Before discussing on the MDR charges on Apple Pay (charge amount and on who is liable), we should first understand how the card payment processing flow works during settlement:

Issuer Bank -----1----> Card Network -----2----> Acquiring Bank / Payment Service Provider -----3----> Merchant

Issuer Bank: The bank who issues the Credit / Debit Card used for payment (if I used a X Bank Credit Card to buy my coffee, the Issuer Bank for the transaction would be X Bank); Yes, the issuer bank gets paid whenever you use your card for providing the card facility in the first place. However when fraud occurs, the issuer bank may be the one who return the disputed funds out-of-pocket.

Card Network: Visa / Mastercard/ AmEx / MyDebit / etc.

Acquiring Bank / PSP: The financial institution used by the merchant to process card payments on their behalf (if the merchant contracted Y Bank to process their payments, Y Bank is most likely the one who provides the Card Terminal to them and Y Bank's info would be printed on the receipt)

*All MDR and fee percentages below are rough approximations for calculation purposes only; it is not meant to be relied on, only to make an example*

Settlement Part 1When settlement occurs, the Issuer Bank would first deduct the Interchange fee (set by card networks typically) and pay the remaining to the Card Network.

Issuer Bank Keeps: RM100.00 * (0.5%) = RM0.50

Issuer Bank Pays: RM100.00 - RM0.50 = RM99.50

Settlement Part 2Card Network takes a cut of the transaction as their fee (association fee etc.) and pass the remaining to the Acquiring Bank.

Card Network Keeps: RM99.50 * (0.1%) = RM0.10

Card Network Pays: RM99.50 - RM0.10 = RM99.40

Settlement Part 3Acquiring Bank takes a cut on the mark-up for providing a service and pass it to the merchant.

Most acquiring banks quote an "all-in" Merchant Discount Rate (MDR) to the merchants and this is the only "public facing" fee. The difference between what the Acquiring Bank Receives and Pays would be the Acquiring Bank's mark-up for providing the service.

All-in MDR: RM100 * (2.0%) = RM2.00

Acquiring Bank Receives: RM99.40

Acquiring Bank Pays &

Merchant Receives : RM100.00 - RM2.00 = RM98.00Acquiring Bank Keeps: RM99.40 - RM98.00 = RM1.40

SUPPOSEDLY the issuer banks are the one who has to fork out the 0.15% (reportedly) to be paid to Apple, the idea is that payments made through Apple Pay are safer and less prone to fraud and Apple gets a cut for making that possible. This is recently in the centre of a court case in the US because some banks disagree with the amount to be paid to Apple for using Apple Pay.

In addition, with card payments, whether with a physical card or Apple Pay, it would still get charged with the same MDR by the Acquiring Bank / PSP since they are still a Visa / Mastercard transaction. If anything,

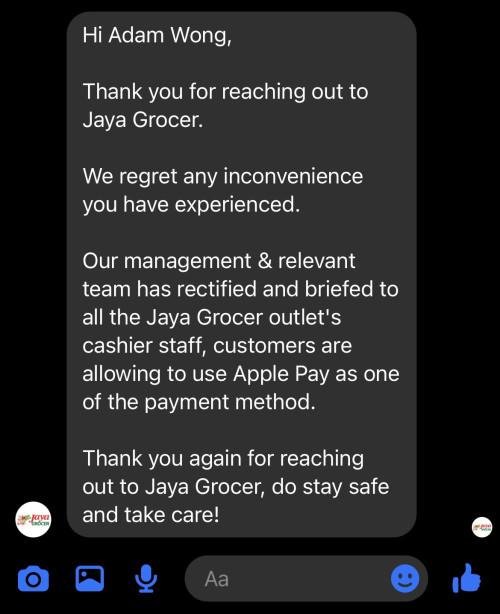

participating FIs reportedly has to agree that they would absorb the fee and not push it to consumers or merchants. And this is very much reflected on Maybank's FAQ and other banks' policies.

Therefore,

if the Apple Pay fees are paid by the merchants, issuer banks would not be suing isn't it?On the experiment done by @asellus, we can see that "Apple Pay + Maybank MAE" and "Alliance Bank Visa CC + Paywave" has similar fee whereas "Maybank MAE card with Paywave" has a much lower fee. This could be because physical MAE Card payment is made through the MyDebit network where else the other 2 is processed through Visa / MC (Google:

"[Card Network Name] Interchange Fee Malaysia"; Credit and Debit cards has different fees).

Therefore, I hope this explains or convinces some of you that Merchants would not be charged extra transaction-related costs for accepting Apple Pay payments. However some merchants might need to upgrade to a contactless-enabled terminal etc. which will incur costs. With that said, some merchants may not want to enable contactless payments at all for strategic reasons (Google:

"Walmart Apple Pay").

Finally, I wish everyone a guilt-free and smooth experience on using Apple Pay. To say that the amount of convenience of having Apple Pay has changed my life in the past few years would be an understatement and I am just glad that I could enjoy the same convenience now even in Malaysia.

TLDR: Merchants do not pay more transaction fee to accept Apple Pay. However other upfront fees may apply (change of card terminal). Merchants may not want to accept Apple Pay for other reasons as well.*Everything is a gross simplification, please do not rely on this post, it is meant to give a very high-level understanding*one of the long ass post that i am willing to read to the end, thanks for the effort of sharing ur knowledge in such a way

so now i can be guilt free when using AP at small merchants and can kind of blame them(lol) for mainly the reason of simply not willing to spend the ‘one off’ investment to change/upgrade the terminal, be it thr might be other reasons.

Aug 15 2022, 05:14 PM

Aug 15 2022, 05:14 PM

Quote

Quote

0.0273sec

0.0273sec

1.00

1.00

7 queries

7 queries

GZIP Disabled

GZIP Disabled