Paying cash for an undercon property, What should the buyer do?

|

|

Mar 26 2016, 10:24 AM, updated 10y ago Mar 26 2016, 10:24 AM, updated 10y ago

Show posts by this member only | Post

#1

|

Senior Member

2,515 posts Joined: Jan 2012 |

If a buyer decides to pay cash for an undercon property what should the buyer do to ensure that the property will not face disclosure in the event the developer did not service their bridging loan eventually? |

|

|

|

|

|

Mar 26 2016, 10:39 AM Mar 26 2016, 10:39 AM

Show posts by this member only | Post

#2

|

Junior Member

429 posts Joined: Jun 2005 From: Cyberjaya |

If dont want any risk, then better buy completed ones.

There is no guarantee if developer can finish the project. |

|

|

Mar 26 2016, 02:18 PM Mar 26 2016, 02:18 PM

Show posts by this member only | Post

#3

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(nookie188 @ Mar 26 2016, 10:24 AM) If a buyer decides to pay cash for an undercon property what should the buyer do There is no guarantee a developer will fulfill their promise to complete the project, thus a undercon project is always a risk where the developer can bankrupt or close down.to ensure that the property will not face disclosure in the event the developer did not service their bridging loan eventually? If want no risk = buy a completed one |

|

|

Mar 26 2016, 03:04 PM Mar 26 2016, 03:04 PM

Show posts by this member only | Post

#4

|

Senior Member

2,515 posts Joined: Jan 2012 |

QUOTE(lifebalance @ Mar 26 2016, 02:18 PM) There is no guarantee a developer will fulfill their promise to complete the project, thus a undercon project is always a risk where the developer can bankrupt or close down. I wanted a discussion on the issue I raised actually - not whether to buy a property undercon or completed - that is not the pointIf want no risk = buy a completed one actually. |

|

|

Mar 26 2016, 03:08 PM Mar 26 2016, 03:08 PM

Show posts by this member only | Post

#5

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(nookie188 @ Mar 26 2016, 03:04 PM) I wanted a discussion on the issue I raised actually - not whether to buy a property undercon or completed - that is not the point You can arrange with the lawyer that you're paying the whole loan as cash, when the lawyer receive the instruction that the developer has completed a certain %, they will ask you to pay up the amount, any late payment of the demanded balance, the purchaser will be penalised based on certain %actually. This post has been edited by lifebalance: Mar 26 2016, 03:09 PM |

|

|

Apr 4 2016, 05:18 PM Apr 4 2016, 05:18 PM

Show posts by this member only | Post

#6

|

Senior Member

4,829 posts Joined: Jan 2012 |

TS, understand what you're trying to do. Buy property from Developer using CASH

FYI, if you do this, for sure, IRB will be paying you a visit very soon, cos the urban legend is that Developers must report CASH purchasers like you to the IRB. But if you insist, like what life balance said, get a good Lawyer (it can be your SPA Lawyer) and tell the Lawyer to check all the documents for you before advisng you to pay. Tell the Lawyer, do the work as if the property is under financing, in this case, you're the Financier You'll have to pay some fees for this. Still, I advise you against this. Better to take an Overdraft Loan for this, some Banks do provide but at a higher interesr rate. The field visit form IRB is no joke, as you know Gamen is in need of money due to low oil prices. Doctors at major private hospitals have been hit by field audits. Can u explain where u got the case to buy the property. |

|

|

|

|

|

Apr 5 2016, 08:08 AM Apr 5 2016, 08:08 AM

Show posts by this member only | Post

#7

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

Sorry to say, the existing law is not protective enough to property buyer, be it loan or cash buyer.

Just last week there is an article on thestar, which may serve a good read. http://www.thestar.com.my/business/busines...se-buyers-trap/ So reputation of developer is one of most important factor to consider when purchasing a property. Having said that, the recent amendment of needed strata title ready when deliver to buyer is a good start to close this loop hole. This post has been edited by cherroy: Apr 5 2016, 08:10 AM |

|

|

Apr 5 2016, 09:58 AM Apr 5 2016, 09:58 AM

Show posts by this member only | Post

#8

|

Senior Member

2,515 posts Joined: Jan 2012 |

QUOTE(cherroy @ Apr 5 2016, 08:08 AM) Sorry to say, the existing law is not protective enough to property buyer, be it loan or cash buyer. yes it was this article that prompt me to open up this discussion though somehow many assumptions were made in the meantime about the cons of buying cash..as we know there are buyers in the market that do pay cash for theirJust last week there is an article on thestar, which may serve a good read. http://www.thestar.com.my/business/busines...se-buyers-trap/ So reputation of developer is one of most important factor to consider when purchasing a property. Having said that, the recent amendment of needed strata title ready when deliver to buyer is a good start to close this loop hole. purchases so what can they do to protect themselves - that was my general question actually.. agree buying a reputable developer is important not only when you are paying it outright but for other good reasons as well.. would a good developer provide a letter to the cash paying buyer that the property will be delivered with no lien? or is this already covered under the spa? |

|

|

Apr 5 2016, 10:53 AM Apr 5 2016, 10:53 AM

Show posts by this member only | Post

#9

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(nookie188 @ Apr 5 2016, 09:58 AM) yes it was this article that prompt me to open up this discussion though somehow many assumptions were made in the meantime about the cons of buying cash..as we know there are buyers in the market that do pay cash for their The fear is always the company bankrupt or liquidated, by then whatever letter/agreement signed also no use already.purchases so what can they do to protect themselves - that was my general question actually.. agree buying a reputable developer is important not only when you are paying it outright but for other good reasons as well.. would a good developer provide a letter to the cash paying buyer that the property will be delivered with no lien? or is this already covered under the spa? Reputable developer want to sell its next phase of property, they don't want something hanky panky in between that could jeopardise their reputation and future property sale and potential premium buyer willing to pay. Newer SPA should cover this area already as there is new law stated that strata title must be delivered when VP time. |

|

|

Apr 5 2016, 12:51 PM Apr 5 2016, 12:51 PM

|

Senior Member

2,515 posts Joined: Jan 2012 |

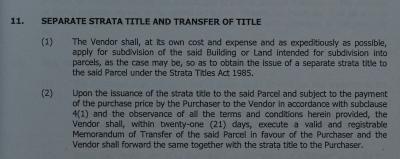

QUOTE(cherroy @ Apr 5 2016, 10:53 AM) The fear is always the company bankrupt or liquidated, by then whatever letter/agreement signed also no use already. do you know when did this ruling that strata title to be delivered upon VP came into effect?Reputable developer want to sell its next phase of property, they don't want something hanky panky in between that could jeopardise their reputation and future property sale and potential premium buyer willing to pay. Newer SPA should cover this area already as there is new law stated that strata title must be delivered when VP time. |

|

|

Apr 5 2016, 01:56 PM Apr 5 2016, 01:56 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

Apr 5 2016, 02:05 PM Apr 5 2016, 02:05 PM

|

Senior Member

2,515 posts Joined: Jan 2012 |

|

|

|

Apr 5 2016, 03:49 PM Apr 5 2016, 03:49 PM

|

Senior Member

587 posts Joined: Apr 2014 |

|

| Change to: |  0.0197sec 0.0197sec

0.33 0.33

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 11:16 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote