Outline ·

[ Standard ] ·

Linear+

Credit Cards Maybank Visa Signature + Barcelona Visa Signature

|

Eurobeater

|

Dec 3 2019, 08:25 PM Dec 3 2019, 08:25 PM

|

|

Hello all, I'm applying for the FCB VS card. I have one question

I'm currently servicing a car loan of a couple hundred RM. I was wondering if I can pay that car loan using this credit card? Coz i don't see in the CB TnC that says I can't claim CB for using the CC to pay for a loan

|

|

|

|

|

|

Eurobeater

|

Apr 6 2020, 11:00 AM Apr 6 2020, 11:00 AM

|

|

One quick question about the FCB VS card.

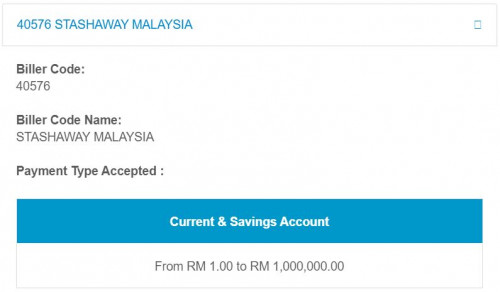

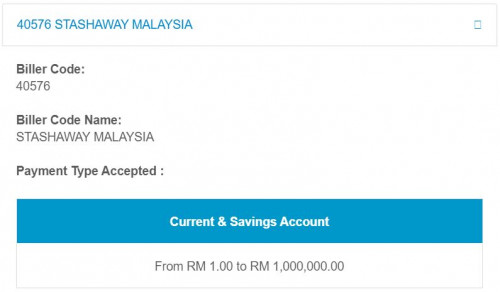

Can you use the card to put money in StashAway via JomPay? Is the amount eligible for cashback, as I'm not sure if it falls under utilities or some other category?

|

|

|

|

|

|

Eurobeater

|

Apr 6 2020, 11:27 AM Apr 6 2020, 11:27 AM

|

|

QUOTE(GrumpyNooby @ Apr 6 2020, 11:09 AM) SAMY via JomPay accepts credit card or not first.  Am unsure. It seems that I can pay with the credit card under Maybank2u, but I have yet to try it out. |

|

|

|

|

|

Eurobeater

|

Apr 6 2020, 11:44 AM Apr 6 2020, 11:44 AM

|

|

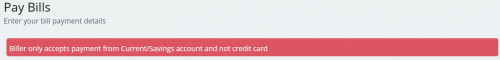

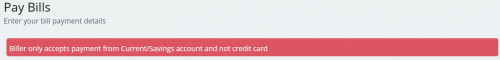

QUOTE(GrumpyNooby @ Apr 6 2020, 11:28 AM) I always use JomPay to fund SAMY. Even though you can select it, I don't think it'll be successfully checked out.  Then I guess it means it is not possible to fund SAMY via credit card. Thanks for the info |

|

|

|

|

|

Eurobeater

|

Jul 20 2020, 07:33 AM Jul 20 2020, 07:33 AM

|

|

Dammit. The cashback is all the reason why I applied.

Now I'm thinking of switching to the 2 gold cards

|

|

|

|

|

|

Eurobeater

|

Jul 20 2020, 11:28 PM Jul 20 2020, 11:28 PM

|

|

QUOTE(ClarenceT @ Jul 20 2020, 03:41 PM) Other banks are making the similar decisions as well, as proposed by Bank Negara. --- BNM's FAQ --- Would the Framework cause consumers to be worse-off as banks are likely to cut back on loyalty points, cash rebates and other cardholder rewards? Cardholder rewards such as loyalty points and cash rebates are funded by merchants through the payment of MDR. Merchants are likely to recover such cost through higher prices of goods and services. As such, consumers who do not use payment cards may end up subsidising the cardholder rewards enjoyed mostly by premium cardholders. With the implementation of the Framework, there is likely to be a dampening in the cardholder rewards. Nevertheless, consumers are not worse-off. With more affordable payment card acceptance cost, merchants will be less pressured to pass on such cost to consumers through higher prices of goods and services. In addition, more merchants would be able to afford the acceptance of payment cards, in particular the debit card. This would provide consumers with the convenience of using their payment cards widely at more merchant outlets, thus lessening the need to carry cash. As expected, they want to bring down the interchange rate. Then it means the cardholders like us will get less rewards in the future |

|

|

|

|

|

Eurobeater

|

Jul 21 2020, 02:14 PM Jul 21 2020, 02:14 PM

|

|

QUOTE(adele123 @ Jul 21 2020, 02:09 PM) After many years of using mbb cc, the 1st card i recommend is still the maybank 2 cards, amex. Everyone should get it. Haha. Barcelona is more of the btw, you should apply this too. I wanted the 2% at the time since a lot of my spending was on weekdays rather than weekends. Tho now if I want the 2 cards, the problem is the extra SST on the Visa card which cannot cancel on its own MBB should just consider offering the Amex card alone |

|

|

|

|

|

Eurobeater

|

Jul 21 2020, 04:00 PM Jul 21 2020, 04:00 PM

|

|

QUOTE(ClarenceT @ Jul 21 2020, 02:31 PM) Oh this ah. This looks almost the same as VS FCB with its 1% Cashback. Only benefit is that it doesn't look like its capped, but has an AF of RM70 apart from the 1st year. Probs pass since I don't spend enough on the FCB card alone lol |

|

|

|

|

|

Eurobeater

|

Aug 4 2021, 11:44 AM Aug 4 2021, 11:44 AM

|

|

Is there a way to set up some kind of SI or autodebit to pay off my oustanding amount every month from another bank?

My salary acc is with HLB but this card obviously is with MBB. How do I set up auto payments such that HLB automatically pays to my MBB credit card based on the outstanding amount, which varies every month?

Want to set up coz I realised I had forgotten to pay my card for July. Kena late charge RIP

|

|

|

|

|

|

Eurobeater

|

Aug 4 2021, 01:32 PM Aug 4 2021, 01:32 PM

|

|

QUOTE(cybpsych @ Aug 4 2021, 12:01 PM) not possible for now hlb does not know your mbb card outstanding; both doesnt talk to each other. another way is you can schedule (future) fund transfer or recurring fund transfer in HLB Connect. downside is your hlb account must always have money inside before scheduled fund transfer initiate. I see. Well then RIP. Need to extra careful now. I thought about setting SI between HLB to MBB and then have MBB perform autopay. Problem is the credit card O/S varies each month unlike car loan. Oh well  QUOTE(Human Nature @ Aug 4 2021, 12:28 PM) Set a monthly recurring alarm at your smartphone or google calendar That's what I did. But I recently switched to a new phone last month so the alarm didn't go off. Need to reset him. Haiz. This mistake gonna show in my ccris for the next 12 months  |

|

|

|

|

Dec 3 2019, 08:25 PM

Dec 3 2019, 08:25 PM

Quote

Quote

0.0284sec

0.0284sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled