Here's a simple exercise. Assume one bought Maybank 10 years ago and held it today.

Dividends collected from 2013 till today = 0.33 + 0.535 + 0.57 + 0.54 + 0.52 + 0.55 + 0.57 + 0.64 + 0.52 + 0.58 = 5.355 (or RM5335.00 per 1,000 shares)

Maybank traded at a high of 10.80 and low of 8.90 in 2013.

Buy at lowest price in 2013 at 8.90.

Share price today (yesterday closing price) = 8.98

Total dividends collected = 5.335

Total share value + dividends collected = 14.315

And this works out to a CAGR gain of only 4.81%.

Source:

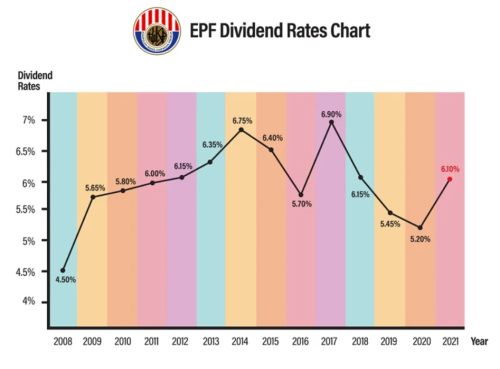

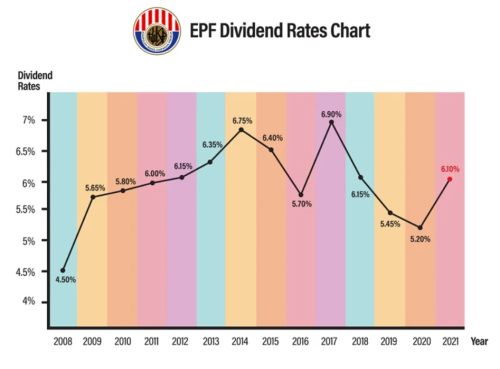

https://ringgitplus.com/en/blog/Personal-Fi...dend-Rates.htmlAverage last 10 year dividend rates from KWSP = 6.15%.

Which means if we invested in KWSP a sum of 8.9k, in 10 years that investment would be worth 16.1k

So clearly investing in Maybank wasn't as good as leaving the money in KWSP and collect dividends.

Now logically it's hard to buy at lowest price.

In real life, buying at the years high is likely scenario many a times for many people.

But let's use average. Year high in 2013 was 10.80. Year low 8.90. So average price would would 9.85.

So same exercise. Using average price of 9.85.

Price today 8.98.

Sudah rugi there....

total value + dividend = 14.315.

And this works out to a CAGR gain of only 3.81%.

If that 9.85k was invested in KWSP, right now the investment would be worth 17.89k.

Massive difference.

Clearly investing for dividends in Maybank and holding it for 10 years isn't as profitable.

The returns is kacang putih.

** yeah imagine if one was 'unlucky' and bought at 10.80?

** which comes back to the main question: Where's the meat?

** Dividends investing is way over rated. Dividends is not constant. Share price isn't either. When profits falls, dividends fall, share price will fall too!

** and yeah... previous data does not guarantee future... but if past is below average, what guarantee that the future is much better?

Apr 29 2022, 02:07 PM

Apr 29 2022, 02:07 PM

Quote

Quote

0.0993sec

0.0993sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled