Outline ·

[ Standard ] ·

Linear+

Credit Cards Hong Leong Bank Wise Credit Card V8, 10% Cashback , Up to RM100 per month

|

psiloveu

|

Jul 9 2018, 01:54 PM Jul 9 2018, 01:54 PM

|

|

QUOTE(Barricade @ Jul 9 2018, 01:15 PM) It's eligable. Both promotion is not related to one another. There's no such clause in 7% cashback promotion. I further check with CS before I applied. 53. FPP allows Eligible Cardholders to repay outstanding Eligible Retail Transactions with a prescribed Minimum Retail Transaction Amount (as defined in Clause 52 above) which have already been debited to the Eligible Cardholder’s credit card account and / or recorded in the current credit card statement, by way of monthly instalments over a prescribed FPP Instalment Period (“FPP Monthly Instalment”) as agreed between the Eligible Cardholder and the Bank. 54. The Eligible Retail Transactions must not have passed its payment due date at the point of the FPP conversion. 55. For the purpose of this Promotion A5, FPP is applicable to all retail transactions save and except for cash advance, instalment amount payable under other programmes of the Bank such as Balance Transfer, Balance Transfer Plus, Extended Payment Plan, Cash-on-Call, Call-for-Cash, Call-for-Cash Plus, annual fees, card forward balances and other charges imposed by the Bank as provided in the Cardholder Agreement (“Eligible Retail Transactions”). 56. FPP conversion is not entitled to any reward points and / or cash rebates unless otherwise notified by the Bank. So I m a bit confused.  |

|

|

|

|

|

psiloveu

|

Jul 8 2019, 04:53 PM Jul 8 2019, 04:53 PM

|

|

QUOTE(fruitie @ Jul 8 2019, 04:35 PM) I know but at the same time this is for invited customers only, few months ago I did receive but I didn't do any conversion and I haven't been spending enough to be eligible again. Yeah, maybe I will try that route. How long does it take to appear? Right after transaction is posted? i also done 0% FPP many times since last year...... the system will auto show you the amount eligible for FPP conversion. It's depend on your CL balance and I did not know how the system work...... sometimes it is not the round figure as I swiped. |

|

|

|

|

|

psiloveu

|

Jul 10 2019, 11:49 AM Jul 10 2019, 11:49 AM

|

|

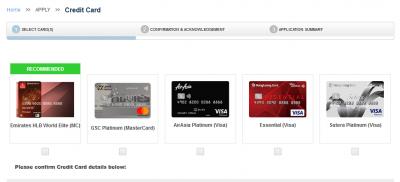

QUOTE(xxnazxx @ Jul 9 2019, 09:15 PM) Since i already have AA plat card, i guess that’s why they put the store card option. At first wasn’t interested in that card, since i nvr go to the store. But then saw on RP that the card gives 0.5% cb uncapped on any retail transactions with no annual fee. So why not right? When all other cards cb are max I log in my account and find only these cards can be selected......it is not my choice.  Attached thumbnail(s) Attached thumbnail(s)

|

|

|

|

|

|

psiloveu

|

Jul 10 2019, 12:01 PM Jul 10 2019, 12:01 PM

|

|

QUOTE(tan_aniki @ Jul 10 2019, 11:53 AM) wow... ur income more than RM20k/month... I just a small fish ...... that's why I want to apply "Wise" card.  |

|

|

|

|

|

psiloveu

|

Jul 10 2019, 12:05 PM Jul 10 2019, 12:05 PM

|

|

QUOTE(tan_aniki @ Jul 10 2019, 12:02 PM) they didn't offer u Infinite P? Infinite "p" is for their premier banking customers, I m not the PB customer. I think system auto select cards for me is due to the credit limit. |

|

|

|

|

|

psiloveu

|

Jul 11 2019, 02:04 PM Jul 11 2019, 02:04 PM

|

|

QUOTE(skty @ Jul 10 2019, 07:46 PM)  i only qualified for Emirates HLB World  For me, that card is not "useful" to me for this moment. I din travel much plus never go to "West" before.  QUOTE(digidigi @ Jul 11 2019, 11:48 AM) wa u qualified with world elite, then what else u can’t get? I just wanna to get the "Wise" card  |

|

|

|

|

|

psiloveu

|

Jul 17 2019, 03:04 PM Jul 17 2019, 03:04 PM

|

|

QUOTE(Barricade @ Jul 17 2019, 02:50 PM) That's for card where AF is not waivable. For cards which AF is waivable, you will only see SST even though you didn't receive the physical card yet. That's normal. That's why I say emirates AF is waivable because there are no AF charged, but there are some members who is so scared to apply  Emirates World Elite ...... is no waiveable.  |

|

|

|

|

|

psiloveu

|

Jul 23 2019, 03:00 PM Jul 23 2019, 03:00 PM

|

|

QUOTE(digidigi @ Jul 23 2019, 02:31 PM) straigh away kena charge annual fees plus sst before I click "proceed"........my fren warned me about the annual.  |

|

|

|

|

|

psiloveu

|

Jul 23 2019, 03:17 PM Jul 23 2019, 03:17 PM

|

|

QUOTE(tan_aniki @ Jul 23 2019, 03:08 PM) i also warned here may times already lol AF 1800 can buy a lot of things  |

|

|

|

|

|

psiloveu

|

Oct 17 2019, 04:53 PM Oct 17 2019, 04:53 PM

|

|

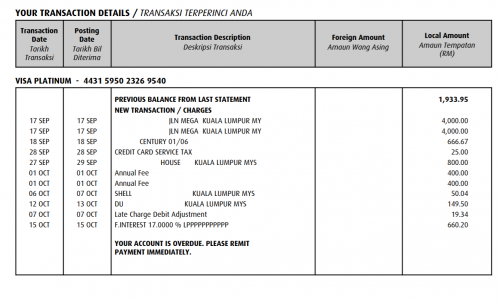

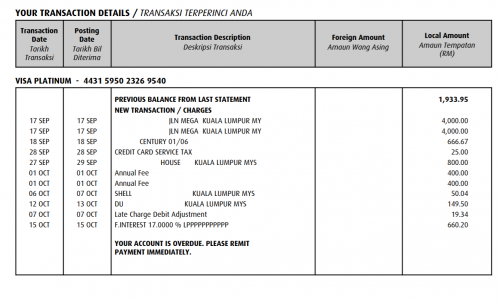

QUOTE(#Victor @ Oct 17 2019, 01:02 PM) how does HLB interest works? the amount seems not tally with previous statement balance?  u din make a payment for last statement, so ur account already overdue for more than two months......your criss is showing "2", god bless u. |

|

|

|

|

|

psiloveu

|

Jul 8 2020, 12:25 PM Jul 8 2020, 12:25 PM

|

|

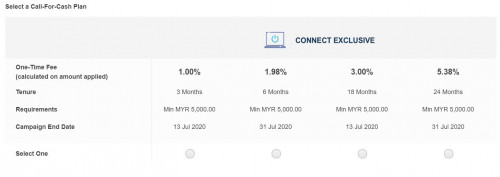

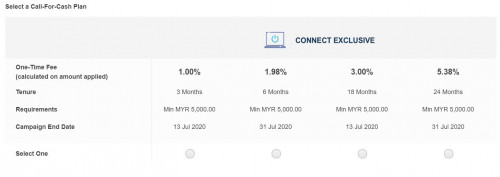

QUOTE(Dexter @ Jul 7 2020, 09:38 AM) The Call-For-Cash (from HLB Connect) for your reference:  Full TNC: https://www.hlb.com.my/content/dam/hlb/my/d...idbody-img-dd20the 18 months plan with 3% looks like a good deal. |

|

|

|

|

|

psiloveu

|

Mar 1 2021, 11:10 AM Mar 1 2021, 11:10 AM

|

|

QUOTE(joonh @ Jan 17 2021, 03:46 PM) Finished my limit buying 2x iPhone at 12:05am. Hope can get that 20% cashback 17 Jan 2021 result was out, did you get the cash back? Thank you. |

|

|

|

|

Jul 9 2018, 01:54 PM

Jul 9 2018, 01:54 PM

Quote

Quote

0.0313sec

0.0313sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled