QUOTE(OPT @ Oct 4 2016, 11:13 AM)

Not the branch that I go Ultimate Discussion of ASNB (47457-V) VI, Wholly owned subsidary of PNB (38218-X)

Ultimate Discussion of ASNB (47457-V) VI, Wholly owned subsidary of PNB (38218-X)

|

|

Oct 4 2016, 11:14 AM Oct 4 2016, 11:14 AM

Return to original view | Post

#21

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

|

|

|

Oct 4 2016, 11:32 AM Oct 4 2016, 11:32 AM

Return to original view | Post

#22

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 4 2016, 11:38 AM Oct 4 2016, 11:38 AM

Return to original view | Post

#23

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 5 2016, 08:53 PM Oct 5 2016, 08:53 PM

Return to original view | Post

#24

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(plumberly @ Oct 5 2016, 08:42 PM) Declaration forms and others. Oo my experience is that get the forms required to fill up, if no unit then I keep the form.Maybe more forms for children's account, guardian etc. Just imagine, after doing all this, no unit available, they have to close the account and cut the passbook! No wonder the staff are reluctant to open account! Having said that holding the form cycle through cimb and pos office once, then only land on affin when they say asm got unit, then only pass them the form to proceed everything |

|

|

Oct 5 2016, 09:04 PM Oct 5 2016, 09:04 PM

Return to original view | Post

#25

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(nexona88 @ Oct 5 2016, 09:00 PM) the staff didn't chop the form with banks logo huh? i got mine from cimb, but no chop on itI remember in RHB, the ASNB form got chop with RHB bank logo on top? But mine is the orange form, when I register at affin, they do need the four forms as well but they help me complete the forms since I completed the form I hold with my info inside And for the record they didnt register the passbook to us unless there is unit for the fund. guess I was lucky to have the registration smooth af |

|

|

Oct 6 2016, 11:32 AM Oct 6 2016, 11:32 AM

Return to original view | Post

#26

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(nexona88 @ Oct 6 2016, 11:29 AM) for cimb, islamic savings account, be it bsa wadiah or other islamic account, as long as it belongs to cimb islamic, do not have the feature to top up asnb fund via cimbclicksI am also in that situation Dont know why they wont allow, is it because fixed price funds are not shariah compliant? This post has been edited by AIYH: Oct 6 2016, 11:32 AM |

|

|

|

|

|

Oct 6 2016, 03:22 PM Oct 6 2016, 03:22 PM

Return to original view | Post

#27

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Kamen Rider @ Oct 6 2016, 03:17 PM) this is really good news, we can avoid seeing actor who won Oscar award say system down lah, no more units lah etc... Seeing how fierce the competition is in grabbing these units.but, hope this online transaction top up from the PNB online portal are free of charges.... and that time every one like waiting buying xiaomi , keeps on submitting top up every minute : If we can see the amount of units available in real time, I hope the system won't crash for such huge traffic |

|

|

Oct 6 2016, 04:45 PM Oct 6 2016, 04:45 PM

Return to original view | Post

#28

|

Senior Member

1,166 posts Joined: Jul 2016 |

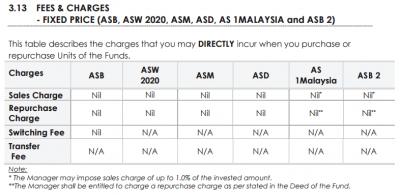

QUOTE(mamamia @ Oct 6 2016, 04:39 PM) I know ASM and ASW no such clause. Caj jualan is sales charge, which is the charges that is commonly found when purchasing unit trust, the point when you invest in the fund.But normally we won't sell for now with the good return.. I'm thinking anything happened to the fund, n we want to sell off, they will charge us since it is caj jualan.. We can't argue since clearly stated in the clause. Besides sales charge, there might be a repurchase charge in the future. Attached thumbnail(s)

|

|

|

Oct 6 2016, 05:24 PM Oct 6 2016, 05:24 PM

Return to original view | Post

#29

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(lagalerie @ Oct 6 2016, 05:20 PM) Anyone can help? actually the dividend is calculated based on monthly minimum balance.May i know is asnb dividend is calculated based on daily average balance? Said I have 10k, after 6mths I withdraw 3k and account left 7k for the next 6mths, is the dividend calculate as following? Let dividend at 6% 10000*6%/12*6 + 7000*6%/12*6=510? Will the dividend totally burned during halfway withdrawal? Your calculation for dividend is correct And no, you will get the pro rated dividend as long as you dont withdraw everything from the fund This post has been edited by AIYH: Oct 6 2016, 05:25 PM |

|

|

Oct 7 2016, 11:23 PM Oct 7 2016, 11:23 PM

Return to original view | Post

#30

|

Senior Member

1,166 posts Joined: Jul 2016 |

ASNB Labur Online T&C

Who wants to try some luck for this? Small fry amount but better than nothing EDIT: this is a recycled campaign, I only realized on this This post has been edited by AIYH: Oct 7 2016, 11:29 PM Attached thumbnail(s)

|

|

|

Oct 8 2016, 09:02 AM Oct 8 2016, 09:02 AM

Return to original view | Post

#31

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 8 2016, 02:35 PM Oct 8 2016, 02:35 PM

Return to original view | Post

#32

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 8 2016, 02:40 PM Oct 8 2016, 02:40 PM

Return to original view | Post

#33

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

|

|

|

Oct 13 2016, 08:42 AM Oct 13 2016, 08:42 AM

Return to original view | Post

#34

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Kamen Rider @ Oct 13 2016, 08:38 AM) Fund Super Mart (FSM) is an online platform that serves as an agent to many fund houses' unit trust fund investment.FSM Malaysia Official Site FSM @ Lowyat Forum |

|

|

Oct 13 2016, 11:10 PM Oct 13 2016, 11:10 PM

Return to original view | Post

#35

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(heavensea @ Oct 13 2016, 10:05 PM) Nasib baik I didn't naik kereta of asg... thanks for warned me Not sure, you might need to ask RHB bank for their service availability.RHB Islamic bond can be done via rhb online? Or I've to go open at bank and top up later via online? Or both need to be done at bank? But I believe FSM has more option as beside RHB Islamic bond, you can invest in other UT and have every fund you invested via FSM, be it Kenanga or RHB Asset Management etc... consolidated in one account btw Ramjade I think Asx FP is not as liquid as eGIA at the moment, cos you still need to go to branches to sell the unit to get the money, unless their soon to be online platform can buy/sell from/to your bank account then ok This post has been edited by AIYH: Oct 13 2016, 11:12 PM |

|

|

Oct 14 2016, 12:26 AM Oct 14 2016, 12:26 AM

Return to original view | Post

#36

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(heavensea @ Oct 13 2016, 11:48 PM) Thanks for advise You need to understand that dividend declared will reduce the asset of the fund, hence NAV will drop.Do we receive pro rate of dividends if we sell the units of asnb before "official dividends" date? Gia return is too low, I'll park short term emergency funds in gia and lt emergency funds in asx fp. Since fixed price fund had their NAV fixed at RM1, performance of the fund is irrelevant, and the dividend declare will not bring down the NAV, hence the reinvested unit into your holding will increase the value of your fund Contrast to ASNB variable price fund (ASn/ASG) and UT in general, dividend declared will bring down the NAV value by the dividend declare. Should you choose to reinvest the unit at the latest NAV, your fund value will remain the same. However, if you choose to cash out the divdend by cash/cheque, your fund value will decrease by the amount of dividend you cash out. Hence for UT in general (except FP Asx), the fund value will be determine by the amount of unit you hold and the NAV aka return of the fund, dividend declared wont affect you fund value as a whole. So, RHB Islamic Bond fund, being a UT, performance will be determined by the growth of the NAV. But being a fixed income UT, the fund is generally low risk, hence less volatile to achieve steadily rising performance and have an annualized return about 7% in 10 years historical performance. Of course, past performance is not a representation for future performance, likewise for dividend declared for FP Asx, but it is a benchmark that it can deliver consistent performance. Moreover, compared to its peers, RHB islamic bond fund was proved to be the pioneer in sukuk (islamic bond) UT fund (it just shariah compliant investment, everyone can invest into it) Should you sell your holding for RHB islamic bond fund, you will sell according to the current NAV, but I will recommend to put the amount you invested at least a year to prevent redemption charge of 1% of the amount you withdraw (if the amount you invested stay in the fund at least a year, the redemption charge is not applicable) I will recommend the following strategy: Highest level emergency fund : eGIA as you can uplift everyday (including weekend and PH) from 6am to 10pm Comment : Very liquid Medium level emergency fund : FP Asx as they gave high dividend but only can sell during working days and office hour at the moment (unless online platform change the landscape :lol) Comment : Traditional liquid (OTC withdrawal) Lowest level emergency fund : RHB islamic bond fund as they provide consistent higher return (historical) than Asx FP dividend, provided you can take a bit risk and can forgo the FD's PIDM capital guarantee concept. Comment : Need few days to receive the fund, and the amount invested need to be put at least a year to avoid redemption charge |

|

|

Oct 14 2016, 01:09 AM Oct 14 2016, 01:09 AM

Return to original view | Post

#37

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(heavensea @ Oct 14 2016, 12:49 AM) Thanks for such informative feedbacks and advised To maintain the fund value, that is before dividend = after dividend reinvested to be exact I need to read more about the concept of vp funds, but now I starting understand why dividends of vp funds need to reinvested into the fund again. To "hold" the current NAV value? I don't get it about asx fp, For example, I uplift/sold units of ASM (fp fund) before 6 months of dividends declaration. Am I eligible to receive 6/12 months of dividends? But how it's calculated? Since the coming dividends not yet declared. Do I get pro rated dividends like how I surrender in certain fd? Regarding to Asx FP, think of it like normal saving accounts which intesrest are calculated daily and credited halfyearly, even though you withdraw some of your savings from it, as long as your account is not closed, you will still get the pro-rated interest at the time of interest crediting Similarly, Asx dividend is calculated monthly minimum balance and credit yearly Say for a hypothetical FP which has a dividend distribution date of 30/6/2016 From 1/7/2015, you have 3000 unit in it. Then on 11/10/2015, you top up 1000 unit into it. Then on 1/3/2016 you top up another 500 unit into it. Then on 4/4/2016, you withdraw 700 unit from it. The dividend is calculated by monthly minimum balance illustrated below: note: X = dividend distribution yet to known until distribution date July 2015 to September 2015 : 3000 * 3 / 12 * X October 2015 to February 2016 : 4000 * 5 / 12 * X March 2016 : 4500 * 1 / 12 * X April 2016 to June 2016 : 3800 * 3 / 12 * X Say on 30/6/2016, they declared 6 sen per unit (which is X) As long as you still have minimum balance in the fund (much like saving account) by the distribution date, you are entitled the sum of pro-rated dividend calculated as above This is unlike premature withdrawal of FD (more tahn 3 months) where you get the pro-rated interest upon uplift Asx FP follows mechanism similar to saving account This post has been edited by AIYH: Oct 14 2016, 01:10 AM |

|

|

Oct 14 2016, 01:19 AM Oct 14 2016, 01:19 AM

Return to original view | Post

#38

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 13 2016, 11:56 PM) Sure or not? Can withdraw any amount during office hours. Money available on the spot. Want 6 digit also no problem as long as got bank account. Of course, I am comparing between eGIA and Asx FP, UT liquidity confirm lose 9 roads compared to either of them Any UT can match that? Yeah not as liquid as eGIA-i as not available on weekends but it is as liquid as FDs. For FDs you still need to visit banks. Yes. That's why I keep about 100-150 units left inside there. This post has been edited by AIYH: Oct 14 2016, 01:20 AM |

|

|

Oct 14 2016, 07:36 AM Oct 14 2016, 07:36 AM

Return to original view | Post

#39

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(heavensea @ Oct 14 2016, 02:18 AM) very very well explanations with given example, I feel like listening to financial classes during University era Hmmm......... Many thanks bro, I've learnt some useful thing! Forgive me for having such a long conversational explanation Just a recent graduate style of talking to prevent miscommunication QUOTE(heavensea @ Oct 14 2016, 02:18 AM) So the total dividends I would received as at 30/6/2016: (6sen) equally as "total amounts" of below calculations? Yes July 2015 to September 2015 : 3000 * 3 / 12 * X October 2015 to February 2016 : 4000 * 5 / 12 * X March 2016 : 4500 * 1 / 12 * X April 2016 to June 2016 : 3800 * 3 / 12 * X QUOTE(heavensea @ Oct 14 2016, 02:25 AM) guys I've some off question about "Full flexi mortgage loan" vs Asx fp, Never have a mortgage before, but roughly understanding its feature, depends on your priority.Is it wise to park money into current account of full flexi mortgage loan (to reduce interest payable) instead of Asx fp? I simply think it's better to invest those money into Asx fp because of the return of fp/vp funds is out run the interest charges of mortgage loan... (let's say 4.6%) Am I right? Or I've neglected necessary parts that should take consideration? If you want to be debt free as soon as possible, dump all into full flexi loan account can reduce your interest charged and overall loan amount. In case anything happen that affect your income, you won't need to pay back as much. Liquidity should be about he same as Asx FP and eGIA.. But if you want to take advantage of return, i suggest don't depend only on Asx FP, understand more about other investment options and diversify it to achieve potentially higher return This post has been edited by AIYH: Oct 14 2016, 07:37 AM |

|

|

Oct 14 2016, 08:29 AM Oct 14 2016, 08:29 AM

Return to original view | Post

#40

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(heavensea @ Oct 14 2016, 07:57 AM) AIYH Case Study:Morning, man don't apologize, I've learn a lot from your explanation Yeah, you're right about diversification. I'm learning to know more about reit and vp funds. Actually I don't understand this statement "To maintain the fund value, that is before dividend = after dividend reinvested to be exact". Do you mind to show me some example with figures? (Whenever you're in leisure) I would like to know "the impacts" of taking out dividends from vp funds, and why it's "better/suggested" to reinvest into the funds. Have a good day You interested to invest in Fund A. Currently Fund A having NAV @ RM0.50 Assume the fund does not have sales charge (for simplicity You decide to invest RM 1,000.00 into it, which grants you 2000 unit. One year later, the NAV is @ RM0.60, with your unit holding, your current fund value is RM 1,200.00, 20% return (again, imgainary Scenario 1: The fund manager decided to declare distribution of 5 sen per unit (arbitrary), which in turn, you current holding will entitled you RM 100.00, and right after the distribution, the NAV dropped to RM 0.55 due to distribution. Choice 1: So, if you decide to cash out the dividend, you will get RM 100.00 in cash/cheque. Your unit holding will still be 2000 unit, however now NAV @ RM0.55, so you fund value is RM 1,100.00 Fund RM 1,100 + Cash RM 100 = RM1,200 Choice 2: If you instead opt for reinvestment (which is the default option for most UT in Malaysia), your RM 100 will be reinvested @ NAV RM 0.55, which granted you 181.82 unit (rounding), so your holding will have 2181.82 unit. Your fund value = 2181.82 unit * NAV @ Rm 0.55 = RM 1,200.00 Scenario 2: The fund manager decided not to declare distribution and everything BAU (business as usual), NAV remained @ RM 0.60 Another year later, the fund has a return of 10% for that year (again, imgainary Scenario 1 Choice 1: NAV rose to RM 0.55 * 1.1 = RM 0.605 You will have fund value of 2000 unit * NAV @ RM 0.605 = RM 1,210.00 Along with the cash distribution of RM 100 you have last year (assumed you didnt touch it or you spend it) Total value = Fund value RM 1,210.00 + RM 100 = RM 1,310.00 Scenario 1 Choice 2: NAV rose to RM 0.55 * 1.1 = RM 0.605 You will have fund value of 2181.82 unit * NAV @ RM 0.605 = RM 1,320.00 Total value = Fund value = RM 1,320.00 Scenario 2: NAV rose to RM 0.60 * 1.1 = RM 0.66 You will have fund value of 2000 unit * NAV @ RM 0.66 = RM 1,320.00 Total value = Fund value = RM 1,320.00 As you can see, Scenario 1 Choice 2 and Scenario 2 showed that distribution is irrelevant as they will result in the same value whether regardless of distribution. However, Scenario 1 Choice 1 showed that if you do not utilize the RM 100 by reinvestment or other better investment, you will end up losing compared to reinvestment choice The problem is quite some UT agents intentionally/unintentionally decided to use dividend (distribution) as the means of describing the performance of the fund to misleads customers, who they thought the meaning of dividend in UT is the same as stocks and reits, which is not |

|

Topic ClosedOptions

|

| Change to: |  0.1003sec 0.1003sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 05:10 PM |