QUOTE(Kaka23 @ Jul 1 2016, 09:14 PM)

mine too...wish everyone is SAME SAME huat... tbh...mine is still abit huat only.....but at least it is a good start.

Attached thumbnail(s)

Fundsupermart.com v14, Happy 牛(bull!) Year

|

|

Jul 1 2016, 10:16 PM Jul 1 2016, 10:16 PM

Return to original view | Post

#41

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jul 2 2016, 10:55 AM Jul 2 2016, 10:55 AM

Return to original view | Post

#42

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 2 2016, 11:12 AM Jul 2 2016, 11:12 AM

Return to original view | Post

#43

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Jul 2 2016, 11:05 AM) last checked last month was thru...Hwang's Asia Quantum and Hwang's Jpn Growth fund both are of insignificants % yes,..just in case someone wondering why Ponzi 1.0......cos latest Ponzi 1.0 has US EQ |

|

|

Jul 2 2016, 11:49 AM Jul 2 2016, 11:49 AM

Return to original view | Post

#44

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Jul 2 2016, 11:39 AM) OOugh, adoi!!."IF" I had managed to correct my dismayed IRR to about 8%, then I would be shifting to a more universal correct allocation. you think I am not scared meh?...with so high in Malaysia small caps...(abt 40%) in the mean time...heart may seems to be steady..... This post has been edited by yklooi: Jul 2 2016, 11:57 AM |

|

|

Jul 14 2016, 10:18 PM Jul 14 2016, 10:18 PM

Return to original view | Post

#45

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 20 2016, 09:01 PM Jul 20 2016, 09:01 PM

Return to original view | Post

#46

|

Senior Member

8,188 posts Joined: Apr 2013 |

Justice Department files lawsuits in connection with 1MDB probe The U.S. Department of Justice filed lawsuits on Wednesday seeking to seize dozens of properties tied to Malaysian state fund 1Malaysia Development Berhad (1MDB), saying that over $3.5 billion was misappropriated from the institution. The U.S. lawsuits said funds misappropriated from 1MDB were transferred to the co-founder of Petrosaudi, a company that had a joint venture with 1MDB, and thereafter to a high-ranking official in the Malaysian government it identified only as "Malaysian Official One". http://www.reuters.com/article/us-malaysia...t-idUSKCN1001FA just hope that it will NOT disturb "MY" funds.... but what are the chances it won't.... This post has been edited by yklooi: Jul 20 2016, 09:34 PM |

|

|

|

|

|

Jul 21 2016, 11:01 AM Jul 21 2016, 11:01 AM

Return to original view | Post

#47

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(T231H @ Jul 21 2016, 10:39 AM) would someone with knowledge in insurance be so kind and free to open another FSM thread solely for FSM insurance? or should "I" refer those that posts FSM's insurance related stuffs to the insurance threads? |

|

|

Jul 23 2016, 11:29 AM Jul 23 2016, 11:29 AM

Return to original view | Post

#48

|

Senior Member

8,188 posts Joined: Apr 2013 |

Sat morning...counting chicken before they are hatch....

just noticed that my portfolio ROI is now abt 1.5% more than previous high....highest so far.... then noticed that my previous highest IRR is abt 1.5% higher than now. a rough estimates...my ROI need to add another 4% to be near previous high. This post has been edited by yklooi: Jul 23 2016, 11:29 AM |

|

|

Jul 24 2016, 07:09 PM Jul 24 2016, 07:09 PM

Return to original view | Post

#49

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 26 2016, 05:01 AM Jul 26 2016, 05:01 AM

Return to original view | Post

#50

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(em0kia @ Jul 26 2016, 01:59 AM) Guys, I am planning my portfolio to be like this. Please let me know if its contradicting. with that, why not go to 90% EQ?Equity: 1. Affin Hwang Select Asia (Ex Japan) Quantum Fund - 5% (I assume it to be 15%) 2. ESI Global Leaders MY Fund - 10% 3. Arbedeen Islamic World Equity Fund - 15% 4. CIMB Titans - 10% 5. KGF - 10% 6. ESI Small Cap - 10% Bond: 1. RHB Asian Total Return Fund - 10% 2. ESI Bond Fund - 10% 3. RHB Smart Balanced Fund - 10% I am a young guy, having enough emergency fund and can park money for long term. But at the same time, I also fear losing too much money as I learn only a fresh grad pay (2k +) there is no lost is you did not sell..... Smart balance is sort of between EQ:FI.....now you have both...why want it? NO right or Wrong...just confusing you.... I cannot sleep...just used my "old" format that I am comfortable with...... I came up with this "Approximate" data..... it show your % of allocation by countries/regions of your 70% EQ (data show 100% of that 70%) you can use it to compare your allocated % against the FSM star rating...... and again...NO right or Wrong...just individual preference btw, there is a very "canggih" format in post #1 that is downloadable...called....."Polarzbearz..........." Attached thumbnail(s)

|

|

|

Jul 26 2016, 10:09 AM Jul 26 2016, 10:09 AM

Return to original view | Post

#51

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Vanguard 2015 @ Jul 26 2016, 09:52 AM) I sold off the CIMB China Equity Fund. Hopefully I can sell off the RHB China India Fund soon as well. giving up on China? RHB China India had been on "Tongkat Ali" for the past 2 months wor....don't want to let it continue some more? I have the same thinking too.. will need to pull back some higher volatility funds when my IRR reached my 'imaginary target".....hopefully by Jan in time for the next promo. |

|

|

Jul 26 2016, 03:14 PM Jul 26 2016, 03:14 PM

Return to original view | Post

#52

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(em0kia @ Jul 26 2016, 02:00 PM) And guys, i am just wondering right, how sure is it that any mutual fund, if purchase and park money inside for long term, guarantees a return? I heard a lot of ppl say that if you invest for long term, mutual fund surely earn money. But i wonder is it possible that one also make constant losses in long term? NO, there is NO guarantee that you will make profits in the long terms..this is because, eventhough your intention is to invest for long terms...the FH might not think so..... there are cases when, a fund may be stopped from existence and the money returned to you.... so just imagine you are holding on to the losses and hope that the fund could recover some time...but the FH might say no, i quit. i funds like that after the Y2k, Dotcom burst. there are some recent funds from RHB too i guess...just forgot the names...that the FH just quit the funds |

|

|

Jul 27 2016, 04:02 AM Jul 27 2016, 04:02 AM

Return to original view | Post

#53

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(1tanmee @ Jul 26 2016, 11:13 PM) Checking, can I have two accounts with FSM? One as main account holder, and the other as beneficiary? Q: Can I open a beneficiary account and how many beneficiary accounts can I have? Wondering about this as I am not sure whether it is best to have my wife to be as main account holder, or is best if she is my beneficiary, whilst I am the main account holder A: You can open one personal account and up to five beneficiary accounts. Do take note that you are still the primary operator and owner of all the accounts. The beneficiaries do not have rights over this account as long as you are living. When you transact under the beneficiary accounts, you can only use cash investment and not your savings in EPF Account 1. https://www.fundsupermart.com.my/main/faq/C...n-I-have-8660#2 hope the above is relevant, else Contact FSM for confirmation/clarification on this technical issue and also other issues that are "important"....else when some forummer says OK...no problem....do you trust that? This post has been edited by yklooi: Jul 27 2016, 04:05 AM |

|

|

|

|

|

Jul 27 2016, 04:09 PM Jul 27 2016, 04:09 PM

Return to original view | Post

#54

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(xuzen @ Jul 27 2016, 03:51 PM) ........ Goijng forward, with MSCI reducing M'sia percentage in its index, less foreign fund will be coming in. We have to look outside our cocoon to cari-makan liao. Xuzen with the MSCI reducing M'sia percentage in its index, less foreign fund will be coming in...... double whammy for M'sia EQ? should we reduce our exposure in M'sia focused Uts? |

|

|

Jul 28 2016, 08:02 AM Jul 28 2016, 08:02 AM

Return to original view | Post

#55

|

Senior Member

8,188 posts Joined: Apr 2013 |

after having the prophecy being provided by the prophet and the readings from the crystal ball, it is still very important for one to really understand his/her own risk appetite, reasons for selecting that funds to be in the composition of his/her portfolio of a reasonable expected ROI returns within a reasonable time frame.

...It is not only important to understand the risks of the investments you are looking at, but also to understand your personal risk appetite. Sometimes, it is not a matter of what kind of risks you want to take, but a matter of what kind of risks you can take given the circumstances that you are currently in. And the best way to do it is to assess your actual experience in investing. For instance, you might have thought that you are an aggressive investor who can cope with a high level of risk based on the results of the risk profiling test. However, in practice, if you find that you always panic too soon every time the market dips, and get overly euphoric and pump in more money whenever markets are on a roll, then high-risk investments are not so suitable for you because they are likely to cause you to lose money. https://www.fundsupermart.com.my/main/resea...?articleNo=2266 This post has been edited by yklooi: Jul 28 2016, 08:34 AM |

|

|

Jul 30 2016, 05:09 AM Jul 30 2016, 05:09 AM

Return to original view | Post

#56

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(em0kia @ Jul 30 2016, 02:44 AM) "The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher. ......So, in conclusion, learning about investing, and actually doing it, is very important https://secure.fundsupermart.com/main/resea...SJBlog_20141031 This post has been edited by yklooi: Jul 30 2016, 05:12 AM |

|

|

Jul 30 2016, 02:37 PM Jul 30 2016, 02:37 PM

Return to original view | Post

#57

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(wil-i-am @ Jul 30 2016, 07:50 AM) according to FSM...YES....Infographic: Women vs. Men https://www.fundsupermart.com.my/main/resea...?articleNo=5855 |

|

|

Aug 1 2016, 08:38 PM Aug 1 2016, 08:38 PM

Return to original view | Post

#58

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Aug 2 2016, 07:08 PM Aug 2 2016, 07:08 PM

Return to original view | Post

#59

|

Senior Member

8,188 posts Joined: Apr 2013 |

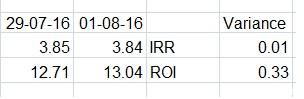

Portfolio entering 3+ yrs.

thanks to the IRR calculation...my ROI per month had to increase 0.33% more now just to maintain the same IRR..... the longer the portfolio duration the higher ROI gain I have to get in order to get the same IRR... Attached image(s)  |

|

|

Aug 2 2016, 09:14 PM Aug 2 2016, 09:14 PM

Return to original view | Post

#60

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

Topic ClosedOptions

|

| Change to: |  0.1660sec 0.1660sec

0.28 0.28

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 05:31 AM |