QUOTE(ksyong9682 @ Sep 11 2016, 10:03 AM)

RM2000 is retail spend. Insurance auto deduct every month is retail spend? Online purchase or paymeny is? I don't think so.... what u guys think?

https://www.hlb.com.my/WISEQ: My average spend per month on WISE Credit Card is RM1,000. How could I meet the minimum RM2,000 requirement?

A: WISE Credit Card gives out one of the highest cash backs. One way to meet the minimum RM2000 requirement is to consolidate all your purchases on your WISE credit card, for instance, pay for daily shopping, dining, groceries, insurance premiums, utility bills as well as enrol for auto-billing service.

https://www.hlb.com.my/main/assets/files/wi...c-en-160906.pdf

3. Terms and Conditions of the Programme

The term “Eligible Retail Transaction” shall refer to any retail purchase transaction made locally and overseas, including online transactions which are charged to the WISE Card (both Principal and supplementary WISE Cards) but EXCLUDES the following transactions:

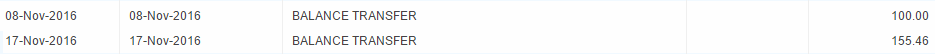

(i) cash-type transactions including but not limited to Cash Advances, Cash-On-Call and Balance Transfers;

(ii) Cash-On-Call transactions;

(iii) fees and charges including but not limited to charges for cash withdrawals and cash payments, annual fees, interest and/or finance charges, disputed transactions, government

charges and any other kind of charges and penalties;

(iv) installment conversion transactions including but not limited to Flexi Payment Plan;

(v) fund transfers (from or to HLB’s account whether by HLB or third party);

(vi) disputed transactions that are subsequently reversed from the account of the Cardholder

My understanding is auto debit insurance and online purchase are retail spending. I think online purchase like LAZADA, AirBnb, AirAsia, etc...

This post has been edited by propusers: Sep 11 2016, 11:11 AM

Sep 11 2016, 11:10 AM

Sep 11 2016, 11:10 AM

Quote

Quote

0.0344sec

0.0344sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled