QUOTE(river.sand @ May 17 2016, 07:35 AM)

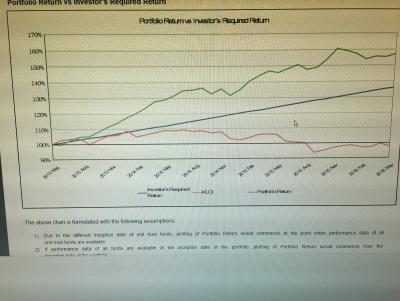

Ok, CAGR is 5.5%.

The probability of it fluctuate between 2 sigma is 95%.

Which means: the probability of the return dropping to -59.5% or worse is (100% - 95%)/2 = 2.5%.

Yes you are right however I did not include this minor detail in because I believe for a UTF to hit more than 2 times SD is very remote. The probability of it fluctuate between 2 sigma is 95%.

Which means: the probability of the return dropping to -59.5% or worse is (100% - 95%)/2 = 2.5%.

For more nitpicking detail: If you take the more than 2 SD into consideration, the chances of this happening in a three year tracking period is about 55 days i.e., in a 3 years (1,095 days) period you make the observation, the chances of the NAV go outside the band of +70.5% or -59.5% will not be more than 55 days in total.

That means if the fund really go to that level, it will very quickly move back towards the mean.

Xuzen

This post has been edited by xuzen: May 17 2016, 10:49 AM

May 17 2016, 10:44 AM

May 17 2016, 10:44 AM

Quote

Quote

0.0566sec

0.0566sec

0.84

0.84

7 queries

7 queries

GZIP Disabled

GZIP Disabled