Anyone has some insight regarding Rainhill to share? 🤔

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Dec 4 2020, 11:20 AM Dec 4 2020, 11:20 AM

Return to original view | IPv6 | Post

#21

|

Senior Member

2,992 posts Joined: Feb 2015 |

Anyone has some insight regarding Rainhill to share? 🤔

|

|

|

|

|

|

Jan 21 2021, 03:20 PM Jan 21 2021, 03:20 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(cherroy @ Jan 21 2021, 02:29 PM) Reit is always a fixed income instrument, not for gorenging. Malaysia don't have a data centre reit right? Would like to get some of this reit in Malaysia. 🤔Reit share price is tightly correlated to its yield. Normally, Reit share price always stay or move according to its yield that is 100bps~300bps MGS or FD rate. So dividend and interest rate level are two major factors. Reit has many sub-sector, current performing sector is Data centre reit, next is industrial/logistics, as those properties are in high demand and providing stable income. |

|

|

Jan 21 2021, 04:14 PM Jan 21 2021, 04:14 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(chromatino_hex @ Jan 21 2021, 03:22 PM) Better to buy telecommunication stocks (TM, Axiata, Time DotCom) or gain exposure in international market via other stock exchanges. QUOTE(cherroy @ Jan 21 2021, 03:28 PM) I see. Thanks for info. Seems like telecoms are the one handling the data centres 👀🤔 |

|

|

Oct 5 2021, 05:06 PM Oct 5 2021, 05:06 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Smurfs @ Oct 4 2021, 10:55 PM) Yeah your expectation is reasonable. O.o, did not know about atrium as an industrial REIT. Will collect some.As long as you are comfortable with the yield that you are getting How about ATRIUM REIT?  Industrial asset focused REIT..Most of the warehouses are 100% occupied (rental income are mostly intact, unless tenants close shop) except for ATRIUM Shah ALAM 4 which underwent AEI. DPU FY2020 : 9 sens DPU YTD : 4.7 sens Current price : 1.47 Also getting ~6% Already have axis REIT. |

|

|

Nov 4 2021, 01:08 PM Nov 4 2021, 01:08 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(PowerOfZero @ Nov 4 2021, 11:47 AM) You do you bruh. People have different kind of thinking. Just read up and come up with your own conclusion. I too have invested in Tenega, just for the dividend and will continue to top up. Dont plan to sell anytime soon until shit hits the fan. Let's hope by then can still preserve capitals 😭🤣 Also one key advice is this. Only to invest the amount that you are prepare to lose. My few 2 cents. |

|

|

Nov 12 2021, 08:57 AM Nov 12 2021, 08:57 AM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,992 posts Joined: Feb 2015 |

Fuu, the drama ongoing is popcorn worthy. Luckily I told all my friends that has invest in Serba related stock to ciao ASAP after I did some of my own digging of the company.

This post has been edited by AthrunIJ: Nov 12 2021, 08:58 AM |

|

|

|

|

|

Nov 12 2021, 09:10 AM Nov 12 2021, 09:10 AM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Nov 12 2021, 09:11 AM Nov 12 2021, 09:11 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,992 posts Joined: Feb 2015 |

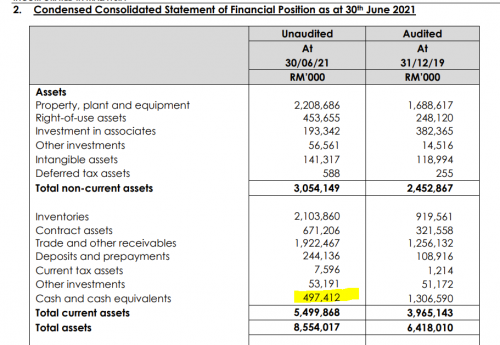

QUOTE(Boon3 @ Nov 12 2021, 08:59 AM) What's really amazing is when one looks at the last QR submitted by SD.... You know , I know, We all know 🤭🤭🤭 Yup... the company said it had 497 million.... so rich, right? but then.... why forfeit the property transaction with Awantec? Untung lo Awantec. Buta buta pocket 2.4 million. and the missed bond payment ... What can one conclude? No money to pay? Don't want to pay? and what about the money stated in QR? It says SD got money what..... |

|

|

Nov 14 2021, 11:43 AM Nov 14 2021, 11:43 AM

Return to original view | Post

#29

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Nov 16 2021, 08:16 AM Nov 16 2021, 08:16 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(jojojoget @ Nov 15 2021, 07:21 PM) the thing is even though the sharebase gets diluted, because they're using it to pay off debt, the equity will also go up. True o.oIf it is just to pay the interest and not including the principal then I don't think it will go up. Probably need to check whether the debt repayment includes principal debt payment also and not just the interest. Anywho, there is a good side and bad side. With this it could mean axreit has cash flow problem. Oddly enough MCO didn't affect industrial REIT that much though. 🤔 |

|

|

Nov 16 2021, 04:08 PM Nov 16 2021, 04:08 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

2,992 posts Joined: Feb 2015 |

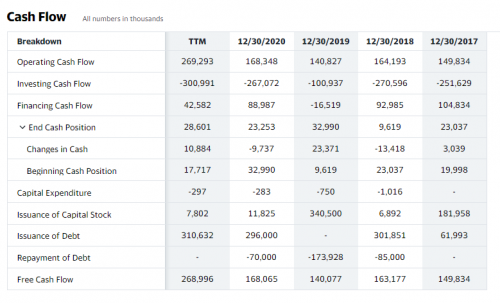

QUOTE(jojojoget @ Nov 16 2021, 03:19 PM) They're using it to pay off principal. They're reasoning is quite interesting, they're gearing is actually quite low (I think 37% ish) so they want to pay off the debt to allow further room for borrowing in the future to expand their portfolio. Yet this just sounds weird to me. Why not just borrow more with the extra room they have or directly use the stock capital for expansion? Why use such a roundabout way? Agree that industrial REITs weren't affected. Their cash flow for reference: Unless it was explained during the previous general share holder meeting, then probably can ask during the next general shareholder meeting on what basis are they using this strategy to pay down debt. Seems quite ok so I'm really not sure what's going on. Other than that, need some REIT sifu for comment haha. Regarding gearing, kinda jumping here and there when I googled for axreit gearing. Some put it as 60%++ This post has been edited by AthrunIJ: Nov 16 2021, 04:09 PM jojojoget liked this post

|

|

|

Nov 16 2021, 08:57 PM Nov 16 2021, 08:57 PM

Return to original view | Post

#32

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(cherroy @ Nov 16 2021, 04:21 PM) It is quite common for reit to undergo private placement to reduce debt gearing so that have more room for borrowing for future acquisition. Fyi, Reit has gearing ceiling limit of 50%. Reit doesn't retain much cash, whenever they have made income and cashflow, it is given out as dividend, (normally at least 90% of their income made) So borrowing and private placement/right issue are the way to expand their portfolio. Private placement means more shares, and may dilute the EPS/dividend per share, but if the proceed from the private placement is used to make yield accretion properties, then it could improve EPS in the future. If a reit intends to do private placement, means they may be eyeing newer acquisition. If one has been following Axisreit over the long term, the reit has been using this way to expand its portfolio and EPS/dividend is improving from its initial IPO, so does share price from RM1.xx (prior before share split 1:1) to now what it is today. QUOTE(Smurfs @ Nov 16 2021, 08:32 PM) Yeah some time it depends on "perspective". REIT sifus has replied xD.Let me give you this perspective from shareholder points of view : Axis REIT DPU is improving over the time, albeit marginally. Based on its history track record, they are quite active in acquisition.. It is one of the MREIT that have improving DPU with more and more properties being injected to its portfolio, and the most important thing is, without needing a single cent from the shareholders. More properties = more rental income , provided if they are able to secure tenants and occupancy rate is there. However, I would think twice if the REIT is using right issues to raise funds... https://www.businesstimes.com.sg/companies-...ng-rights-issue Thanks for the info. I also do tend to be wary about the constant right issues to raise funds. REITs are required to payout at least 90% profits as dividend so the rest 10% can be kept to get acquisition though. Then again mreit so far is paying above 95% this I can see why they usually always using right issues to raise funds. Need to check the balance sheet every report I suppose and hopefully the auditor is doing a good job This post has been edited by AthrunIJ: Nov 16 2021, 08:57 PM |

|

|

Nov 17 2021, 08:41 AM Nov 17 2021, 08:41 AM

Return to original view | Post

#33

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(spring onion @ Nov 16 2021, 08:45 PM) if scenario, In REITs, it is all about occupancy rate of said buildings.what would you think if IGB reits if IGBB decides to inject Mid Valley JB into IGB Reits? Sooner or later case right i assume? You can have REIT a with 20 buildings with 20 percent occupancy rate vs REIT b 10 buildings with 90 percent occupancy rate and with everything else constant then you should get some picture regarding the rental income of said REITs. |

|

|

|

|

|

Nov 29 2021, 09:35 AM Nov 29 2021, 09:35 AM

Return to original view | IPv6 | Post

#34

|

Senior Member

2,992 posts Joined: Feb 2015 |

Stock up on your favourite stock now? 😂🤣

|

|

|

Dec 14 2021, 05:35 PM Dec 14 2021, 05:35 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Davidtcf @ Dec 14 2021, 10:38 AM) US stocks or Malaysia stocks a good buy for long term hold for growth/dividend? For US, I would choose growth stock as the dividends are tax for non US residents.US stocks take at least 1 day for funds to reach via Wise > IBKR. Malaysia stocks instant can invest via FPX deposit to Mplus etc brokers. I see US stocks keep increase like mad.. Malaysia stocks I got hold a few their value keep up and down +- RM10 to 20 bucks. If wanna invest in local stocks need to go for those cheap stocks with a lot of potential growth? not the matured stocks? Please share your advise sifus sekalian.. For dividend stocks, I would choose local bourse and Singapore REIT. Planning to open a Singapore bank account soon once hit my local investment target. Well, any sifu want to add on or critisize? I am all ears and eyes 👀 Davidtcf liked this post

|

|

|

Feb 15 2022, 03:09 PM Feb 15 2022, 03:09 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Feb 12 2022, 09:27 AM) ????? Minister level taichi begins 🤣🤣I wonder what has happened to all the money it raised .... there's the 450 million private placement in May 2020... there's the 500 million private placement in Feb 2021... and then there's the 1.2 billion raised via islamic bonds.... |

|

|

Mar 28 2022, 12:26 PM Mar 28 2022, 12:26 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Mar 26 2022, 04:18 PM) In the news again........... Ni bila close shop for fraud? 👀https://www.theedgemarkets.com/article/serb...namik-spotlight .... Firstly, its former auditor KPMG flagged what it thought were questionable transactions valued at RM2.32 billion, trade receivables of RM652 million, and materials on site balance of RM569 million. There were other issues as well, such as suppliers having similar registered addresses, and having small paid-up capitals while undertaking transactions of between RM60 million to RM96 million. In total, these transactions amounted to RM481 million. Also in the spotlight were customers and suppliers in Bahrain whose office addresses could not be located. Transactions with the companies from Bahrain amounted to US$101 million (RM417.48 million then) while trade receivables balance stood at US$24 million (RM99.2 million then). While Serba Dinamik brushed aside KPMG’s grouses, the appointment of EY Consulting saw the O&G company change tack and focus on preventing EY Consulting’s FFU from being made public. The market reacted swiftly. Investors voting with their feet, selling down Serba Dinamik, shedding more than RM4.7 billion in market value, and its shares tumbled from about RM1.60 prior to KPMG’s whistleblowing to 35 sen, just before the counter was suspended from trade in October last year. Flicking through the EY Consulting report, which is part of Bursa Malaysia’s bundle of documents in its suit against Serba Dinamik, it becomes apparent why the O&G company is reluctant to let the findings of the EY Consulting report be made public The EY Consulting report, in a nutshell, questions why Serba Dinamik was in possession of company stamps — both of its vendors and those of national oil major Petronas, other oil majors, and of the company’s many suppliers. In summary, EY Consulting stopped short of suggesting that Serba Dinamik had been raising cash — both via borrowings and cash calls — only to take or transfer funds to suppliers and vendors which were under Serba Dinamik’s control. the raising cash issue... posted b4... there's the 450 million private placement in May 2020... there's the 500 million private placement in Feb 2021... and then there's the 1.2 billion raised via islamic bonds... |

|

|

Apr 7 2022, 12:28 AM Apr 7 2022, 12:28 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(The Nomad @ Apr 7 2022, 12:23 AM) It looks like Bursa may have got its mojo back. Might just be a small up then down again. Stocks recently are mostly green even when US and HK markets sell off. Probably due to promise of political stability+high commodity prices. It was like that a few weeks ago. Market pass 1600 then suddenly drop to 1580 ish. Probably will just oscillate between 1550 to 1610 👀 The Nomad liked this post

|

|

|

Apr 12 2022, 09:32 AM Apr 12 2022, 09:32 AM

Return to original view | IPv6 | Post

#39

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Apr 12 2022, 08:37 AM) https://www.theedgemarkets.com/article/will...alse-reports-sc Tak yah explain.KUALA LUMPUR (April 11): It appears that Serba Dinamik Holdings Bhd's chief executive officer (CEO) Datuk Mohd Abdul Karim Abdullah and three other top executives who have been charged with providing false reports to the Securities Commission Malaysia (SC) last December might be let off with just a compound, instead of being tried in court and possibly face jail time for the offences they were charged with. This follows reports on Monday that Serba Dinamik had sent letters of representation to the Attorney-General's Chambers (AGC), which, according to proceedings in the Sessions Court, had been “conditionally accepted” by the chambers. Normally, a representation letter is sent either to reduce a charge or have the charges dropped. SC's deputy public prosecutor Hashley Tajudin told the Sessions Court that the AGC was "agreeable" to the representation, contingent on certain conditions being fulfilled, but did not elaborate. This took place when the SC was supposed to update the court about handing over the relevant documents to the defence team about the charges the defendants faced. Meanwhile, over at the Court of Appeal (COA), Serba Dinamik's counsel Mak Lin Kum, who is representing the company in the matter of it being compelled by Bursa Malaysia Securities Sdn Bhd to reveal Ernst & Young Consulting Sdn Bhd's fact-finding update (FFU) from their special independent review, informed the court that his clients' charges at the Sessions Court would be compounded. “The AG Chambers has agreed and they would issue compounds instead,” the counsel told the COA bench that is led by Justice Datuk Lee Swee Seng. Regardless of this revelation, Serba Dinamik failed to obtain a stay from the COA on the High Court's order that compelled the company to abide by Bursa's directive to reveal the FFU. Execs charged in four different courts Presently, Serba Dinamik and its senior executives are facing charges at four different Sessions Courts, three of which are in Kuala Lumpur and one in Shah Alam. On Dec 28, Serba Dinamik itself was charged under Section 369(a)(B) of the Capital Markets and Services Act 2007 (CMSA) involving a false statement relating to the revenue of RM6.014 billion recorded by the group in its consolidated results for the quarter and year ended Dec 31, 2020. On the same day, the oil and gas giant’s executive director Datuk Syed Nazim Syed Faisal, group chief financial officer Azhan Azmi, and vice president of accounts and finance Muhammad Hafiz Othman were each charged with the same offence under Section 369(a)(B), read together with Section 367(1), of the same Act. A day later (Dec 29), Mohd Abdul Karim was charged with the same offence, also framed under Section 369(a)(B) of the CMSA, which stipulates that a person who, with the intent to deceive, makes or furnishes any false or misleading statement or report to the commission, a stock exchange, a derivatives exchange or an approved clearing house relating to the affairs of a listed corporation commits an offence. If found guilty, a person can be jailed for up to 10 years or fined up to RM3 million. Muhammad Hafiz was also separately charged at the Shah Alam Sessions Court with falsifying the accounting records of the group's subsidiary, Serba Dinamik Sdn Bhd (SDSB). He was alleged to be directly involved in instructing the preparation of false documents relating to the sales of SDSB, an offence under Section 368(1)(b)(i) of the CMSA. Notably, the High Court had, earlier this year, allowed the SC's appeal to sentence Transmile Group Bhd CEO Gan Boon Aun to two years' jail and to fine him RM2.5 million for a similar offence. Gan was found guilty of furnishing a misleading statement, with intent to deceive, relating to Transmile’s revenue in the company's earnings report for the financial year ended Dec 31, 2006. Gan's charge was, however, framed under the Securities Industries Act 1983. Gan, meanwhile, is said to have turned fugitive after he submitted an application to overturn his guilty conviction, for which he was initially sentenced to just one day in jail. theedgemarkets.com has reached out to the AGC for comments on Serba Dinamik possibly being given a compound, and is awaiting its response. If a compound is indeed going to be offered, why did the AGC change its mind after giving the go-ahead to the SC to file criminal charges last December? What has happened since? The AGC must expain. Oren Kito help Oren Kito. Nothing to see here and move on Open for trading soon I think. Need to be more prudent in picking stocks in Malaysia This post has been edited by AthrunIJ: Apr 12 2022, 09:41 AM |

|

|

Apr 12 2022, 10:23 AM Apr 12 2022, 10:23 AM

Return to original view | IPv6 | Post

#40

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

| Change to: |  0.1025sec 0.1025sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 04:20 AM |