QUOTE(yungkit14 @ Sep 13 2020, 08:49 PM)

You mean that OCBC rate is not the best for short term placememnt?OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

OCBC 360 Savings Account - Up to 3.25% Interest !, Get higher interest on your savings acct

|

|

Sep 13 2020, 08:01 PM Sep 13 2020, 08:01 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

|

|

|

Sep 13 2020, 08:39 PM Sep 13 2020, 08:39 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(CPURanger @ Sep 13 2020, 09:18 PM) Well, it depends. If the person is able to meet conditions, deposit RM500, spending RM500 and pay 3 bills every month, can consider OCBC 360. Otherwise FD. yup and save the hassle to withdraw to saving and find another bank for better rate.Personally I prefer putting money in OCBC 360, can withdraw money anytime I want without losing interest. The problem is the average daily balance in OCBC 360. I have FD mature today already in my OCBC 360, thinking whether 6 months at 2.45% pa, which is the same rate as OCBC 360 is worth or not |

|

|

Sep 13 2020, 08:41 PM Sep 13 2020, 08:41 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(CPURanger @ Sep 13 2020, 09:18 PM) Well, it depends. If the person is able to meet conditions, deposit RM500, spending RM500 and pay 3 bills every month, can consider OCBC 360. Otherwise FD. yup and save the hassle to withdraw to saving and find another bank for better rate.Personally I prefer putting money in OCBC 360, can withdraw money anytime I want without losing interest. The problem is the average daily balance in OCBC 360. I have FD mature today already in my OCBC 360, thinking whether 6 months at 2.45% pa, which is the same rate as OCBC 360 is worth or not |

|

|

Feb 15 2021, 09:50 AM Feb 15 2021, 09:50 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

1,628 posts Joined: May 2013 |

I remember OCBC cut off time for the transaction count as today date. What is the cutoff time?

If there is a cutoff time, any transaction done after the cut off time will record in Value date or Transaction date in our online bank detail? |

|

|

Feb 15 2021, 09:46 PM Feb 15 2021, 09:46 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Feb 16 2021, 09:03 PM Feb 16 2021, 09:03 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

1,628 posts Joined: May 2013 |

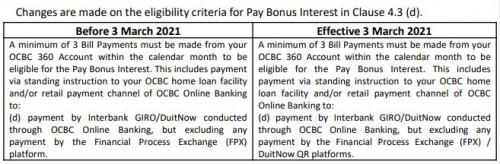

QUOTE(GrumpyNooby @ Feb 16 2021, 03:09 PM) [11/02/2021] Revision of OCBC 360 Account/-i Terms and Conditions Some bank will use instant transfer as DuitNow. Does it mean we cannot use instant transfer to non-ocbc account to qualify for the Pay bonus?The Bank has revised the Terms and Conditions (T&C) for the OCBC 360 Account/-i.  This revised Terms and Conditions will take effect on 3 March 2021. Please refer to this document for a summary of the key changes. https://www.ocbc.com.my/assets/pdf/Accounts...nC_11022021.pdf |

|

|

|

|

|

Apr 2 2021, 03:31 PM Apr 2 2021, 03:31 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

Apr 6 2021, 12:22 PM Apr 6 2021, 12:22 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

1,628 posts Joined: May 2013 |

Anyone still have missing one Bonus profit for March 2021?

|

|

|

Apr 9 2021, 09:48 AM Apr 9 2021, 09:48 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

1,628 posts Joined: May 2013 |

I got mine too.

Just to confirm the base interest of 0.05% pa is for maintaining balance at least RM500? I got another sub-account, I got the profit amount for something. |

|

|

Oct 6 2021, 07:58 AM Oct 6 2021, 07:58 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

1,628 posts Joined: May 2013 |

Just want to reconfirm FPX transaction and Direct debit (both money out) are belong to Spend or Pay category?

This post has been edited by rocketm: Oct 6 2021, 10:37 AM |

|

|

Oct 6 2021, 11:44 AM Oct 6 2021, 11:44 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(rojakwhacker @ Oct 6 2021, 12:27 PM) Fpx excluded. Money out from bank account is belong to Pay category. Direct debit is consider under the Pay category right?4.3. Pay Bonus Interest A minimum of 3 Bill Payments must be made from your OCBC 360 Account within the calendar month to be eligible for the Pay Bonus Interest. This includes payment via standing instruction to your OCBC home loan facility and/or retail payment channel of OCBC Online Banking to: (a) your OCBC/OCBC Al-Amin home loan facility; or (b) any account with any bank or financing institution other than the Bank and OCBC Al-Amin Bank Berhad (Company No. 200801017151 / 818444-T); or © any participating billing organisations; or (d) payment by Interbank GIRO/DuitNow conducted through OCBC Online Banking, but excluding any payment by the Financial Process Exchange (FPX)/DuitNow QR platforms. https://www.ocbc.com.my/assets/pdf/Accounts...unt_TnC_ENG.pdf |

|

|

Oct 6 2021, 12:09 PM Oct 6 2021, 12:09 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(rojakwhacker @ Oct 6 2021, 12:53 PM) From search of this thread, for direct debit from debit card is consider as Spend category. While standing instruction is consider as Pay category. ok, should be true.I remember the direct debit transaction require me to insert my debit card number. So, it is under Spend category. Have not using standing instruction yet so cannot verify on that. Thank you for helping out me. rojakwhacker liked this post

|

|

|

Nov 3 2023, 10:37 PM Nov 3 2023, 10:37 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

1,628 posts Joined: May 2013 |

May I know when I paywave using my OCBC debit card, is it consider under Spend category? I saw my online account stated "SA MYDEBIT PURCHASE".

|

| Change to: |  0.0977sec 0.0977sec

0.16 0.16

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 10:32 PM |