WSJ FINANCE | INVESTING

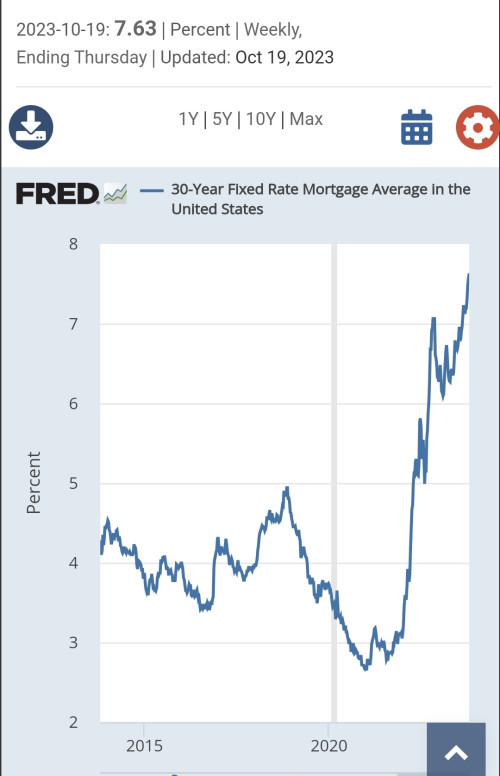

Muni Funds That Use Borrowed Money Take a Big Hit

Closed-end municipal-bond funds are suffering from rising interest rates

https://www.wsj.com/finance/investing/muni-...share_permalink

--------------------------------

WSJ FINANCE | STOCKS | HEARD ON THE STREET

Profits Are Making a Comeback

Despite challenges including rising labor costs and high interest rates, U.S. corporate earnings are on an upswing

https://www.wsj.com/finance/stocks/profits-...share_permalink

----------------------------------

WSJ BUSINESS | AIRLINES

The ‘Revenge Travel’ Boom Shows Signs of Slowing

Travel demand is getting back to normal and for some budget airlines that means an autumn slowdown

https://www.wsj.com/business/airlines/the-r...share_permalink

-----------------------------------

WSJ FINANCE | CURRENCIES

What’s Changed for Crypto After FTX? Not Much.

Regulations aren’t happening as digital currencies have endangered individual investors—not the whole financial system

https://www.wsj.com/finance/currencies/what...share_permalink

--------------------------------------

WSJ BUSINESS | RETAIL | HEARD ON THE STREET

A Gilded Age is Fading for Luxury Brands

The latest results from Louis Vuitton owner LVMH show that luxury shoppers are sobering up after years of heavy spending

https://www.wsj.com/business/retail/a-gilde...share_permalink

----------------------------------------

WSJ ECONOMY | HOUSING

The Californization of the Texas Housing Market

Migration from more expensive states has pushed home prices out of reach for many locals; ‘a very hard market for first-time buyers’

https://www.wsj.com/economy/housing/texas-h...share_permalink

-----------------------------------------

WSJ BUSINESS | RETAIL | HEARD ON THE STREET

PepsiCo Serves Up Lukewarm Reassurance on Consumers

Snacks and soda giant sees a cautious but still healthy consumer as staples stocks get hit hard

https://www.wsj.com/business/retail/pepsico...share_permalink

--------------------------------------------

WSJ HEALTH | HEALTHCARE | HEARD ON THE STREET

Healthcare Strikes Threaten to Prolong Wage Pressure on Hospitals

Tenet could face labor action next, after Kaiser Permanente employees staged the largest U.S. healthcare walkout on record

https://www.wsj.com/health/healthcare/healt...share_permalink

-----------------------------------------------

WSJ FINANCE | STOCKS | HEARD ON THE STREET

These Stocks Are Screaming Recession. It’s Almost Time to Buy Them.

Small-capitalization stocks can supercharge portfolios on the other side of economic downturn

https://www.wsj.com/finance/stocks/these-st...share_permalink

------------------------------------------------

WSJ TECHNOLOGY | HEARD ON THE STREET

Apple’s Easy Google Money May Get Harder to Keep

Government trial targets search deal just as worries grow about iPhone 15 cycle, future in China

https://www.wsj.com/tech/apples-easy-google...share_permalink

-----------------------------------------------

WSJ FINANCE | BANKING | HEARD ON THE STREET

What Could Finally Turn Around Citigroup?

Trimming layers of managers will help, but global bank faces headwinds ranging from interest rates to new capital rules

https://www.wsj.com/finance/banking/what-co...share_permalink

USA Stock Discussion v8, Brexit: What happens now?

Oct 11 2023, 10:42 PM

Oct 11 2023, 10:42 PM

Quote

Quote

0.0265sec

0.0265sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled