QUOTE(PAChamp @ Mar 8 2024, 03:22 PM)

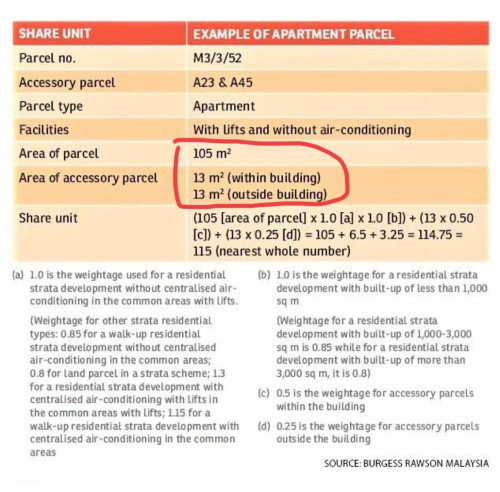

Per Share Unit i believe.

All condos will be facing this. Not just new ones. However, the new ones will suffer more because when developer wants to sell, they will press down the service charges even before factoring in the inflation happening now. Once VP, developer not under much pressure to sell, so allow maintenance to go up to market rate.

My condo has done many things to raise revenue and cut costs thus able to keep maintenance low. Firstly cut off the management company and migrate all billing, accounting and database to the management office. Then implement energy saving ie. replace flourescent tube with energy savings and LEDs. Rent out advertising spaces in lifts billboards etc. Rent out some visitor car parks and common areas. Charge for some facilities. But you will need a dedicated team of owners to come into the committee to handle it.

Usually quite a bit of capital works to implement these new changes. And once again shared by lesser units generally with the older developments.

QUOTE(DragonReine @ Mar 8 2024, 03:32 PM)

Energy efficiency implementation is still rather limited for most high rise unless somehow can implement solar panels. A lot of the fancy little facilities and the high density favoured by commercial titled high rise cannot be included if want to be truly energy efficient.

Most Malaysian high rise on commercial title land moving forward will be facing the steep increase in cost for electricity costs.

Yea the commercial under HDA spec is used so widely that these price increases going forward may become a real issue. It might put preferential status back onto residential titled units. The differences may have been negligible before but maybe not now.

QUOTE(Najibaik @ Mar 8 2024, 04:14 PM)

many new launch serviced apartment will have solar panels at rooftop to somehow use natural sunlight to generate electricity to cover part of the cost

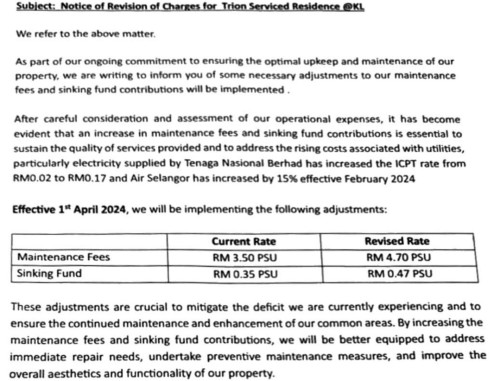

so far i see Trion & Trion 2 both also increase their maintenance fees by quite a lot very soon after vp

for trion 2 they even increased it from 44sen to 60sen before gotten key

That’s around 30% increase. Very big chunk of change for what still looks like a very average investment property. Everyone just needs to bleed once a month like half the population.

This post has been edited by Cavatzu: Mar 8 2024, 04:41 PM

Jan 2 2024, 05:31 AM

Jan 2 2024, 05:31 AM

Quote

Quote

0.0204sec

0.0204sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled