QUOTE(tan_aniki @ Nov 19 2020, 12:50 PM)

wow, I learnt sth new today. Didnt know annual fee can be pro rated. Thank you !Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

|

Nov 19 2020, 02:20 PM Nov 19 2020, 02:20 PM

Return to original view | Post

#21

|

Junior Member

149 posts Joined: May 2017 |

|

|

|

|

|

|

Dec 2 2020, 10:31 AM Dec 2 2020, 10:31 AM

Return to original view | Post

#22

|

Junior Member

149 posts Joined: May 2017 |

My card anniversary month is Nov. Got charged SST in Oct and till now annual fee still not posted. Usually when will annual fee be charged?

|

|

|

Dec 2 2020, 11:36 AM Dec 2 2020, 11:36 AM

Return to original view | Post

#23

|

Junior Member

149 posts Joined: May 2017 |

|

|

|

Jan 15 2021, 09:57 AM Jan 15 2021, 09:57 AM

Return to original view | Post

#24

|

Junior Member

149 posts Joined: May 2017 |

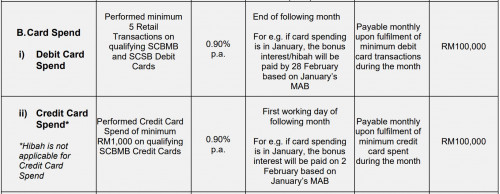

QUOTE(GrumpyNooby @ Jan 14 2021, 10:28 PM) Only 5 transactions with no min spending mentioned: Bonus Hibah is not applicable for credit card spend - does that mean those with Islamic account is not entitled for the 0.9% credit card spend bonus. My account is super salary-i, bank told me same as PSA. PSA thread: https://forum.lowyat.net/topic/4892672/+1080#entry99625873 k2017 liked this post

|

|

|

Jan 15 2021, 10:04 AM Jan 15 2021, 10:04 AM

Return to original view | Post

#25

|

Junior Member

149 posts Joined: May 2017 |

|

|

|

Feb 8 2021, 10:50 AM Feb 8 2021, 10:50 AM

Return to original view | Post

#26

|

Junior Member

149 posts Joined: May 2017 |

For the WFH campaign, is there a maximum number of cash back that one can win each day?

|

|

|

|

|

|

Feb 8 2021, 11:17 AM Feb 8 2021, 11:17 AM

Return to original view | Post

#27

|

Junior Member

149 posts Joined: May 2017 |

QUOTE(MGM @ Feb 8 2021, 10:51 AM) QUOTE(GrumpyNooby @ Feb 8 2021, 10:52 AM) Thanks for the replies ! Ya I remember past campaigns also had limit of 2 wins per day but just now couldnt find it in TnC, maybe I have overlooked. Just won 2 cashback this morning, I shall then only try again tomorrow. |

|

|

Feb 10 2021, 10:03 AM Feb 10 2021, 10:03 AM

Return to original view | Post

#28

|

Junior Member

149 posts Joined: May 2017 |

|

|

|

Apr 16 2021, 10:15 AM Apr 16 2021, 10:15 AM

Return to original view | Post

#29

|

Junior Member

149 posts Joined: May 2017 |

SCB rejected my request to increase credit limit. My current credit limit is only RM13,500

Anyone can advise some tips for successful credit limit increase? |

|

|

Apr 16 2021, 11:46 AM Apr 16 2021, 11:46 AM

Return to original view | IPv6 | Post

#30

|

Junior Member

149 posts Joined: May 2017 |

QUOTE(wjleong15 @ Apr 16 2021, 10:25 AM) I applied they reject but later receive sms offer increase then I reply I got it So my thought is wait the sms to offer increase cl QUOTE(avinlim @ Apr 16 2021, 10:47 AM) QUOTE(CPURanger @ Apr 16 2021, 10:59 AM) I didn't make any request increase limit but receive sms offer recently, almost double the limit I request through live chat at first, submitted all documents and 2 days later received sms offer. So I replied the sms to accept and today received sms saying request not successful I do pay on time (bill balance) and never use flexipay. Yes, I pay my monthly credit card bill on time and never missed any payment. CS asked me to try after 6 months. |

|

|

Apr 16 2021, 01:53 PM Apr 16 2021, 01:53 PM

Return to original view | IPv6 | Post

#31

|

Junior Member

149 posts Joined: May 2017 |

QUOTE(jhleo1 @ Apr 16 2021, 11:54 AM) Another option. Try to call the card, retention officer may call you up to ask reason and told them. Usually easy to increase credit limit unless you got so much commitment then that will become another story. lol, i thought of this trick too. But worry if they really proceed to cancel without getting retention team to call me. Anyway, thanks for your suggestion jhleo1 liked this post

|

|

|

Apr 16 2021, 01:59 PM Apr 16 2021, 01:59 PM

Return to original view | IPv6 | Post

#32

|

Junior Member

149 posts Joined: May 2017 |

QUOTE(avinlim @ Apr 16 2021, 12:55 PM) There are few reasons that may affect the results. Only my speculation and suggestion la. hmm, some of your reasons are applicable to me 1. May be bank deems your salary increment over 5 years not big enough. 2. You have many credit application record over short period. 3. total CL on other banks hit ceiling. what you can do (what I did was) prior to apply again, I open saving account with the bank and pledge 10-20k into the saving account of that bank. I did that for my ocbc and pbb both successful on second time application after I have saving inside bank account. haha...just my experience la.... I already have a saving account with them and it is not a small sum of money somemore. Guess I can only try again after 6 months. |

| Change to: |  0.4187sec 0.4187sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:39 AM |