QUOTE(Toku @ May 21 2022, 11:36 AM)

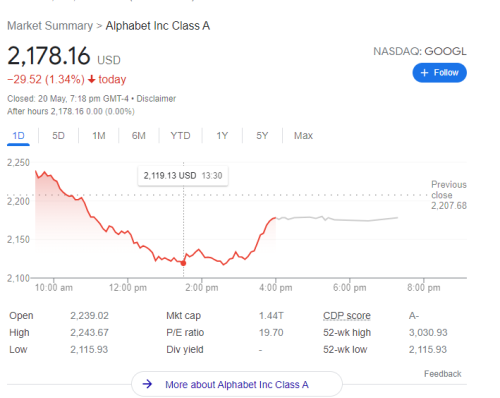

took a bit of a bite of GOOGL @ $2121. Now to hold on for dear life XD

IMHO:

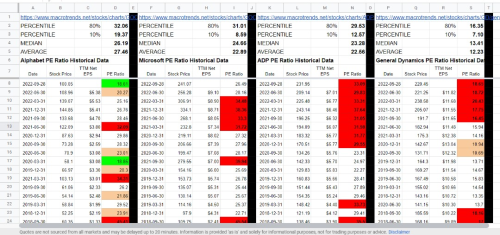

1. GOOGL at 2121 is -30% from its 52wk high & PE of 19.19+/-, its 10 years' average PE is 21-22 https://www.macrotrends.net/stocks/charts/G...phabet/pe-ratio

2. if a 2008 or 2001 happens, another buy at $1212, -60% from highs & PE of 10.97+/- XD

Why i chose GOOGL instead of stuff like MSFT or AAPL?

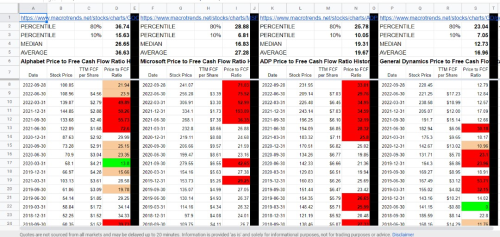

a. its amount of FreeCashFlow (FCF) over sharecap is high

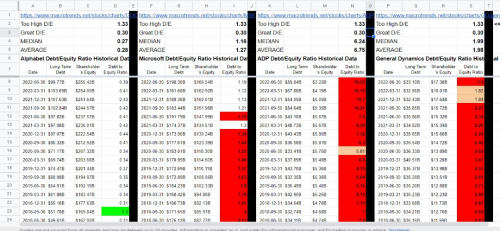

b. low debts to equity and can easily pay off all debts

c. growth yoy for past 10 years is up there

+

as Peter Lynch style - I use GOOGL's products daily and rely on them thus good stuff XD

May 21 2022, 02:01 PM

May 21 2022, 02:01 PM

Quote

Quote

0.4468sec

0.4468sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled