QUOTE(CharBoo @ Oct 6 2016, 02:14 PM)

thanks for replying...i think Vanguard does not mean to seek answers to those questions....literally...

this Vanguard is well versed in those things....

Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

|

|

Oct 6 2016, 02:19 PM Oct 6 2016, 02:19 PM

Return to original view | Post

#81

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Oct 7 2016, 03:38 PM Oct 7 2016, 03:38 PM

Return to original view | Post

#82

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 8 2016, 10:07 AM Oct 8 2016, 10:07 AM

Return to original view | Post

#83

|

Senior Member

5,143 posts Joined: Jan 2015 |

a "friend of mine"...always has a minimum

1) 1/2 month expenses in CASH lying around the house 2) 1 monthly expenses in Saving a/c of EACH of the 3~4 different banks with ATM cards 3) 3 months of saving in FDs on monthly renewal mode that is "his" 1st pockets of Emergency fund that is to be "VERY" liquid. there is really no right or wrong methods to have in an emergency fund. just that don't be too annalistic in "concerning" too much about the "losses" of some % of interest on this emergency fund....not to the extend of calculating to the precise "lag" time in days of the x% of emergency cash in the said a/c.... concentrate more into how/where to position one funds in the portfolio; be it includes among other things like; Vanguard credit ninja trick, RSP ninja trick, abit of timing (buy lower |

|

|

Oct 8 2016, 09:44 PM Oct 8 2016, 09:44 PM

Return to original view | Post

#84

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Avangelice @ Oct 8 2016, 09:33 PM) The Government is going to table its budget on Oct 21 ...........http://www.thestar.com.my/business/busines...7-expectations/ |

|

|

Oct 8 2016, 10:19 PM Oct 8 2016, 10:19 PM

Return to original view | Post

#85

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(AIYH @ Oct 8 2016, 10:01 PM) Since last discussion about the high correlation between CIMB APDIF and RHB AIF, would it be good if I keep APDIF and drop AIF? This post has been edited by T231H: Oct 8 2016, 10:23 PMjust a note: one is a Eq fund the other is a Balanced fund... Trying to have a fund for emerging market but the only better one I see is in fixed income sector, namely RHB Emerging market bond fund, which some very correlated with RHB ATR. just a note: I would go for RHB EM bond...because it invested abt 70% in Govt. securities Seeking for advise on the comparison between the 2 p/s: Do I just need to register morningstar free account to analyze the correlation between 2 funds? just a note: yes, you need to register,...but some forummer questioned that the correlation number given is related to USD.......thus the number may be off in relation to RM |

|

|

Oct 9 2016, 12:35 PM Oct 9 2016, 12:35 PM

Return to original view | Post

#86

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(AIYH @ Oct 9 2016, 10:41 AM) Since they are different asset classes, would you recommend that for people like me who RSP every month, to keep CIMB APDIF to take advantage of the larger volatility compared to RHB AIF? This post has been edited by T231H: Oct 9 2016, 12:37 PMmost of the data points to EQ fund has better ROI over Balanced funds over the longer period. if one wanted better ROI, can take the heat and can sleep in those heats....why not? Don't just buy, do RSP, then forget......(to at least monitor 9~12 months once to see the performance against its peers) If I am considering to shift from RHB AIF to RHB EMBF instead of RHB ATR, I can't really understand the region break as there is a lot of others region that neither FSM nor morningstar is helpful in breaking down on that Anyone can kindly enlighten me more on the region breakdown in RHB EMBF (I know is emergin market, but with 67% others, is kinda really hard to understand more try get the name of the target, goto FSM SG search that fund...get the latest annual reports...it is inside... example https://secure.fundsupermart.com/main/admin...portsUBGEMS.pdf just a note: a) the allocation composition is just by estimates as they can be changed by the FM when he/she seems necessary. b) EM Bond Fund is only suitable for investors who among other things are also comfortable with the greater volatility and risks of a bond fund which invests primarily in the debt investments and products of Emerging Markets. p/s: noticed that the target fund of RHB EMBF, united emerging market bond fund, the SGD and USD class performance were similarly to a bond fund. While the RHB counterpart performance similar to equity. Is this due to different currencies' appreciation/depreciation at different time that results in such a different in return and volatility? YES, I think currency fluctuation did play a part here. |

|

|

|

|

|

Oct 9 2016, 03:19 PM Oct 9 2016, 03:19 PM

Return to original view | Post

#87

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Nom-el @ Oct 9 2016, 03:08 PM) Different people have different levels of risks tolerance. Some people are willing to take more risk for potentially higher returns. That does not mean they have to take the highest level of risk to get the highest level of returns. Some people invest 100% into EQ funds, some 90% EQ : 10% FI, some 50% each, some 100% FI. To each his own. To imply that only people who are willing to take a lot of risk should consider investment is wrong. Otherwise, why bother with volatility, Sharpe ratio and correlation. but, if you refer to his post, he mentioned about Xuzen's post..... xuzen's post is here at page# 60, post# 1185, https://forum.lowyat.net/topic/4047177/+1180 he is responding to those that is comparing apple, oranges and pineapple pens just to try to select the winner for the minute gains of liquidity and lag time... |

|

|

Oct 9 2016, 04:06 PM Oct 9 2016, 04:06 PM

Return to original view | Post

#88

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 9 2016, 04:09 PM Oct 9 2016, 04:09 PM

Return to original view | Post

#89

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 9 2016, 05:08 PM Oct 9 2016, 05:08 PM

Return to original view | Post

#90

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Oct 10 2016, 10:14 AM Oct 10 2016, 10:14 AM

Return to original view | Post

#91

|

Senior Member

5,143 posts Joined: Jan 2015 |

1 1/2 years ago, FSM came out with this article....

How Can Malaysian Investors Cope With The Ringgit Depreciation? [22 May 2015] https://www.fundsupermart.com.my/main/resea...n--22-May--5873 then weeks later RHB ATF "chionged" upwards this week FSM again came out with this article.... How You Can Benefit From A Weakening Ringgit? [7 Oct 2016] https://www.fundsupermart.com.my/main/resea...-Oct-2016--7560 This post has been edited by T231H: Oct 10 2016, 10:18 AM Attached thumbnail(s)

|

|

|

Oct 10 2016, 10:28 AM Oct 10 2016, 10:28 AM

Return to original view | Post

#92

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(AIYH @ Oct 10 2016, 10:20 AM) With the upcoming US presidential election, is just the matter of magnitude i think the main one is the FED rate hike....Although very small amount, hope the amount I invested in RHB EMBF later will chiong EDIT: since the presidential outcome effect is still unknown, is hard to judge the timing is this what they call depreciating saving? This post has been edited by T231H: Oct 10 2016, 10:29 AM |

|

|

Oct 10 2016, 11:31 AM Oct 10 2016, 11:31 AM

Return to original view | Post

#93

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(puchongite @ Oct 10 2016, 11:24 AM) Don't scold arh, how come in my portfolio Cimb Asian Pacific Income is one of the best performing fund whereas, RHB Asian Income fund is one of my lower performing fund ? |

|

|

|

|

|

Oct 10 2016, 03:25 PM Oct 10 2016, 03:25 PM

Return to original view | Post

#94

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(spiderman17 @ Oct 10 2016, 03:20 PM) Here's my 6month old portfolio fund allocation. I'd pefer slightly heavy bias towards foreign exposure. Any suggestions/comment welcomed. Now /Target /Fund Name 15% / 20% / CIMB-Principal Asia Pacific Dynamic Income Fund 21% / 20% / CIMB-Principal Global Titans Fund 20% / 20% / Kenanga Growth Fund 19% / 15% / United Income Plus Fund 07% / 15% / AmAsia Pacific REITS -Class B 18% / 10% / RHB Islamic Bond Fund just let it ride for sometimes and review how it goes during mkt corrections.... maybe one risk appetite may change....trade off for a better sleep. btw, what is United income Plus Fund? |

|

|

Oct 10 2016, 08:32 PM Oct 10 2016, 08:32 PM

Return to original view | Post

#95

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(DearWJ @ Oct 10 2016, 08:27 PM) Finally i figured out the prob! I put in the amount for dividen (actually just put in units then enough) Kenanga Growth IRR 7.68 Eastspring Small Cap IRR 3.42 Eastspring Equity Income IRR 11.79 CIMB Asia Pacific Dynamic Income IRR 36.65 CIMB Global Titans IRR 15.96 Hope that i din't calculated wrong this time. Just start my investment Dec of 2016, those CIMB funds started on May 2016, so quite lucky to bought for lower prices. But din't make much portion in my portfolio, now extremely regret that din top up much note: if you had gotten into it in Jan/FEB......better "Huat-lah" than Dec 2015 |

|

|

Oct 10 2016, 08:40 PM Oct 10 2016, 08:40 PM

Return to original view | Post

#96

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(DearWJ @ Oct 10 2016, 08:37 PM) ROI means the amount shown in "profit" in FSM account? that is simplest....(does that profits take into consideration of sales charges paid?)such a noob question here, but newbie should ask more to learn more right? for more than 1 year than use IRR.... FSM does not have this function.... |

|

|

Oct 10 2016, 11:21 PM Oct 10 2016, 11:21 PM

Return to original view | Post

#97

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Avangelice @ Oct 10 2016, 11:17 PM) heads up the king of Thailand may pass on very soon and the junta may be going back into civil war. FSM MY don't have Thailand focused fund.you can buy in after the death of the kind and the subsequent military fall out. CIMB APDIF has only 6.5% in it... not much impact to the fund... any idea what fund is heavier on Thailand? This post has been edited by T231H: Oct 10 2016, 11:22 PM |

|

|

Oct 10 2016, 11:54 PM Oct 10 2016, 11:54 PM

Return to original view | Post

#98

|

Senior Member

5,143 posts Joined: Jan 2015 |

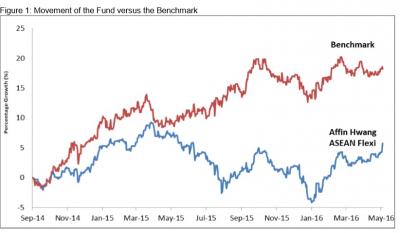

QUOTE(AIYH @ Oct 10 2016, 11:43 PM) CIMB-Principal ASEAN Total Return Fund -Class MYR (launched 1.5 years) (13.6% Thailand Equity) thanks for the input.... AFFIN HWANG ASEAN FLEXI FUND - MYR CLASS (launched 2 years) (28% Thailand Equity) YTD performance comparison with APDIF, what do you think? I think I will stick with CIMB APDIF....at just 6.5% else may have overexposure to other Asean countries if take in another CIMB ATRF for the benefits of 2x in Thailand. the hwang one is a Balanced fund.....not thinking of having a balanced fund for now.... |

|

|

Oct 11 2016, 12:02 AM Oct 11 2016, 12:02 AM

Return to original view | Post

#99

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(AIYH @ Oct 10 2016, 11:56 PM) Actually still got more, can dig out, quite some fund have double digit allocation in Thailand from the annual report......saw this..... Affin one is balanced, but in fund fact sheet, only 4.1% bond, which is Genting SG PLC Bond, the sole bond in the fund, and is maturing within a year, balanced? Attached thumbnail(s)

|

|

|

Oct 11 2016, 12:13 AM Oct 11 2016, 12:13 AM

Return to original view | Post

#100

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0811sec 0.0811sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 03:19 AM |