for the excess funds transfer service. However, you can instruct us not to provide this service to you at any time. 24.3 There is no fees chargeable for this service. 24.4 Use of the excess funds transfer service is subject to the following: ▪ all your accounts with us have been conducted well, without any breach; ▪ there is an outstanding amount due and payable under the related PLC account or any of your credit card account; and ▪ none of the reasons for termination by us set out in the Client Terms has arisen. Other Terms remain unchanged. Please visit our Retail and Commercial Terms and Conditions page here for the full Terms and Conditions. If you have any questions on the revised Terms, please speak to our branch personnel or email us at Malaysia.Feedback@sc.com. Announcement link: https://av.sc.com/my/content/docs/my-revisi...-card-terms.pdf |

|

|

|

|

|

Jan 23 2021, 08:35 PM Jan 23 2021, 08:35 PM

Return to original view | IPv6 | Post

#627

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 24 2021, 11:41 AM Jan 24 2021, 11:41 AM

Return to original view | IPv6 | Post

#628

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 24 2021, 02:40 PM Jan 24 2021, 02:40 PM

Return to original view | IPv6 | Post

#629

|

All Stars

12,387 posts Joined: Feb 2020 |

Tronoh liked this post

|

|

|

Jan 24 2021, 09:16 PM Jan 24 2021, 09:16 PM

Return to original view | IPv6 | Post

#630

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Tronoh @ Jan 24 2021, 09:15 PM) if anyone wants to use smart card to pay for Netflix and Spotify, note that there's a 1% fee. 14.90 -> 15.05 for Spotify. Is it the same for JOP or Liverpool card? If that 1% extra is cross border charge, then all credit card from SC will have it and won't limited to Smart card only. |

|

|

Jan 25 2021, 04:22 PM Jan 25 2021, 04:22 PM

Return to original view | IPv6 | Post

#631

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(enterthefatdragon @ Jan 25 2021, 04:17 PM) https://shopee.com.my/m/22-standard-charter...tt=3.10177574.3 |

|

|

Jan 26 2021, 10:03 PM Jan 26 2021, 10:03 PM

Return to original view | IPv6 | Post

#632

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(prescott2006 @ Jan 26 2021, 09:45 PM) Means the sms is not important? Cash back is determined when we spent? It doesn’t matter is we click the link or not? The prize has been predefined once the link is generated and sent out.Impossible. All transactions are the same, which is into Boost. So, it won't matter if you did receive the SMS, clicked it or even played the claw game. prescott2006 liked this post

|

|

|

Jan 28 2021, 09:29 AM Jan 28 2021, 09:29 AM

Return to original view | IPv6 | Post

#633

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tencentliverstar @ Jan 28 2021, 09:23 AM) Petrol station can use credit card to top up touch n Go card? Because I go some petrona station, they say only accept cash to top up TnG card Refer to this thread:https://forum.lowyat.net/topic/3757650/+4620#entry99578124 |

|

|

|

|

|

Jan 28 2021, 04:51 PM Jan 28 2021, 04:51 PM

Return to original view | IPv6 | Post

#634

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 30 2021, 01:28 PM Jan 30 2021, 01:28 PM

Return to original view | IPv6 | Post

#635

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(june1522 @ Jan 30 2021, 01:27 PM) Do I understand correctly, to max Rm60 rebate, I need to Yes, as insurance is not under exclusion.1. Max insurance spent is Rm133 to get Rm20 2. Max online spent is Rm133 to get Rm20 3. Max petrol spent is Rm133 to get Rm20 4. Others spent Rm2102 which give Rm0 rebate For “others”, can I use to pay my insurance?  This post has been edited by GrumpyNooby: Jan 30 2021, 01:29 PM |

|

|

Jan 30 2021, 01:51 PM Jan 30 2021, 01:51 PM

Return to original view | IPv6 | Post

#636

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 30 2021, 04:17 PM Jan 30 2021, 04:17 PM

Return to original view | IPv6 | Post

#637

|

All Stars

12,387 posts Joined: Feb 2020 |

Boost & Touch ‘n Go eWallet COF Mastercard Campaign (1 Feb 2021 – 31 July 2021) Campaign 1. The Standard Chartered Bank Malaysia Berhad ("the Bank") Boost & Touch ‘n’ Go eWallet COF Mastercard Campaign (“Campaign”) commences on 1 February 2021 and ends on 31 July 2021, inclusive of both dates ("Campaign Period"). Eligibility (“Eligible Cardholders/participants”) 4. This Campaign is open to credit cardholders of any Mastercard credit card (other than corporate cards) issued by the Bank (“SCBMB Card”)who have maintained all their accounts with the Bank in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. 5. Only cardholders who have no transactions at Boost or Touch ‘n Go e-wallets on any Standard Chartered credit card (Visa or Mastercard) during the period of 1 August 2020 to 31 January 2021 are eligible to participate in this Campaign. Participation 8. To participate in the Campaign, Eligible Cardholders are required to top up a cumulative amount of RM100 per calendar month on either of the selected e-Wallets as specified in Clause 9 (“Minimum Spend Criteria”) within the Campaign Period using their SCBMB Card. Rewards 13. At the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in either eligible e-wallet will be selected as winners in sequential order from the first Eligible Cardholders who meet the required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 1000 winners per month. 14. The 1000 monthly winners will receive RM10 cashback per month or up to RM30 cashback for the entire Campaign. 15. In addition, at the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in both e-wallets will be selected as bonus winners in sequential order from the first Eligible Cardholders who meet required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 500 winners per month. 16. The 500 monthly bonus winners will receive RM5 cashback per month or up to RM15 cashback for the entire Campaign. 17. Eligible Cardholders can receive a maximum of RM45 cashback for the entire campaign. Campaign T&C: https://av.sc.com/my/content/docs/my-cof-campaign-mc-tc.pdf This post has been edited by GrumpyNooby: Jan 30 2021, 04:59 PM alandhw and thecurious liked this post

|

|

|

Jan 30 2021, 04:59 PM Jan 30 2021, 04:59 PM

Return to original view | IPv6 | Post

#638

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(GrumpyNooby @ Jan 30 2021, 04:17 PM) Boost & Touch ‘n Go eWallet COF Mastercard Campaign (1 Feb 2021 – 31 July 2021) Similar event for Visa:Campaign 1. The Standard Chartered Bank Malaysia Berhad ("the Bank") Boost & Touch ‘n’ Go eWallet COF Mastercard Campaign (“Campaign”) commences on 1 February 2021 and ends on 31 July 2021, inclusive of both dates ("Campaign Period"). Eligibility (“Eligible Cardholders/participants”) 4. This Campaign is open to credit cardholders of any Mastercard credit card (other than corporate cards) issued by the Bank (“SCBMB Card”)who have maintained all their accounts with the Bank in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. 5. Only cardholders who have no transactions at Boost or Touch ‘n Go e-wallets on any Standard Chartered credit card (Visa or Mastercard) during the period of 1 August 2020 to 31 January 2021 are eligible to participate in this Campaign. Rewards 13. At the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in either eligible e-wallet will be selected as winners in sequential order from the first Eligible Cardholders who meet the required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 1000 winners per month. 14. The 1000 monthly winners will receive RM10 cashback per month or up to RM30 cashback for the entire Campaign. 15. In addition, at the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in both e-wallets will be selected as bonus winners in sequential order from the first Eligible Cardholders who meet required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 500 winners per month. 16. The 500 monthly bonus winners will receive RM5 cashback per month or up to RM15 cashback for the entire Campaign. 17. Eligible Cardholders can receive a maximum of RM45 cashback for the entire campaign. Campaign T&C: https://av.sc.com/my/content/docs/my-cof-campaign-mc-tc.pdf Boost & Touch ‘n Go eWallet COF Visa Campaign (1 Feb 2021 – 31 July 2021) Campaign 1. The Standard Chartered Bank Malaysia Berhad ("the Bank") Boost & Touch ‘n’ Go eWallet COF Visa Campaign (“Campaign”) commences on 1 February 2021 and ends on 31 July 2021, inclusive of both dates ("Campaign Period"). Eligibility (“Eligible Cardholders/participants”) 4. This Campaign is open to credit cardholders of any Visa credit card (other than corporate cards) issued by the Bank (“SCBMB Card”) who have maintained all their accounts with the Bank in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. 5. Only cardholders who have no transactions at Boost or Touch ‘n Go e-wallets on any Standard Chartered credit card (Visa or Mastercard) during the period of 1 August 2020 to 31 January 2021 are eligible to participate in this Campaign. Participation 8. To participate in the Campaign, Eligible Cardholders are required to top up a cumulative amount of RM100 per calendar month on either of the selected e-Wallets as specified in Clause 9 (“Minimum Spend Criteria”) within the Campaign Period using their SCBMB Card. Rewards 13. At the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in either eligible e-wallet will be selected as winners in sequential order from the first Eligible Cardholders who meet the required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 1000 winners per month. 14. The 1000 monthly winners will receive RM10 cashback per month or up to RM30 cashback for the entire Campaign. 15. In addition, at the end of each Campaign Month during the Campaign Period, Eligible Cardholders who meet the Minimum Spend Criteria in both e-wallets will be selected as bonus winners in sequential order from the first Eligible Cardholders who meet required e-Wallet Top Up amount per month as specified in Clause 8 until it reaches the maximum capping of 500 winners per month. 16. The 500 monthly bonus winners will receive RM5 cashback per month or up to RM15 cashback for the entire Campaign. 17. Eligible Cardholders can receive a maximum of RM45 cashback for the entire campaign. Campaign T&C: https://av.sc.com/my/content/docs/my-cof-ca...gn-visa-tnc.pdf |

|

|

Jan 31 2021, 12:09 AM Jan 31 2021, 12:09 AM

Return to original view | IPv6 | Post

#639

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(hoys88 @ Jan 31 2021, 12:09 AM) I just received my new SC LFC card and the cashback revised to 1%. I forgot the cashback range, so in order to get 50 cash back this month, I should spend 2500 or 2667? Before revision, it's RM 2000.TIA  This post has been edited by GrumpyNooby: Jan 31 2021, 12:17 AM hoys88 liked this post

|

|

|

Jan 31 2021, 04:00 PM Jan 31 2021, 04:00 PM

Return to original view | IPv6 | Post

#640

|

All Stars

12,387 posts Joined: Feb 2020 |

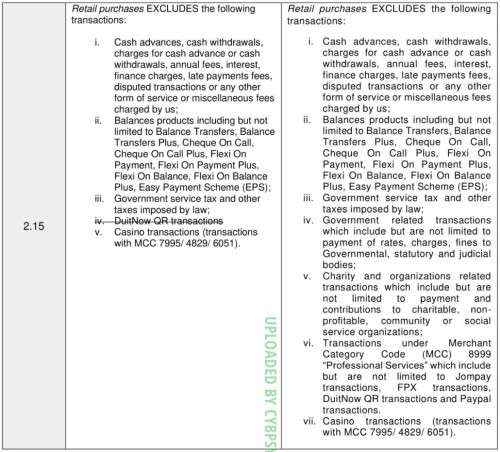

QUOTE(Human Nature @ Jan 31 2021, 03:56 PM) ^ actually why the CB table above for LFC is not shown at the card page itself? Couldn't find it anywhere there. Because new revision takes effect tomorrow with 1% cash back and no more tiered range spending.https://www.sc.com/my/credit-cards/liverpool-fc-cashback/ QUOTE(GrumpyNooby @ Jan 7 2021, 06:09 PM) The day has come for JOP: This post has been edited by GrumpyNooby: Jan 31 2021, 04:06 PMRevision to the Consolidated Credit Card Terms (“Terms”) effective 1 February 2021 Kindly be informed of the following revisions to the Consolidated Credit Card Terms effective 1st February 2021: 1. For JustOne Platinum Mastercard credit card: a) Autobill payments, online purchases and petrol cashback is capped at RM20 each[b], subject to the cashback cap in each spend tier. b) Transactions for Government, Charity and Professional Services (including but not limited to JomPAY, FPX and PayPal) categories will be excluded from Retail Purchases and will not earn cashback. -> Similar to LFC 2. For [b]Liverpool FC Cashback credit card: You will earn 1% Cashback per month on your Retail Purchases (excluding petrol and insurance transactions), subject to a cap of RM 50 per month. -> Almost similar to Maybank FCB VS Other Terms remain unchanged. Please visit our Retail and Commercial Terms and Conditions page here for the full Terms and Conditions. If you have any questions on the revised Terms, please speak to our branch personnel or email us at Malaysia.Feedback@sc.com https://av.sc.com/my/content/docs/my-revisi...-card-terms.pdf |

| Change to: |  0.0508sec 0.0508sec

1.30 1.30

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 09:59 AM |