QUOTE(Cubalagi @ Mar 19 2020, 06:31 PM)

So today I bought Mah Sing at 0.33.

Tbh I wasn't planning to buy so soon, but can't resist the cheap offer.

At 33 sen share price, Mah Sing market cap is RM800 million. This is less than its bank balance of RM1 billion. Meaning I'm buying the cash and getting all its landbank n development projects for free. So there is a big margin of safety.

Also it has proposed to pay out 3.35 sen dividend this September for a yield of 10%.

proposed means, subject to shareholder approval?

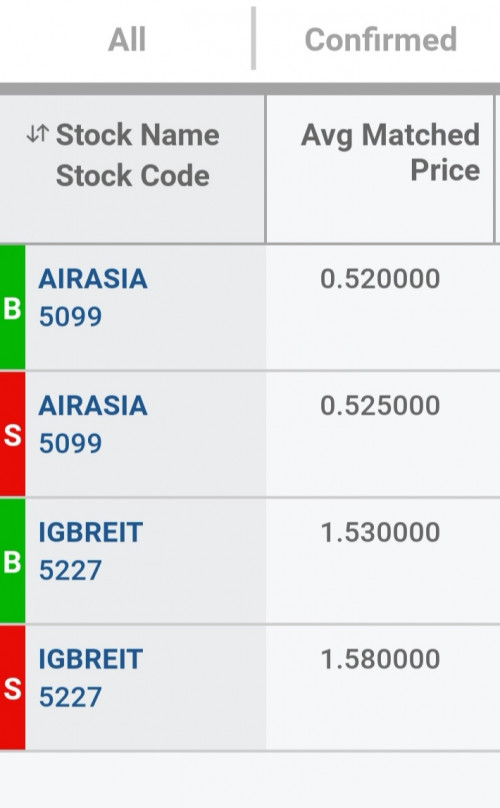

I'm also tempted to buy but given how Malaysians act to the lockdown, I fear the worst is yet to come .... (this is only virus, not yet politics, economics etc). Even IGBReit, Maybank, PBB also, I'm quite hesitant.

What do you think about the current property market (specifically those of MahSing)? Low interest rates should lead to more buyers, I guess?

Mar 16 2020, 05:17 PM

Mar 16 2020, 05:17 PM

Quote

Quote

0.0619sec

0.0619sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled